“You’d better brace yourselves, a hurricane is coming…”

The Gist:

[Porter’s full letter here]

Porter Stansberry has released a new documentary called The Two Men Destroying America.

And a lot of powerful people would rather this exposé never saw the light of day. Chances are, they’ll attempt to have it scrubbed from existence.

That’s because it tells the true (and terrifying) story of how two men from New York have engineered a reset of not just your personal wealth, but the entire US economic system.

You can watch it here, or read a special message from Porter below…

From the desk of Porter F. Stansberry:

I’m going to unpack a sobering economic reality…

One that no one else will have the courage to explain to you.

And the scary thing is this: If more Americans appreciated the ugly reality of what they’re facing, they’d be on the streets – en masse – tomorrow. And it would be very, very ugly.

First, though, it’s important to understand one key economic precept…

In an honest marketplace with real private property and a legitimate currency, the value of wages always rises to meet growth in productivity. This is a central feature of the invisible hand of the free market.

Why would a profit-seeking entity voluntarily pay higher wages to employees? To maximize the company’s earnings. That might sound contradictory at first. Often, it’s easier to see the invisible hand at work when you “invert” the question.

So, what happens when governments mandate minimum wages that are in excess of prevailing productivity? Unemployment soars, of course: companies and entrepreneurs can’t afford to pay wages that are not economically viable.

The opposite is also true: when productivity increases, entrepreneurs increase employment and wages. They do so because of the invisible hand: to maximize their own profits… they need more efficient employees (who require higher wages) to get the job done.

Think of Henry Ford. He famously doubled the wages of his huge workforce from $2.50 per day to $5.00 per day in 1914. It was a pay raise that cost him $10 million. Why did he do it?

Because gains in productivity made producing more and more cars vastly more profitable. But to increase production, he needed a more reliable labor force. The year before the pay raise Ford made 170,000 cars. In 1914 he was able to increase production to 202,000.

The details matter when it comes to pay and incentives.

Most historians leave out the fact that Ford’s pay raise came in the form of a bonus paid at the end of the year. And it was only paid to those workers who lived their lives in an “American” way.

They had to speak English. Their wives couldn’t work outside the home. And they had to avoid drinking and gambling. Sound money and a free market promote a stable and orderly society.

Historically in the U.S., “real” wages (after tax, after inflation) continuously rose to match the rising productivity of the U.S. economy. This is exactly as economic theory would predict — in a free market, with sound money.

As the productivity of our economy grew – thanks at first to the industrial revolution, then because of the electrification of our country, and, finally due to the information revolution – real wages rose at virtually the exact same rate. No need for unions or strikes. Just the invisible hand.

But all of this changed, in the early 1970s.

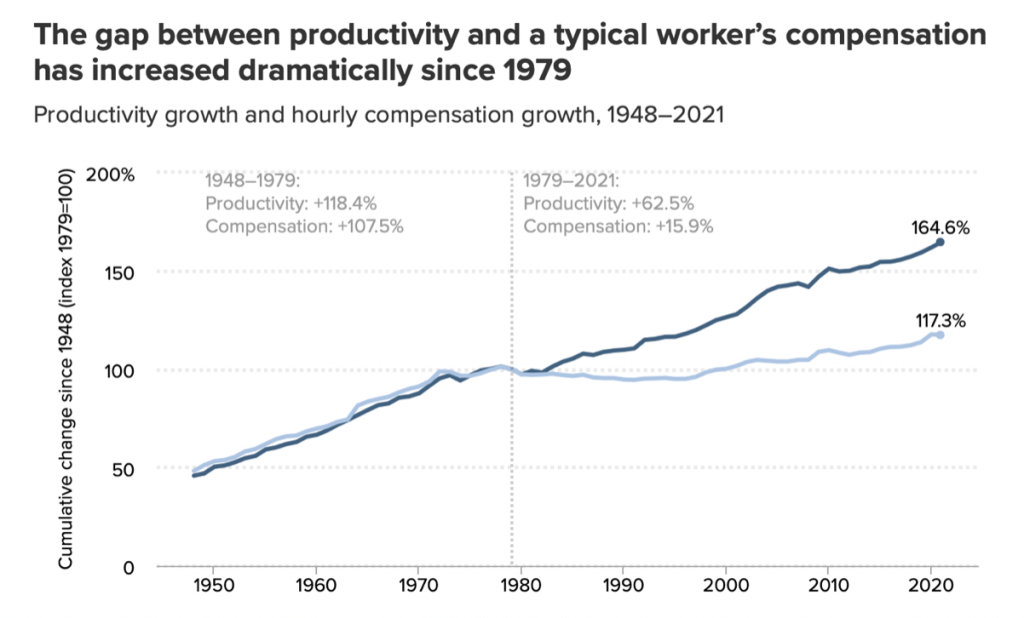

And that’s where the revolution would come in – if America’s workers took a long, hard look at this chart…

Your Hard Work Doesn’t Matter Anymore

As the chart below shows clearly, wages and productivity “decoupled” about 50 years ago.

That’s when the U.S. abandoned the gold standard. By untethering our currency and banking system from a foundation in gold, credit was able to expand far beyond savings.

This set the stage for a massive inflation and ever-increasing government borrowing.

Ever since then, most of the gains we’ve experienced in productivity have, sooner or later, been erased from real wages by periods of inflation.

The most recent spike in inflation will probably reduce real wages by 10% to 20% over the next five years, even as productivity continues to grow.

That’s why, for more and more Americans, no matter how hard they work, they will not be able to avoid slipping into poverty. That’s why, for more and more Americans, our government, our economy, and our “system” seem completely illegitimate.

They are not wrong: they have been defrauded.

And they are right to be angry.

The root of this problem isn’t the private sector or “greedy” corporations. It is simply the ongoing rising (and massive) government deficits, which are financed, more and more, by inflation.

Ironically, it is typically poor Americans who continue to vote for yet more government spending and intervention in the economy. And, sadly, it seems virtually certain that their gullibility will only increase, thanks to the growing influence of the government over the media.

Sooner or later, a massive — and possibly violent — crisis will strike.

Jamie’s Warning – Like Merrill’s?

Jamie Dimon, CEO of JP Morgan, is so far the only major Wall Street figure who has offered any substantial warning about what’s happening.

He said on a recent earnings call, “You’d better brace yourselves… a hurricane is coming.” And he’s so concerned he’s having his bank – America’s largest – stockpile reserves in the hundreds of millions. This isn’t business as usual.

Right before the Great Depression, in the spring of 1928, a young stockbroker advised his clients to get out of debt – completely. Back then, virtually all investors in the stock market used margin loans to finance their holdings. Telling his customers to get completely out of debt was tantamount to telling them to sell virtually all their investments.

This young broker also warned his clients to completely avoid owning any corporation that was financed, in any way, with debt. He repeated this advice month after month, for more than a year, until the market crashed in the fall of 1929.

His advice saved the fortunes of his clients. And it made him, and his firm, Merrill Lynch, the most famous and successful stock brokerage in the country for nearly 70 years.

Dimon’s warning is essentially the same. And for the exact same reason.

What’s happening right now is the big “unravel.” Since the financial crisis of 2008/2009, the U.S. economy has been completely dependent on the creation of massive amounts of additional debt.

Most of the debt that’s been created (in the U.S.) is federal government debt, which now totals $30.5 trillion, up 200% since before the financial crisis.

Lots of other forms of private debt have grown too, like student debt. Today, 44 million Americans owe a total of $1.7 trillion in student debt, overall up 183% since before the financial crisis.

These debts are virtually all held by the U.S. government, which has suspended repayment since the onset of Covid and now seems determined to forgive most, if not all of this debt — another massive form of inflation, and a severe blow to the kind of middle-class work ethic that sustains our society.

Going back to the huge stock market bubble of the late 1990s and early 2000s, over roughly the last 20 years, total debt in the U.S. economy has grown from 2.6x GDP to 4x GDP. Today that total debt is an incredible $91 trillion.

That’s a number that’s impossible to conceptualize. But it’s basically $1 million per household. Meanwhile, the average U.S. family has under $10k in savings.

This level of debt is, as should be obvious, completely unsustainable. And the only way it can be financed is by continued increases to the money supply, via the Federal Reserve.

Our central bank has been printing new dollars, by the trillions, and buying government bonds and mortgage bonds to keep interest rates low, and fixed income (bond) prices high. This is, on a much, much bigger scale, “third world finance.”

And this kind of manipulation will produce a booming economy… until… eventually… inflation soars.

Once people begin to realize that the entire economy is built on a house of cards, everything changes. People began to hoard resources and shun financial assets. Everything collapses.

That’s what’s happening. It’s happening right now. And you have to get ahead of it… or you risk losing everything.

That’s why Jamie Dimon is so worried. And in time, Dimon’s warning will be remembered as virtually identical to Merrill’s.

He warned us: A hurricane is coming.

That storm will see rising interest rates, rising debt defaults and, most importantly, declining real wages, because the inflation that’s begun will prove very difficult to rein in.

This recession will probably be “mild” for most affluent Americans – whose relatively high incomes, investments, and real estate will shield them from the worst impact of inflation.

But for the middle class, the coming recession will be the worst since the 1970s.

The Two Men Behind the Storm

Here’s the most frightening part:

This coming catastrophe isn’t a faceless threat.

Set against a backdrop of rampant debt, money-printing, and shrinking wages, our country is being turned upside down as part of a deliberate plot to reset not just your personal wealth, but the entire U.S. economic system.

This is a plan that’s been meticulously engineered by two of the world’s most powerful men over the last 20 years.

These are two unelected billionaires who exist outside the checks and balances of Washington, D.C., yet wield far more power than any politician or political party.

And what they have planned next will terrify you…

It could result in tens of millions of Americans being wiped out financially. I believe it will be more devastating than the 2008 financial crisis. And for those who are unprepared, it could decimate their entire livelihoods.

That’s not even the worst of it, though. I believe the shockwaves from this “reset” will rip our country even further apart, leading to a surge in violence, protests, and economic disruption.

That’s why it’s critical that you watch my new documentary immediately – to discover how you can protect your wealth, your loved ones, and your way of life.

To stream it at no cost, click here now.

Sincerely,

Porter Stansberry

You might also like:

- A.I. Gamechanger Says “$2.50 Stock Set to Breakout Overnight”

- Mysterious Gold Leverage Just Announced

- Elon’s New A.I. Device is About to Shock the World

- Prepare Now Before This Looming $2 Trillion D.C. Shock

- Buy Elon Musk’s New $1 Play before June 30

- Write this ticker symbol down…

- The Crypto Melt-Up has Begun

- “A.I. is a Tidal Wave” – Here’s What to Buy

- Beware Executive Order 14067

- #1 AI Stock for 2024 and Beyond