You don’t need much money to invest in outstanding dividend-paying stocks. For example, here are three great chip stocks with affordable shares and generous dividends.

If you want to add some dividend-paying stocks to your portfolio, you don’t have to break the bank to find some great options. In fact, there are plenty of high-yield, low-priced stocks out there that can provide a nice stream of income without costing you a fortune. If you have $400 to invest in income-generating stocks this month, that’s more than enough to get a healthy dividend flow going.

You may have noticed that many semiconductor stocks have taken a particularly hard hit lately. The good news is that the industry’s manufacturing capacity shortage is easing up, which suggests that lagging top-line growth and slim bottom-line earnings should improve over the next couple of years. Hence, I think it’s smart to snag some high-quality chip stocks to lock in those generous dividend yields.

Qualcomm yield: 2.7%

Wireless communications specialist Qualcomm (QCOM 5.43%) has a long history of consistent dividend payments and has systematically increased its dividend over time. The payouts have tripled in 10 years. The company has a strong financial foundation, with a 45% return on invested capital over the last four quarters and somewhat uneven but reliably positive free cash flows. That robust flow of cash profits is fertile ground for continued dividend increases.

Most of Qualcomm’s semiconductors end up in the telecommunications sector, which tends to be relatively stable and resistant to economic downturns. People need their cellphones, after all, and many companies specialize in finding innovative ways to make use of mobile data networks. As a result, investors can expect a reliable stream of dividends from Qualcomm.

The stock is also trading at the penny-pinchiest valuation ratios in decades and the dividend yield has nearly doubled in 52 weeks. What’s not to love about this rock-solid dividend machine?

Analog Devices yield: 1.9%

Mixed-signal processor maker Analog Devices (ADI 3.65%) also has a stellar history of cash-powered dividend increases. The company’s sales more than quadrupled in the last decade, driving trailing free cash flows 500% higher. Analog Devices tapped into those surging cash profits to lift dividend payments 124% higher over this period.

The company stretches its semiconductor tentacles into a plethora of target markets, including muscular sectors such as automotive computing, military applications, and digital communications. Industrial chips account for more than half of Analog Devices’ annual sales. All four of its operating divisions saw sales surge at least 50% higher in fiscal year 2022, which ended on Oct. 29, 2022. That’s a stellar performance, especially since it was achieved in a period with inflationary pressure holding back many of Analog Devices’ target markets and device-building customers.

The stock isn’t exactly cheap, trading less than 20% below its all-time highs at 31 times trailing earnings and 38 times free cash flows. However, you’re paying a premium price for a top-quality business. All signs point to higher prices for Analog Devices’ stock over time, so you may want to grab a couple of shares before they fly much higher.

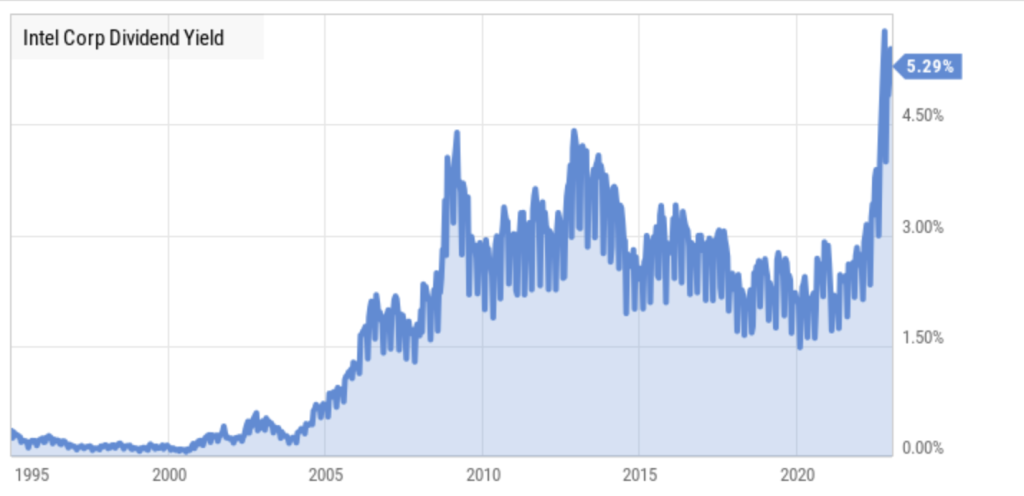

Intel yield: 5.3%

And then there’s the traditional king of the castle. Industry giant Intel (INTC 4.25%) is on fire sale these days, with shares trading more than 50% below their 52-week highs at just 8.5 times trailing earnings.

There are solid reasons for Intel’s price drop, of course. The company is operating under relatively new management, untangling the mess left behind by its forebears, in the midst of an industrywide manufacturing shortage that started with coronavirus lockdowns in 2020.

CEO Pat Gelsinger came back to Chipzilla in February 2021 after a 12-year stint at the helm of virtual computing expert VMWare. I believe Gelsinger’s decades of engineering experience are the right medicine to cure the manufacturing troubles left behind by his predecessors, Brian Krzanich and Bob Swan. Now two years into Gelsinger’s return, you should soon start to see the concrete results of his innovation-focused revolution of Intel’s company culture.

Remember, the pipeline from initial idea to shelf-ready processors is about four years long. The many steps of just manufacturing a single processor add up to a process of at least two months. Improving the infrastructure behind the design and chip-building processes is even slower. Nothing comes quickly or easily when you’re making a game-changing U-turn in this industry.

So the bears found plenty of fuel for their pessimistic arguments. At the same time, Intel has a unique business advantage that smaller rivals simply can’t match. This giant should be able to spend its way out of pretty much any predicament.

As of Oct. 1, 2022, Intel had $23 billion of cash equivalents and short-term investments. Its property, plant, and equipment (PP&E) assets clocked in at $75.8 billion, consisting mostly of chipmaking equipment and facilities. Intel invested another $19.1 billion in more PP&E improvements in the first three quarters of 2022.

I firmly believe that Gelsinger is putting Intel back on the right track, and investors will start seeing the benefits of his efforts over the next couple of years. The stock is curling up to deliver a spring-loaded rebound when the time is right.

In the meantime, the combination of lower share prices and ever-increasing dividend payouts has led to a plateau with the highest dividend yields in Intel’s history. This looks like a great time to lock in those juicy dividend payouts at a rock-bottom stock price.

The real-world payout

You really can create a balanced tech portfolio of these three chip stocks for less than $400. At their current prices, you can pick up one share of Qualcomm, one share of Analog Devices, and four shares of Intel for a total of $380, leaving you with almost enough pocket change to grab another Intel stub. Even if you don’t, that mini-portfolio will deliver annual dividends of $11.60. If you repeat those buys for a full year, your little cash machine will generate $139 in yearly dividend payouts.

That’s in a perfect vacuum where no stock price ever moves and dividend payouts are unchanged in the long run. You’ll do better in the real world as dividend payouts are able to increase and stock prices can go up.

Read Next – Calling the bottom

I called the exact day bitcoin peaked in 2017.

And I called the exact hour marijuana stocks would start their big collapse in 2018.

In 2020, the very day the stock market bottomed during the coronavirus crisis, I told my readers it was the best time to be an investor in more than a decade.

Now, I’m sticking my neck out again on of one of the most talked-about stocks of the year.

I think there’s a good chance this stock just bottomed. And if my previous record of calling bottoms is any indication, you had better hurry…

Get the full details of this opportunity right here.

P.S. Some of the world’s biggest investors including Bill Gates and Cathie Wood have already invested investing millions into it. Don’t miss it for world.