Seeking out great stocks to buy is important, but many would say it’s even more essential to know which stocks to steer clear of. With fears of a global recession escalating, now is the time to prepare for the worst because a losing stock can eat away at your precious long-term returns. So, determining which stocks to trim or eliminate is essential for proper portfolio maintenance, especially now.

Even the best gardens need pruning, and our team has spotted a few stocks that seem like prime candidates for selling or avoiding. Continue reading to find out which three stocks our team is staying away from this week.

The dramatic shift from brick-and-mortar shopping to e-commerce over the past two years has been a tremendous obstacle for investors in retail. With interest rates marching higher as the economy slows, this is likely just the beginning of the pain for retailers.

Recent data suggests that 25% of America’s 1,000 malls will be closed in the next 3-5 years. As a cornerstone to shopping malls across the country, department store chain Macy’s (M) has been among the stocks to suffer. Over the past twelve months, M stock has declined 36% to trade at $22.23 a share.

Although Macy’s delivered a solid third-quarter report along with an increase to its earnings outlook, there are obstacles ahead for the iconic retailer. With the Federal Funds Rate at its highest level since 2008 and no sign of slowing down, the consumer economy faces unprecedented challenges. While anyone left holding M stock could enjoy a holiday bump, in the face of a looming recession, any increase seems likely to be short-lived.

Despite rising consumer prices, Americans kicked off the holiday season with record spending on Black Friday and Cyber Monday. As a result, many retail and e-commerce stocks are seeing a nice holiday boost. However, some names will enjoy the holiday cheer more than others.

One e-commerce firm to be cautious about is online furniture and home goods seller Wayfair Inc. (W). Wayfair saw a dramatic recovery from its pandemic lows as consumers focused on their homes. With shelter-in-place orders in effect and mortgage rates at record lows, Americans snapped up spacious family houses, leaving behind once-desirable apartments in the city. As a result, Wayfair’s share price rocketed 572% from its March 2020 low to a high of $340 by August 2020. Sadly, W stock has fallen nearly 90% since then and is currently trading at $42.10, 50% below its pre-pandemic price.

Opportunistic bargain hunters may be eyeing the stock’s momentum due to a 12% increase over the past four weeks. However, those looking for e-commerce stocks to ride the holiday wave would do better looking elsewhere. Not only has demand shifted, but consumers are also now met with economic pressures, which inevitably affects discretionary spending, and Wayfair is feeling the pinch. The online retailer’s active customers shrunk by 1 million quarter-over-quarter in Q3 or more than 4% to 22.6 million, down a whopping 22.6% from the year-ago period. The trend of dwindling customers may continue amid rising consumer prices.

Wayfair has only managed to turn an annual profit once – in 2020. From the looks of it, 2022 will not be the year that changes. Operating loss for the year has already surpassed $1 billion, while the year-to-date net loss is $980 million. Over the past 6 weeks, the median consensus forecast has been slashed by nearly 25% to $40, representing a loss of 5% from its current price.

Food delivery leader and pandemic darling DoorDash (DASH) was one of the big winners in the shift to stay-at-home culture. Between 2019 and 2021, DASH revenue increased by 451% from $885 million to $4.88 billion. But once the economic reopening was complete, Wall Street’s enthusiasm over the stock sharply halted. Since hitting its peak in November of last year, the stock has plunged more than 75%. Now that the tide has washed out, investors are left to access what’s left, searching for an answer to the looming question – is profitability in the cards for DoorDash?

DoorDash has never generated a profit, with the exception of the second quarter of 2020, where it made a profit of $23 million. “It took a global pandemic to drive the firm’s one-quarter of profitability. The firm has not been profitable since, and we think it may never be,” said David Trainer, the CEO and founder of New Constructs. The company reported third-quarter revenue and EBITDA 4% and $29M above consensus expectations, but DASH’s EPS is estimated to remain negative in 2022 and 2023. The company expects $49 to $51 billion in gross order volume in 2022, implying a modest 14% increase from $41.9 billion last year. However, that’s not enough to justify DASH’s lofty valuation. Currently, the stock trades at a trailing twelve-month price-to-sales multiple of 3.7, expensive compared to top competitors like Uber Technologies (UBER), which trades at a price-to-sales multiple of 1.9 – almost half that of DASH.

You might also like:

- The Crypto Melt-Up has Begun

- “A.I. is a Tidal Wave” – Here’s What to Buy

- Beware Executive Order 14067

- #1 AI Stock for 2024 and Beyond

- Bank plague 2024

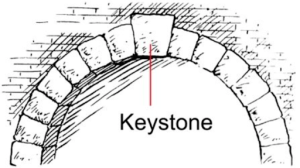

- Gates, Bezos, and Buffett invest in AI Keystone

- Congress Just Fast-tracked New A.I. Energy Breakthrough

- Elon Musk: THIS will be bigger than Tesla

- EV charging stations that pay you up to $93/day!

- Legendary Wall Street Stock-Picker Names #1 A.I. Stock of 2024, Live On-Camera