With the Q1 earnings season just around the corner, the major indexes didn’t see much action during the holiday-shortened trading week. The S&P 500 slipped 0.1%, the Nasdaq fell 1.1%, and the Dow added 0.6%. Expectations are low heading into the season, which opens this week as major banks begin reporting first-quarter results. As of Friday, analysts surveyed by FactSet were expecting companies in the S&P 500 to post an average earnings decrease of 6.8%, which would be the most significant earnings decline since the second quarter of 2020.

This past week we have seen signals of a pending slowdown emerging, including weakness in the labor market, manufacturing, and housing. Amidst this backdrop, inflation remains a key concern for investors, with the Labor Department set to release the Consumer Price Index (CPI) for March next week. We’ll also get insights into the Fed’s latest policy meeting and an update on retail sales for March.

Despite recent market gains, the path forward in the near term may be challenging, especially as the economy weakens and potentially enters a mild recession. However, long-term investors can take heart as opportunities may arise in the coming months, particularly as markets begin to look past the slowdown towards a recovery period. Read on for our weekly stock picks and analysis.

Bunge (BG)

No matter what’s going on with the economy, civilizations need access to sustenance. Bunge Limited is an agribusiness and food company headquartered in Missouri, USA. In its Q4 earnings report (published in February 2022), the company announced revenue growth of over 32%.

Bargain hunters will appreciate the value proposition that Bunge brings to the table—currently, the market prices BG at a trailing multiple of 8.8. As a discount to earnings, the stock ranks better than 76% of the competition. Further, it trades at just 8.04 times forward earnings, which sits well below the industry median of 16.97 times. The stock also provides some decent passive income with a forward yield of 2.63%, backed by a 22.1% payout ratio, indicating a highly sustainable yield.

BG has a consensus strong buy rating and an average price target of $123, implying over 29% upside potential.

[stock_market_widget type=”accordion” template=”extended” color=”#5679FF” assets=”BG” start_expanded=”true” display_currency_symbol=”true” api=”yf”]

Amazon.com, Inc. (AMZN)

The e-commerce market may continue to suffer in the coming months amid recession fears. Nevertheless, the $9 trillion industry is still expected to expand at a CAGR of 14.7% for at least the next four years. Amazon is by far the world’s largest e-commerce company, with five times the market share of its closest rival, Walmart. The company’s 38% leading market share means it will likely gain the most significant advantage from the market’s growth.

Amazon’s business model has built-in advantages like its subscription service, Amazon Prime, and its streaming platform. The service currently has more than 200 million subscribers globally and 163.5 million in the U.S. That figure is expected to continue to expand at a steady pace. According to a report by Statista, U.S. Prime members are expected to reach more than 176.5 million by 2025.

Wall Street is optimistic about AMZN, with 75% of analysts rating the stock a buy and the average one expecting the stock to rise by more than 30%. That would mean a continuation of the stock’s rally, as it has jumped 21.5% year to date.

[stock_market_widget type=”accordion” template=”extended” color=”#5679FF” assets=”AMZN” start_expanded=”true” display_currency_symbol=”true” api=”yf”]

Kymera Therapeutics (KYMR)

Generally speaking, biotech stocks offer investors an excellent opportunity for significant upside success. Grand View Research reports that the global market size for the industry was $1.02 trillion in 2021. It is expected to grow at a compound annual growth rate (CAGR) of 13.9% from 2022 to 2030, reaching $3.88 trillion by the end of the forecasted period.

Kymera Therapeutics is a promising example of a biotech stock worth considering, with the market showing faith in its potential. KYMR’s share price has gained over 25% since the start of the year. Zooming out, KYMR has lost 64% of its value since its 2021 IPO, but it has been forming a series of higher lows since June of last year.

Investors take heart in the company’s strong balance sheet, with a cash-to-debt ratio of 23.49 times and an equity-to-asset ratio of 0.81 times, both of which outperform the majority of its peers. Analysts have a consensus moderate buy rating on KYMR, with an average price target of $58, suggesting an upside potential of almost 87%.

[stock_market_widget type=”accordion” template=”extended” color=”#5679FF” assets=”KYMR” start_expanded=”true” display_currency_symbol=”true” api=”yf”]

You might also like:

- The Crypto Melt-Up has Begun

- “A.I. is a Tidal Wave” – Here’s What to Buy

- Beware Executive Order 14067

- #1 AI Stock for 2024 and Beyond

- Bank plague 2024

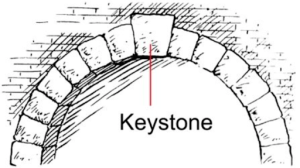

- Gates, Bezos, and Buffett invest in AI Keystone

- Congress Just Fast-tracked New A.I. Energy Breakthrough

- Elon Musk: THIS will be bigger than Tesla

- EV charging stations that pay you up to $93/day!

- Legendary Wall Street Stock-Picker Names #1 A.I. Stock of 2024, Live On-Camera

NEXT:

Get Free Stock Picks via SMS by Signing Up Below!

I would like to receive timely trade ideas and stock watchlists from Wall Street Watchdogs at the phone number provided. Message frequency varies. Message and data rates may apply. Reply HELP for help or STOP to cancel.(Watchdogs SMS Terms of Service & Privacy Policy)