No doubt about it, trading for the broader market could continue to be bumpy in the near term, but the biggest money tends to be made by those who treat market pullbacks as opportunities to build positions in promising companies. With that in mind, read on for a look at one category-leading tech giant that’s presenting an attractive risk-reward proposition at today’s prices.

Amazon.com, Inc. (AMZN)

The e-commerce market may continue to suffer in the coming months amid recession fears. Nevertheless, the $9 trillion industry is still expected to expand at a CAGR of 14.7% for at least the next four years. Amazon is by far the world’s largest e-commerce company. With five times the market share of its closest rival, Walmart, its 38% leading market share means it will likely gain the most significant advantage from the market’s growth.

Amazon’s business model has built-in advantages like its subscription service, Amazon Prime, and its streaming platform. The service has more than 200 million subscribers globally and 163.5 million in the U.S. That figure is expected to continue to expand at a steady pace. According to a report by Statista, U.S. Prime members are expected to reach more than 176.5 million by 2025.

Wall Street is optimistic about AMZN, with 75% of analysts rating the stock a buy and the average one expecting the stock to rise by more than 30%. That would mean a continuation of the stock’s rally, as it has jumped 21.5% year to date.

[stock_market_widget type=”accordion” template=”extended” color=”#5679FF” assets=”AMZN” start_expanded=”true” display_currency_symbol=”true” api=”yf”]

You might also like:

- The Crypto Melt-Up has Begun

- “A.I. is a Tidal Wave” – Here’s What to Buy

- Beware Executive Order 14067

- #1 AI Stock for 2024 and Beyond

- Bank plague 2024

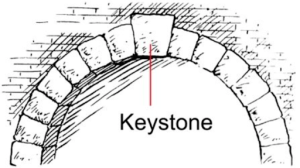

- Gates, Bezos, and Buffett invest in AI Keystone

- Congress Just Fast-tracked New A.I. Energy Breakthrough

- Elon Musk: THIS will be bigger than Tesla

- EV charging stations that pay you up to $93/day!

- Legendary Wall Street Stock-Picker Names #1 A.I. Stock of 2024, Live On-Camera

NEXT:

Get Free Stock Picks via SMS by Signing Up Below!

I would like to receive timely trade ideas and stock watchlists from Wall Street Watchdogs at the phone number provided. Message frequency varies. Message and data rates may apply. Reply HELP for help or STOP to cancel.(Watchdogs SMS Terms of Service & Privacy Policy)