Seeking out great stocks to buy is important, but many would say it’s even more essential to know which stocks to steer clear of. A losing stock can eat away at your precious long-term returns. So, determining which stocks to trim or eliminate is essential for proper portfolio maintenance.

Even the best gardens need pruning, and our team has spotted a few stocks that seem like prime candidates for selling or avoiding. Continue reading to find out which three stocks our team is staying away from this week.

The gig economy could be in for some big changes soon. The U.S. Department of Labor is considering updates to its policies that would force gig employers to categorize some of their workers as employees instead of independent contractors. The rule change aims to prevent companies from avoiding benefits that employees are legally entitled to.

The new policy will likely go into effect next year and will almost certainly have a negative impact on gig economy stocks. Deutsche Bank analyst Benjamin Black quantified the risk of re-classification, which he calculates could lead to a 20% increase in gross fares and close to 70% of drivers being eliminated from both platforms. Lyft (LYFT) is one of the companies facing the proverbial eight ball.

Bof A analyst Michael McGovern recently initiated coverage of LYFT with an underperform rating and a $14 price target, noting that Uber management said that their U.S. Mobility market share was “at or near a multi-year high” in the second quarter. In the near term, the analyst expects Lyft’s smaller scale to create “unique challenges in its post-pandemic recovery,” including share losses.

The company is expected to post quarterly earnings of $0.07 per share in its upcoming November report, representing a year-over-year change of +40%. Revenues are expected to be $1.05 billion, up 21.9% from the year-ago quarter.

There’s no question that electric vehicles are the future, but investors looking for bargains amid the market meltdown would be wise to steer clear of third-party companies specializing in EV charging stations like Blink Charging (BLNK). It’s much too soon to predict winners in this cutthroat niche of the EV industry, mainly because it’s still unclear if third-party charging kiosks will ever be profitable.

Analysts don’t see Blink becoming profitable before 2026. The company will likely look at a much different landscape by then. A lot can change in three and a half years. From the current vantage point, the near future looks murky for the entire EV industry.

Blink Charging shares have fallen 70% since peaking in early 2021 and are 41% lower year-to-date, but the stock is still trading at 28 times, trailing twelve-month revenue. For perspective, the price-to-sales ratio for the S&P 500 index as of September was roughly 3. The current consensus is to Hold Blink stock. We’ll stick to the sidelines on third-party EV charging companies until EV industry headwinds subside.

Over the past two years, the dramatic shift from brick-and-mortar shopping to e-commerce has been a tremendous obstacle for investors in malls and shopping centers. The demise of cornerstones like Sears and JCPenny hastened the decline as shopping malls are now left without anchor tenants. Recent data suggests that 25% of America’s 1,000 malls will be closed in the next 3-5 years.

Leading shopping mall REIT Simon Property (SPG) is struggling to pivot amid the inevitable decline of its core asset group. The REIT has been aggressive in diversifying into outlets and foreign real estate, which may help to hedge against increasingly substantial losses from their shopping mall category. But given current inflation and the possibility of an economic slowdown, both shoppers and retailers may be in a tight spot this holiday season which will inevitably weigh heavily on SPG.

Investors choose REIT stocks because of their income-producing abilities and yields. The fact that SPG is concentrated in brick-and-mortar retail is tangential to its income feature. Anyone looking for the reliable income that real estate and mortgage investments can bring would be wise to steer clear of Simon Property for now.

You might also like:

- The Crypto Melt-Up has Begun

- “A.I. is a Tidal Wave” – Here’s What to Buy

- Beware Executive Order 14067

- #1 AI Stock for 2024 and Beyond

- Bank plague 2024

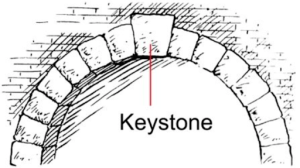

- Gates, Bezos, and Buffett invest in AI Keystone

- Congress Just Fast-tracked New A.I. Energy Breakthrough

- Elon Musk: THIS will be bigger than Tesla

- EV charging stations that pay you up to $93/day!

- Legendary Wall Street Stock-Picker Names #1 A.I. Stock of 2024, Live On-Camera

NEXT:

Get Free Stock Picks via SMS by Signing Up Below!

I would like to receive timely trade ideas and stock watchlists from Wall Street Watchdogs at the phone number provided. Message frequency varies. Message and data rates may apply. Reply HELP for help or STOP to cancel.(Watchdogs SMS Terms of Service & Privacy Policy)