Trading was muted to start the day as investors waited to see whether Republicans would take back the House or Reps, the Senate, or both. Today’s midterm election will determine which party will control Congress and steer future spending and policy.

Our recommendation for today is a top choice from an area of the market set for expansion, no matter what the results of today’s election will be. That’s because as the world advances to become more digitized, so too do its threats. We are all at risk of losing personal data security as hackers continue to develop new ways to exploit networks, software, and the array of evolving technology services. Today’s featured company is leading the pack when it comes to global automated protection.

According to Mordor Intelligence, the application delivery controller market is expected to reach a valuation of $3.78 billion by 2026, representing a CAGR of 9.63%. One of the companies set to benefit most from the trend is A10 Networks (ATEN). Specialists, when it comes to the manufacturing of application delivery controllers, A10 leverages artificial intelligence protocols to provide automated protection against distributed denial-of-service (DDoS) attacks, which are increasing in relevance by the day.

Widening profit margins surfaced in the most recent quarterly results as earnings expanded faster than revenues. Second-quarter earnings came in at $0.20 per share, surpassing the consensus estimate of $0.18. Revenues were also upbeat at $72.1 million, representing a 10% increase from the same period last year and exceeding analyst expectations of $$71.02 million.

“A10 is consistently achieving revenue and EPS targets despite a variety of macro headwinds in all regions. This demonstrates robust demand for our proprietary security-led solutions, disciplined execution, and a focus on diversification that drives sustainability. We have positioned our business to avoid concentration in any single geography, any specific customer type, or any isolated product offering, and this diversification enables consistent execution despite economic, supply chain, and geopolitical challenges. Customer-centric technical innovation, global commercial execution, and focus on driving the business model are bolstering our sustainability and driving continued success,” said Dhrupad Trivedi, President, and CEO of A10 Networks.

The drastic earnings growth indicates the business is going from strength to strength. A trend that investors hope will continue well into the future. Management reiterated its full-year top-line growth target of 10 – 12% and expanded EBITDA in the range of 26 – 28% of revenue. A10 Networks certainly ticks a few boxes and seems well worth watching

You might also like:

- The Crypto Melt-Up has Begun

- “A.I. is a Tidal Wave” – Here’s What to Buy

- Beware Executive Order 14067

- #1 AI Stock for 2024 and Beyond

- Bank plague 2024

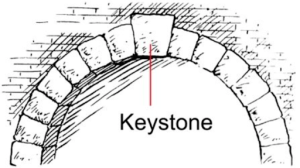

- Gates, Bezos, and Buffett invest in AI Keystone

- Congress Just Fast-tracked New A.I. Energy Breakthrough

- Elon Musk: THIS will be bigger than Tesla

- EV charging stations that pay you up to $93/day!

- Legendary Wall Street Stock-Picker Names #1 A.I. Stock of 2024, Live On-Camera