Given the unprecedented situation with major threats from Russia and China, Washington is not the only world power taking steps to strengthen the technical capabilities of its military and that of its allies while also seeking to protect the U.S. from cyber threats. Experts project that by 2027, the global network security market will command a valuation of $16.6 billion, representing a CAGR of 23.5% from 2023 estimates.

Long-term-minded investors would do well to include stocks from the segment as governments and businesses around the world ramp up their efforts against cyberterrorism. But not all companies from the burgeoning subsector are set to last. Online security is a young, quickly evolving industry. Competition is heavy in the space, and demand continues to grow faster in both volume and complexity.

As a leader when it comes to cybersecurity solutions, today’s featured company is poised to scoop up a significant portion of the whopping 15.6 billion that the U.S. is expected to spend on cybersecurity in 2023. Unlike many of its competitors, this ticker is still reasonably priced.

Booz Allen Hamilton (BAH) is one of the world’s largest cybersecurity solutions providers. Specializing in marketing cybersecurity products that are produced by other companies, nearly every U.S. federal, intelligence and defense agency uses its services. In other words, Booz Allen is poised to scoop up a significant portion of the whopping 15.6 billion that the U.S. is expected to spend on cybersecurity in 2023.

For its fiscal 2023 second quarter, which ended September 30, revenue surged 9.16% year over year to $2.3 billion, while its net income jumped an impressive 10.4% to $170.93 million. Booz Allen reported quarterly earnings of $1.25 per share, exceeding Wall Street expectations of $1.13 per share. The company raised its full-year EPS view to $4.24-$4.50 from $4.15 – $4.45. Wall Street expects $4.88 EPS for the full year, indicating a reasonable forward P/E of 24 times.

Cowen analyst Cai von Rumohr recently raised the firm’s price target on BAH to $123 from $109 after hosting the company at the firm’s London Industrials & Renewables Summit and coming away with a favorable outlook, driven by continued demand tailwinds and an easing labor market.

The current consensus recommendation is to Buy BAH. A median price target of $115 implies an 21% upside. The stock comes along with a 1.66% dividend yield.

You might also like:

- The Crypto Melt-Up has Begun

- “A.I. is a Tidal Wave” – Here’s What to Buy

- Beware Executive Order 14067

- #1 AI Stock for 2024 and Beyond

- Bank plague 2024

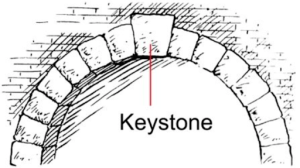

- Gates, Bezos, and Buffett invest in AI Keystone

- Congress Just Fast-tracked New A.I. Energy Breakthrough

- Elon Musk: THIS will be bigger than Tesla

- EV charging stations that pay you up to $93/day!

- Legendary Wall Street Stock-Picker Names #1 A.I. Stock of 2024, Live On-Camera

NEXT:

Get Free Stock Picks via SMS by Signing Up Below!

I would like to receive timely trade ideas and stock watchlists from Wall Street Watchdogs at the phone number provided. Message frequency varies. Message and data rates may apply. Reply HELP for help or STOP to cancel.(Watchdogs SMS Terms of Service & Privacy Policy)