Companies in the financial industry provide services such as loans, savings, insurance, payment services, and money management to both individuals and businesses. Companies involved in retail and commercial banking, accountancy, insurance, asset management, credit cards, and brokerage are all represented by financial sector stocks. Wells Fargo Co. (WFC), Goldman Sachs Group Inc. (GS), and Morgan Stanley (MS) are all well-known names in the industry.

Over the previous 12 months, financial companies, as represented by the Financial Select Sector SPDR ETF (XLF), have outperformed the wider market, with a total return of 36.7% vs. 27.2% for the Russell 1000.

I’ve discussed financial stocks in the past, but on a broader scale, including financial giants such as Visa (V). Today I’ll instead break down three not-so-huge names from the financial sector that the experts are saying exhibit excellent growth potential. They’re also noted for their momentum and their value. This is all especially worth considering when moving into a new fiscal year.

Let’s glimpse at those three stocks which the analysts call smart, innovative picks for our portfolios:

Alliance Data Systems Corp (ADS)

Alliance Data Systems Corp. (ADS) operates in the supply of data-driven and transaction-based marketing, customer loyalty, and payment solutions. ADS is divided into three segments: LoyaltyOne, Epsilon, and Card Services. The LoyaltyOne division provides coalition and short-term loyalty programs. Epsilon provides marketing solutions. Card Services provides risk management solutions, account origination, funding, transaction processing, customer support, collections, and marketing services. ADS’ headquarters are in Columbus, Ohio, formed in 1996.

On November 8th, ADS completed the spin-off of its LoyaltyOne component into Loyalty Ventures Inc, a new publicly listed company (LYLT). ADS will hold its common stock for 19% of the outstanding shares. ADS has an impressive earnings record for fiscal 2021; they most recently beat EPS projections by 60.31% and 99.43% the quarter prior. ADS’ current quarter shows us $1.93 per share, with sales of $1.1 billion. ADS currently pays a dividend yield of 1.15%. The consensus price target for ADS from analysts that provide 12-month price projections is 109.00, with a high of 145.00 and a low of 75.00. The estimate is up 55.27% from the most recent price. Analysts tell us to buy stock in ADS.

Evercore, Inc (EVR)

Evercore, Inc. (EVR) is a privately held investment banking advising firm. It works in two main segments: investment banking and investment management. The company’s worldwide advisory business, through which it provides strategic corporate advice, capital markets advisory, and institutional equities services, is included in the Investment Banking sector. The Investment Management segment offers wealth management and trust services through Evercore Wealth Management LLC. Roger C. Altman created the firm in 1995, and it is based in New York, NY.

When it comes to having a good year on the earnings front, EVR had one in 2021. They easily (by pretty big margins) beat analysts’ projections on EPS (Earnings-per-share) and revenue for the last four consecutive quarters. EVR’s current quarter, shows us $864.7 million in sales, at $4.45 per share. EVR currently pays a dividend yield of 2.03%. The year-over-year financials and forecasts all indicate continued growth in EVR. It has a consensus price target of 167.00 among analysts that provide 12-month price estimates, with a high of 185.00 and a low of 141.00. The forecast reflects an increase of 22.03% over its current price, and the consensus is strong to buy and hold EVR.

Blackstone, Inc (BX)

Blackstone, Inc. (BX) is a financial services company specializing in investing and fund management. Private Equity, Real Estate, Hedge Fund Solutions, and Credit are the segments it operates. Private equity funds, Blackstone Capital Partners funds, and sector-focused corporate, private equity funds make up the Private Equity section. The Real Estate division comprises the management of core real estate funds and non-exchange traded real estate investment trusts (REITs). Blackstone Alternative Asset Management, which manages hedge funds, is part of the Hedge Fund Solutions sector. GSO Capital Partners LP, which manages credit-oriented funds, is part of the Credit division. Stephen Allen Schwarzman created the firm in 1985, and it is based in New York, NY.

As with Evercore, BX has had an incredible 2021 regarding earnings reports. It crushed experts’ predictions on EPS and sales for the last four consecutive fiscal quarters. BX currently pays a dividend yield of 3.37%. Their year-over-year numbers and forecasts all look great, with both annual and quarterly growth projected. The current quarter for BX shows us an EPS of $1.31 per share, with sales of $3.3 billion. The consensus price target for BX among analysts that provide 12-month price projections is 148.00, with a high estimate of 190.00 and a low estimate of 110.00. The median estimate is up 23.58% from the previous price, and the consensus gives BX a strong buy rating.

Should you invest in Blackstone, Inc right now?

Before you consider buying Blackstone, Inc, you'll want to see this.

Investing legend, Keith Kohl just revealed his #1 stock for 2022...

And it's not Blackstone, Inc.

Jeff Bezos, Peter Thiel, and the Rockefellers are betting a colossal nine figures on this tiny company that trades publicly for $5.

Keith say’s he thinks investors will be able to turn a small $50 stake into $150,000.

Find that to be extraordinary?

Click here to watch his presentation, and decide for yourself...

But you have to act now, because a catalyst coming in a few weeks is set to take this company mainstream... And by then, it could be too late.

Click here to find out the name and ticker of Keith's #1 pick...

You might also like:

- The Crypto Melt-Up has Begun

- “A.I. is a Tidal Wave” – Here’s What to Buy

- Beware Executive Order 14067

- #1 AI Stock for 2024 and Beyond

- Bank plague 2024

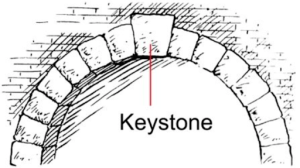

- Gates, Bezos, and Buffett invest in AI Keystone

- Congress Just Fast-tracked New A.I. Energy Breakthrough

- Elon Musk: THIS will be bigger than Tesla

- EV charging stations that pay you up to $93/day!

- Legendary Wall Street Stock-Picker Names #1 A.I. Stock of 2024, Live On-Camera