Although the broad market continues to be driven by macro uncertainties, small-cap stocks have already been off to a good start thus far in 2023. The small-cap Russell 2000 Index has beaten the broader market this year, with a gain of 7.31%, outperforming the S&P 500’s 4.24% gain and the Dow, which is currently down nearly 1% YTD.

Stocks with small market capitalizations are generally less correlated to the performance of larger companies and can provide an additional layer of diversification for investors. Considering the implosion in some mega-cap tech names, now is a perfect time to consider adding to your small-cap position.

Even if you missed out on early 2023’s run-up in small-cap stocks, you’ve far from missed the boat when it comes to undervalued, under-the-radar opportunities in this space. In this list, we’ll cover three promising small-caps with ample room to run in 2023 and beyond.

I-80 Gold (IAUX)

The junior miner is moving into the production stage just as gold prices are soaring. I-80’s latest mining discoveries may enable it to, within a few years, increase its annual gold production to between 250,000 and 400,000 ounces. Considering the gold miner’s strong long-term growth potential, the stock appears undervalued. At current prices, shares trade for less than 3.5 times earnings.

[stock_market_widget type=”accordion” template=”extended” color=”#5679FF” assets=”IAUX” start_expanded=”true” display_currency_symbol=”true” api=”yf”]

Sachem Capital (SACH)

This mortgage REIT focuses on making short-term, so-called “hard money” loans backed by good collateral. For this reason, it could prove to be much more resilient than other mortgage REITs this year. Currently trading at a 30% discount to book, the small-cap seems to have plenty of runway ahead in 2023. Aside from its potential for solid capital gains, SACH investors enjoy a hearty 13.6% dividend yield backed by a sustainable payout rate.

[stock_market_widget type=”accordion” template=”extended” color=”#5679FF” assets=”SACH” start_expanded=”true” display_currency_symbol=”true” api=”yf”]

VAALCO Energy (EGY)

The oil exploration and production company is among the most undervalued small-cap names. Trading at just 3.9 times forward earnings, it’s cheap even for an energy stock. Even if crude oil prices fail to return to their 2022 highs, cost savings from its merger with TransGlobe Energy could result in earnings growth.

Aside from its ample upside potential, EGY offers investors steady returns with a sizeable payout. On Feb. 14, management announced that it is raising Vaalco’s quarterly dividend by 92%, from 3.25 cents per share to 6.25 cents per share. This increase gives EGY a forward yield of 5.23%.

Read Next – BREAKING: The embarrassing end for Biden 2024?

Will this finally end Biden’s 2024 dreams?

A humiliating video is very bad news for Calamity Joe.

In this video, new evidence links Biden to direct US military confrontation with Russia.

American lives are now at risk because of Biden’s blunder.

A presentation was released by a patriotic former CIA and Pentagon advisor…

Who believes every American deserves to see the disturbing truth HERE.

[stock_market_widget type=”accordion” template=”extended” color=”#5679FF” assets=”EGY” start_expanded=”true” display_currency_symbol=”true” api=”yf”]

You might also like:

- The Crypto Melt-Up has Begun

- “A.I. is a Tidal Wave” – Here’s What to Buy

- Beware Executive Order 14067

- #1 AI Stock for 2024 and Beyond

- Bank plague 2024

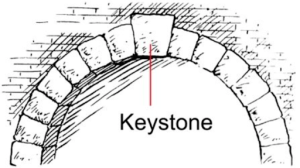

- Gates, Bezos, and Buffett invest in AI Keystone

- Congress Just Fast-tracked New A.I. Energy Breakthrough

- Elon Musk: THIS will be bigger than Tesla

- EV charging stations that pay you up to $93/day!

- Legendary Wall Street Stock-Picker Names #1 A.I. Stock of 2024, Live On-Camera