Seeking out great stocks to buy is important, but identifying quality investments is only half the battle. Many would say it’s just as essential for investors to know which stocks to steer clear of. A losing stock can eat away at your precious long-term returns. By taking a proactive approach to avoiding losing stocks, you can set yourself up for greater success in your investing journey.

Even the best gardens need pruning, and our team has spotted a few stocks that seem like prime candidates for selling or avoiding. Read on to find out why we believe these particular stocks are poor investment choices and learn how to apply our analysis to your own portfolio management strategy…

Chesapeake Energy (CHK)

Chesapeake Energy was a solid name to have held in 2022. Like many energy stocks, it had a strong year due to booming energy prices. The company deals primarily in natural gas, which soared last year. As a result, CHK stock increased from $66 to $94 in 2022. Of course, 2023 is an entirely different story. The stock has since declined to around $75 per share.

The company guided that 2023 production volume will likely be lower than 2022 when it released earnings in February. And the U.S. Energy Information Administration has forecast lower prices throughout 2023. The company’s forecasted production volume, as well as expected energy prices, are not in Chesapeake’s favor. The company won’t produce 2022-level revenues in 2023, which is a simple reason to avoid CHK stock now.

[stock_market_widget type=”accordion” template=”extended” color=”#5679FF” assets=”CHK” start_expanded=”true” display_currency_symbol=”true” api=”yf”]

Summit Materials (SUM)

Summit Materials has struggled to show consistent growth since its 2015 initial public offering. Over the last eight years, the vast majority of the company’s growth has come from acquisitions, with only 2.9% of its growth coming from organic revenue expansion. Between 2015 and 2022, the company spent more than $1 billion buying other construction material companies, taking on debt to do so. This strategy has weighed on Summit Materials’ balance sheet and share price.

Unfortunately, construction materials isn’t a great business to be in, especially with your average U.S. mortgage rate now above 6% in a cooling market. Investors would be wise to steer clear of this homebuilder stock.

[stock_market_widget type=”accordion” template=”extended” color=”#5679FF” assets=”SUM” start_expanded=”true” display_currency_symbol=”true” api=”yf”]

Palantir (PLTR)

Some data points from Palantir’s fourth-quarter results indicate that, despite businesses and governments’ increased embrace of AI in recent months, the company’s growth is slowing a great deal. In Q4, the company’s U.S. revenue increased just 1.7% versus the previous quarter to $302 million. And its overall top-line growth slowed to 18% year-over-year in Q4, down from 22% in Q3.

On a positive note (snicker), after nearly 20 years of existence, the company generated its first quarterly profit, as it reported a Q4 net income of $31 million or 1 cent per share. However, its operations still generated an $18 million loss, with its operating margin at a discouraging -4%.

[stock_market_widget type=”accordion” template=”extended” color=”#5679FF” assets=”PLTR” start_expanded=”true” display_currency_symbol=”true” api=”yf”]

You might also like:

- The Crypto Melt-Up has Begun

- “A.I. is a Tidal Wave” – Here’s What to Buy

- Beware Executive Order 14067

- #1 AI Stock for 2024 and Beyond

- Bank plague 2024

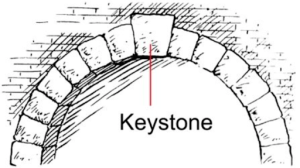

- Gates, Bezos, and Buffett invest in AI Keystone

- Congress Just Fast-tracked New A.I. Energy Breakthrough

- Elon Musk: THIS will be bigger than Tesla

- EV charging stations that pay you up to $93/day!

- Legendary Wall Street Stock-Picker Names #1 A.I. Stock of 2024, Live On-Camera

NEXT:

Get Free Stock Picks via SMS by Signing Up Below!

I would like to receive timely trade ideas and stock watchlists from Wall Street Watchdogs at the phone number provided. Message frequency varies. Message and data rates may apply. Reply HELP for help or STOP to cancel.(Watchdogs SMS Terms of Service & Privacy Policy)