Here’s why you should invest in some of Buffett’s biggest losers.

The stock market has gotten off to a brutal start in the first half of 2022. The S&P 500 index is down roughly 20% year to date. Meanwhile, the Nasdaq Composite index has slid a staggering 29% during that stretch.

With a decline of roughly 7% this year, Berkshire Hathaway stock has held up significantly better than the market at large, but Warren Buffett’s company has stocks in its portfolio that have recorded dramatic losses amid current market pressures. Snowflake (SNOW 3.93%) and StoneCo (STNE 0.91%) stand out as two of the biggest losers in the Berkshire portfolio, but risk-tolerant investors could actually go on to score big wins with these beaten-down companies. Here’s why these growth stocks are worth betting on.

1. Snowflake

The ability to store and analyze data through the cloud has never been more vital to business and organizational success. In most cases, having a wider range of information to draw from leads to superior insights and data-driven decision-making. Unfortunately, cloud-infrastructure providers don’t make it easy to get the full picture and prevent information from being shared across their respective services. That’s where Snowflake comes in.

The cloud software specialist provides data warehousing services that make it possible to combine, store, and analyze otherwise walled-off information on the fly. Amid digital-transformation trends and an explosion of new data being created, the ability to analyze, act on, and automate services based on the most relevant information available is already central to success for many organizations. It will only become more important for large businesses and institutions.

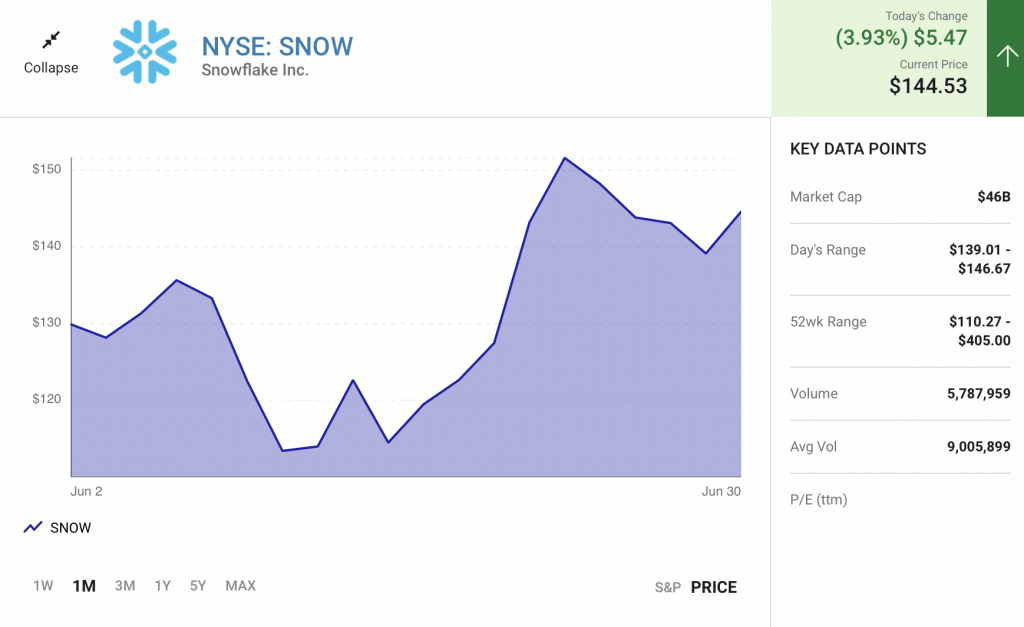

At its peak, Snowflake stock traded as high as $405 and was briefly one of the best-performing stocks in the Berkshire portfolio. However, the company’s valuation has collapsed as the broader market has come under pressure and investors have bailed on growth-dependent software stocks. Its share price is now down 57% in 2022 and 65% from its high.

With the Federal Reserve implementing large interest rate hikes to combat rising inflation and Snowflake still sporting a growth-dependent valuation, it’s not hard to see why the stock has fallen out of favor. On the other hand, the data specialist is providing important services that have an incredibly strong long-term demand outlook. Patient investors could score big wins with this beaten-down tech leader.

2. StoneCo

As bad as they’ve been in the U.S. lately, inflationary pressures have been even worse in some other parts of the world. Brazil has been particularly hard hit, and coupled with a relatively weak economic recovery on the heels of the coronavirus pandemic, the challenging backdrop has created major headwinds for the nation’s growth-dependent fintech and e-commerce companies.

StoneCo is a Brazil-based financial-technology company that provides payment-processing services and once had a promising credit business catering to small-and-medium-sized businesses. Due to business failures spurred by pandemic conditions and new governing policies being introduced by Brazilian regulators, the company’s lending business has run into trouble that has reshaped the narrative on the company at large.

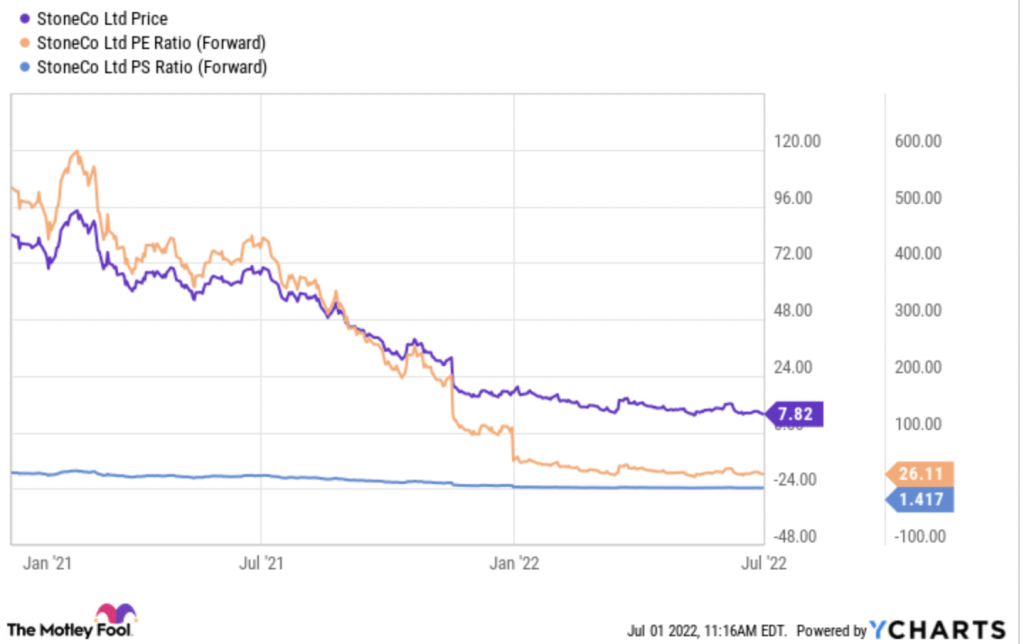

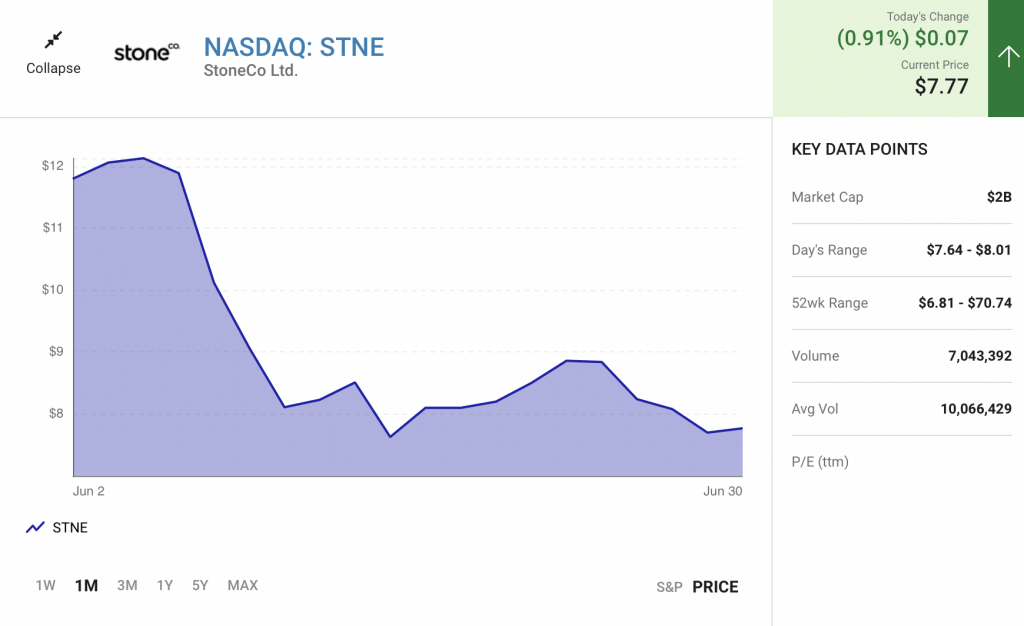

Facing these challenges, StoneCo is set to take a large write-off on its debt portfolio, and the outlook for that segment of the business looks uncertain, with new loans currently on hold. The stock is currently down about 54% year to date and roughly 92% from the all-time high in early in 2021.

Despite the large loss that the company will have to digest from its credit business, StoneCo is still increasing sales at an attractive clip and posting substantial profits, and it looks cheaply valued at a market capitalization of roughly $2.4 billion.

The company’s payment-processing business has continued to post encouraging performance, and the business’s overall results in the first quarter were pretty strong. The fintech services provider’s active payments client base grew roughly 112% year over year to reach approximately 1.92 million, and overall revenue increased 139% year over year — hardly the kind of numbers that would suggest the fintech is down for the count.

It’s possible that StoneCo will never reclaim the valuation high it hit last year, but the shares offer attractive upside at current prices.

Read Next: $150 Trillion | Transformation of US | Bezos/Musk

This is troubling.

Have you heard of COP26?

Almost nobody has.

Amid the distractions caused by lingering health issues, conflicts overseas, shortages, and inflation…

Treasury Secretary Janet Yellen recently took the stage at COP26 in Glasgow, Scotland to address some of the world’s most powerful people, including:

●U.S. President, Joe Biden…

●British Prime Minister, Boris Johnson…

●Canadian Prime Minister, Justin Trudeau…

●French President Emmanuel Macron…

●… and many more…

From the stage, Yellen called for world leaders to commit to a $150 trillion ‘global transition’ of our economy.

Since then, Bank of America has signed the accord, along with 131 countries, 234 cities, and 695 of the world’s biggest companies.

Jeff Bezos and Elon Musk have invested in this ‘transformation’ as well.

What is it that Yellen, Biden, Trudeau, Bezos and Musk are pushing for?

And what does it mean for your money?

Investigative journalist and renowned economist, Nomi Prins has followed the money… And what she’s found is startling.

She says:

“While most Americans are distracted by mainstream media headlines calling for a stock market crash, I’ve found evidence that shows where the elites are spending $150 trillion to ‘transform’ the economy.Most Americans will be shocked when they see what happens next.”

I had to know more, so I scheduled an interview for Nomi to go deeper into the details of this ‘transformation.’

She agreed to do the interview on one condition: she wanted to record it so she could get her message in front of as many Americans as possible before it’s too late.

Go here to see how this ‘transformation’ will play out –and what it means for your money.