Stocks oscillated between gains and losses last week but closed modestly higher amid concerns over the banking system, Fed outlook, and recession risks. The S&P 500 added 1.37%, the Dow rose 1.15%, and the Nasdaq finished the week 1.81% higher.

This week, we’ll receive the latest updates on home prices, with the Case-Shiller National Home Price Index for January. Investors will also find out if inflation extended its uptick into February with the release of the Federal Reserve’s preferred gauge for checking prices. The most recent report showed that the Personal Consumption Expenditures Price Index rose 0.6% in January, marking the most significant month-to-month increase since last June.

Growth stocks got hammered in 2022, but investors want a fresh start in 2023. If you believe in the buy-low, sell-high philosophy, you may want to read ahead. Our first recommendation was one of the biggest losers in 2022 as the inflation rate skyrocketed against historical norms. According to some of the pros, this stock is undervalued and poised for resurgence.

Match Group (MTCH)

The pandemic provided a bump in online dating and sent MTCH stock price soaring, reaching its ATH of around $169 in October 2021. Since the share price has lost nearly 75% of its value, but the global, fundamental need to meet people isn’t going anywhere. Match benefits from inelastic demand, compared to other consumer discretionary names. Which the company intends to continue capturing with its technologies, including Tinder, OkCupid, and Hinge, providing a solid and resilient subscription-based business. MTCH has a consensus Buy rating. A $60 price target implies a 50% upside.

[stock_market_widget type=”accordion” template=”extended” color=”#5679FF” assets=”MTCH” start_expanded=”true” display_currency_symbol=”true” api=”yf”]

Uber Technologies (UBER)

The global ride-sharing market is expected to grow from $84.30 billion in 2022 to a whopping $242.73 billion in 2028, representing a Compound Annual Growth Rate (CAGR) of 16.3% over the next six years. Uber stands out as a clear winner in the ride-sharing race based on profit growth and current valuation.

Uber’s gross bookings rose 28% in 2022, down from its 56% post-pandemic growth in 2021, and it expects just 17%-21% year-over-year bookings growth in the first quarter of 2023. However, its adjusted EBITDA improved from a loss of $774 million in 2021 to a profit of $1.7 billion in 2022. It also expects to post a positive adjusted EBITDA of $660 million to $700 million in the first quarter. The impressive profit growth can be attributed to its cost-cutting measures and rising take rates across its mobility and delivery businesses.

For the full year, analysts expect Uber’s revenue to increase 16% to $36.9 billion as its adjusted EBITDA rises 86% to $3.2 billion. Based on those estimates, its stock trades at just two times this year’s sales and 21 times its adjusted EBITDA. It’s also still trading nearly 25% below its IPO price. 41 0f the 46 analysts offering recommendations say to Buy Uber stock. A median price target of $47 represents an increase of 50% from the current price.

[stock_market_widget type=”accordion” template=”extended” color=”#5679FF” assets=”UBER” start_expanded=”true” display_currency_symbol=”true” api=”yf”]

UPS (UPS)

UPS stands to benefit from the current global supply chain disruptions, as the company’s expertise in logistics and supply chain management makes it well-positioned to navigate these challenges. As consumers increasingly turn to online shopping and same-day delivery options, UPS is poised to capitalize on these trends and continue its strong growth trajectory. With a 3.51% yield to sweeten the deal, it’s attractive to investors looking for stocks to hold long-term.

[stock_market_widget type=”accordion” template=”extended” color=”#5679FF” assets=”UPS” start_expanded=”true” display_currency_symbol=”true” api=”yf”]

You might also like:

- The Crypto Melt-Up has Begun

- “A.I. is a Tidal Wave” – Here’s What to Buy

- Beware Executive Order 14067

- #1 AI Stock for 2024 and Beyond

- Bank plague 2024

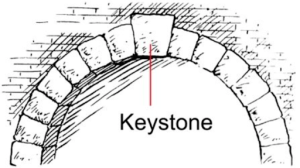

- Gates, Bezos, and Buffett invest in AI Keystone

- Congress Just Fast-tracked New A.I. Energy Breakthrough

- Elon Musk: THIS will be bigger than Tesla

- EV charging stations that pay you up to $93/day!

- Legendary Wall Street Stock-Picker Names #1 A.I. Stock of 2024, Live On-Camera