After a tough few months, lithium — a crucial element in electric vehicle batteries— is back in focus as prices rebound. Lithium futures on the LME were down over 45% year-to-date by the end of April and well off their record highs seen in late 2022. But this month, however, lithium prices started to bounce back. Battery-grade lithium carbonate prices in China rose around 10% this month, according to Refinitiv data.

Though falling spot prices have raised red flags for investors over the long-term outlook of lithium miners, analysts believe spot prices will rise again as we get closer to the end of the year. “We expect pricing to find a bottom in 2023 on the back of strong demand,” said Reg Spencer of Canaccord Genuity.

In the long run, the supply and demand story for the silver-white light metal seems to be in the miner’s favor and now may be the perfect time to strike on some of the beaten-down names from the industry.

Sigma Lithium (SGML)

Last month Sigma Lithium achieved its first production of Green Lithium, officially transitioning the company from developer to producer. The company announced that it has successfully achieved first production of spodumene concentrate at its flagship Grota do Cirilo project in Brazil. Sigma reached output on time, a rare achievement for a lithium development project. As the project ramps to full production capacity, high-quality Green Lithium will be stockpiled and prepared for sale, with an inaugural first shipment of approximately 15,000 tons expected in May.

The company also recently announced that it had obtained its environmental operating license to sell all Green Lithium products from current and future production, including any stockpiled product. SGML currently holds a 75% buy rating from the eight analysts that cover it. A median price target of $46.96 indicates an upside potential of 27%.

[stock_market_widget type=”accordion” template=”extended” color=”#5679FF” assets=”SGML” start_expanded=”true” display_currency_symbol=”true” api=”yf”]

Microvast Holdings, Inc. (MVST)

Headquartered in Stafford, Texas, Microvast Holdings, Inc. designs, develops and manufactures various Li-ion battery solutions for electric vehicles and energy storage systems. The company’s continued focus on R&D and technology investments offers improved battery performance at highly competitive prices. Microvast’s MV-C Gen 4 high-energy lithium-ion battery packs have been specifically designed for commercial vehicle applications, offering a high energy density of 53.5Ah, a long cycle life of 5,000+ cycles, and a modular pack design for easy installation.

“Microvast’s high-performance battery technologies provide the required high energy density, enabling us to deliver the high power and performance our industrial vehicles require to move heavy loads and perform demanding industrial applications,” explained Sven Woyciniuk, Head of Electrical Engineering at MAFI & TREPEL.

Analysts are only starting to take notice of MVST, with only two covering the stock. Nonetheless, both analysts see the stock as a Strong Buy and see a median increase of nearly 600% over the next twelve months. Microvast is a speculative play and may not be for everyone. Investors with a high tolerance for risk may want to consider this ticker for potential 6x gains.

[stock_market_widget type=”accordion” template=”extended” color=”#5679FF” assets=”MVST” start_expanded=”true” display_currency_symbol=”true” api=”yf”]

Lithium Americas Corp (LAC)

Lithium Americas Corp has full ownership of two development-stage operations in Argentina. One of which is approaching initial production, expected to come later this year. The timeline has been disrupted on LAC’s US project –The Thacker Pass, Nevada lithium mine – due to ongoing legal and regulatory discrepancies. However, a US judge recently said she would rule “in the next couple of months” on whether former President Donald Trump erred in 2021 when he approved the company’s right to begin mining the US’s largest-known lithium resource. It seems likely that the case outcome will be positive for LAC, considering Washington’s push to boost domestic production of metals crucial to the green energy transition and wean the country off of Chinese supplies.

The high-growth -potential small-cap has been gaining the attention of the pros on Wall Street. “We believe 2023 could be an eventful year as there could be several key announcements on growth projects and Argentina divesture, which could be catalysts for the share price,” explained HSBC analyst Santhosh Seshadri. To this end, Seshadri recently initiated coverage of LAC with a Buy rating, backed by a $36 price target.

Most analysts agree with Seshadri’s thesis. LAC claims a Strong Buy consensus rating, based on 15 Buys vs. 1 Hold and no Sell ratings. At $37, the average price target makes room for 12-month gains of 87%.

Read Next – PhD: “Future of dollar in one shocking chart”

If, like millions of Americans, you’re awake-at-night concerned about the status of the dollar…

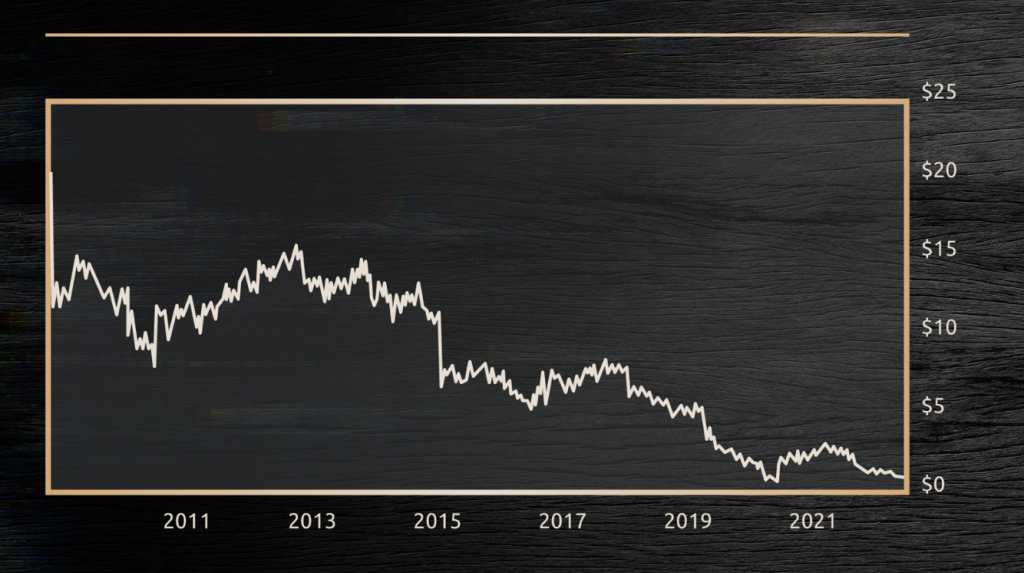

Take a look at this chart.

What do you see?

Most folks simply see a stock falling from $20 to $1…

But there’s something much deeper going on here.

You see – this firm’s CEO recently stepped down after issuing a major warning about our

currency.

According to his research, demand for his firm’s product has plummeted to a 20-year low…

And Dr. Nomi Prins is convinced this crisis will develop in a shocking way in the days ahead, as a major currency crisis strikes America’s financial system.

Dr. Prins says:

“This company could go bankrupt along with many others due to a complete overhaul

we’re about to see to our financial system. In other words, our money is about to

change forever… and it’s set to happen in just a few weeks.”

To help folks prepare, she’s recorded a briefing that explains exactly what she sees coming, how it will play out, and how much time you have to prepare.

Click here now to see Dr. Prins’ free presentation.

[stock_market_widget type=”accordion” template=”extended” color=”#5679FF” assets=”LAC” start_expanded=”true” display_currency_symbol=”true” api=”yf”]