Seeking out great stocks to buy is important, but identifying quality investments is only half the battle. Many would say it’s even more essential for investors to know which stocks to steer clear of. A losing stock can eat away at your precious long-term returns. So, determining which stocks to trim or eliminate is essential for proper portfolio maintenance.

Even the best gardens need pruning. Here we’ll cover three stocks that seem like prime candidates for selling or avoiding next week.

Black Hills Corporation (BKH)

Natural gas producer Black Hills Corporation reset its growth outlook lower after reporting disappointing Q4 results, slashing its 2023 EPS view to $3.65-$3.85 from $4.00-$4.20. The revision was driven by a rapid shift in macroeconomic factors, including elevated natural gas price volatility and higher natural gas demand driven by winter storm Elliot in December 2022. With elevated natural gas price volatility, higher interest rates, and general inflationary pressures forecasted through 2024, Black Hills is only expected to grow earnings by 2% in 2024 and 4% in 2025.

[stock_market_widget type=”accordion” template=”info” color=”#5679FF” assets=”BKH” start_expanded=”true” display_currency_symbol=”true” api=”yf”]

[stock_market_widget type=”chart” template=”basic” color=”#5679FF” assets=”BKH” range=”1mo” interval=”1d” axes=”true” cursor=”true” range_selector=”true” display_currency_symbol=”true” api=”yf”]

Funko Inc. (FNKO)

This week pop culture consumer products company Funko, Inc. announced a set of leadership changes that include a C-suite management shakeup, a COO role creation, and the introduction of an execution consultant following several missteps over the last two quarters. The changeover in management could take several quarters to reset and could present challenges in building investor confidence. FNKO shares currently trade at a premium to its historical averages and near the high end of its relative valuation range versus the S&P 500. The stock’s rich valuation seems unwarranted, considering the high degree of execution risk.

[stock_market_widget type=”accordion” template=”info” color=”#5679FF” assets=”FNKO” start_expanded=”true” display_currency_symbol=”true” api=”yf”]

[stock_market_widget type=”chart” template=”basic” color=”#5679FF” assets=”FNKO” range=”1mo” interval=”1d” axes=”true” cursor=”true” range_selector=”true” display_currency_symbol=”true” api=”yf”]

Carvana (CVNA)

Used car prices skyrocketed coming out of the pandemic. However, it looks like the used car market is entering a correction, with some analysts calling for an impending collapse. The Manheim Used Vehicle Value Index showed that used car prices sank 14.9% year-over-year in December 2022, the largest annualized price decline in the 26-year history of that index.

Due to the steep decline in used car prices, Carvana stock has lost 95% of its value over the last 12 months. The company’s profit per vehicle was lower by 25% in 2022. Meanwhile, its total debt stands at $9.25 billion, with only $650 million of cash on hand. There have also been confirmed media reports that the company’s creditors have signed an agreement on handling negotiations with Carvana if it goes bankrupt. That’s not a good sign.

[stock_market_widget type=”accordion” template=”info” color=”#5679FF” assets=”CVNA” start_expanded=”true” display_currency_symbol=”true” api=”yf”]

[stock_market_widget type=”chart” template=”basic” color=”#5679FF” assets=”CVNA” range=”1mo” interval=”1d” axes=”true” cursor=”true” range_selector=”true” display_currency_symbol=”true” api=”yf”]

You might also like:

- The Crypto Melt-Up has Begun

- “A.I. is a Tidal Wave” – Here’s What to Buy

- Beware Executive Order 14067

- #1 AI Stock for 2024 and Beyond

- Bank plague 2024

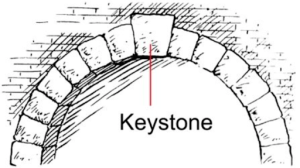

- Gates, Bezos, and Buffett invest in AI Keystone

- Congress Just Fast-tracked New A.I. Energy Breakthrough

- Elon Musk: THIS will be bigger than Tesla

- EV charging stations that pay you up to $93/day!

- Legendary Wall Street Stock-Picker Names #1 A.I. Stock of 2024, Live On-Camera

NEXT:

Get Free Stock Picks via SMS by Signing Up Below!

I would like to receive timely trade ideas and stock watchlists from Wall Street Watchdogs at the phone number provided. Message frequency varies. Message and data rates may apply. Reply HELP for help or STOP to cancel.(Watchdogs SMS Terms of Service & Privacy Policy)