2022 was a massive year for energy stocks, but so far, in 2023, the sector’s performance has been underwhelming. The energy sector underperformed the broader market in January, with the Energy Select Sector SPDR Fund (XLE) returning just 2.8%. February is off to a bad start, with the fund falling more than 2%. However, several Wall Street pros say the bull market for energy stocks still has room to run after some cyclical funds saw investors pull out cash last year.

“Despite stellar returns in 2022 (+65%), energy sector ETFs still saw -$1.6bn in outflows. We have a favorable view based on valuation, light positioning, and strong commodity & equity fundamentals,” said Bank of America investment strategist Jared Woodard.

With the current conditions in mind, many market participants are seeking to beef up their position in energy with some undervalued names. In this list, we’ll look at three stocks from the energy sector, currently trading at a discount compared to industry peers.

Matador Resources (MTDR)

Matador Resources shareholders can take confidence from the fact that EBIT margins are up from 36% to 60%, and revenue is growing. Earnings are expected to grow by 6.21% per year over the next ten years. MTDR is a good value with a PE ratio of 6.5 times compared to the US Oil and Gas industry average of 7 times.

[stock_market_widget type=”accordion” template=”extended” color=”#5679FF” assets=”MTDR” start_expanded=”true” display_currency_symbol=”true” api=”yf”]

HF Sinclair Co. (DINO)

Most recently, HF Sinclair Co. reported quarterly earnings at $4.58 per share, surpassing the consensus estimate of $4.20 per share. HF Sinclair had a return on equity of 27.56 percent, while their net margin was 6.59 percent. Cash flows well cover the stock’s 2.8% dividend with a low payout ratio of 18%. DINO is a good value with a PE ratio of 5 times compared to the US Oil and Gas industry average of 7 times.

[stock_market_widget type=”accordion” template=”extended” color=”#5679FF” assets=”DINO” start_expanded=”true” display_currency_symbol=”true” api=”yf”]

Coterra Energy (CTRA)

Coterra Energy has become profitable over the past five years, growing earnings by an average of 54% each year. CTRA is a good value at five times earnings compared to the US Oil and Gas industry average of 7 times. With its reasonably low payout ratio (42.8%), CTRA’s impressive 10.9% dividend payments are well covered by earnings.

[stock_market_widget type=”accordion” template=”extended” color=”#5679FF” assets=”CTRA” start_expanded=”true” display_currency_symbol=”true” api=”yf”]

You might also like:

- The Crypto Melt-Up has Begun

- “A.I. is a Tidal Wave” – Here’s What to Buy

- Beware Executive Order 14067

- #1 AI Stock for 2024 and Beyond

- Bank plague 2024

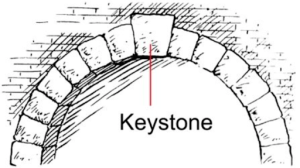

- Gates, Bezos, and Buffett invest in AI Keystone

- Congress Just Fast-tracked New A.I. Energy Breakthrough

- Elon Musk: THIS will be bigger than Tesla

- EV charging stations that pay you up to $93/day!

- Legendary Wall Street Stock-Picker Names #1 A.I. Stock of 2024, Live On-Camera