After a positive start to the year stocks suffered their first negative week of 2023 amid mixed earnings results, big layoff announcements from major tech firms, and recession concerns. The Dow lost 2.7%, and the S&P 500 fell 0.6%. Meanwhile, the technology-focused Nasdaq Composite finished the week with a 0.6% gain.

Last week, the 10-year Treasury yield hit a four-month low of 3.37%, fueling optimism around tech and growth stocks. Meanwhile, as Fed rate hikes appear close to a peak, hopes for an economic soft landing are growing. The Nasdaq composite hit a bear market closing low as recently as Dec. 28. But it is up 6.4% in 2023.

Our first of three weekly stock recommendations is a mega-cap tech name presenting an attractive opportunity as inflation subsides.

As price increases slow, consumers may spend more, boosting some battered consumer discretionary names. Amazon (AMZN) tops our list of stocks to watch this week as its share price has been nearly cut in half this year on higher inflation and rising rates.

Amazon is by far the world’s largest e-commerce company and, in 2021, surpassed Walmart as the world’s largest retailer outside of China. Without a direct competitor in the U.S., the company has experienced rapid growth through its third-party marketplace. The company operates 110 fulfillment centers worldwide, with 110 in the U.S.

Amazon’s business model has built-in advantages like its subscription service, Prime, and streaming platform. The service has more than 200 million subscribers globally and 163.5 million in the U.S. That figure is expected to continue to expand at a steady pace. According to a report by Statista, U.S. Prime members are expected to reach more than 176.5 million by 2025.

The e-commerce market may continue to suffer in the coming months amid recession fears. Nevertheless, the $9 trillion industry is expected to expand at a CAGR of 14.7% for at least the next four years. Considering the online shopping behemoth held five times the market share of its closest rival, Walmart, its 38% leading market share, it will likely gain the most significant advantage from the market’s growth.

The tech sector took a beating in 2022, creating opportunities in some desirable names. Citi and Goldman Sachs recently named the tech titan as one of their top picks for 2023, echoing the sentiment of many of Wall Street’s pros. Of 53 analysts offering recommendations for AMZN, 48 call it a Buy, and 4 call it a Hold. There are no Sell recommendations for the stock. A median price target of $135 represents a 57% upside from Friday’s closing price.

Throughout 2022, established automakers like Ford, GM, and Mercedes unveiled plans for dozens of new electric vehicles. Mass production of most of these vehicles will kick into gear starting in 2023 and 2024. Our first of three stock recommendations for the week is a small cap with extreme growth potential over the next few years on the black of upcoming E.V. production.

By 2029, electric vehicles could account for a third of the North American market and about 26% of vehicles produced worldwide, according to AutoForecast Solutions. Lithium Americas Corp (LAC) is one company hoping to ride the wave of anticipated global E.V. demand. Launched in 2007, the Canada-based firm searches for lithium deposits in the U.S. and Argentina. While the company is still a pre-revenue concern, its pipeline is brimming with potential, including one project set to enter production stages this year.

The company has full ownership of two development-stage operations in Argentina. One of which is approaching initial production, expected to come later this year. The timeline has been disrupted on LAC’s U.S. project –The Thacker Pass, Nevada lithium mine – due to ongoing legal and regulatory discrepancies. However, a U.S. judge said on Thursday she would rule “in the next couple of months” on whether former President Donald Trump erred in 2021 when he approved the company’s right to begin mining the U.S.’s largest-known lithium resource. It seems likely that the case outcome will be positive for LAC, considering Washington’s push to boost domestic production of metals crucial to the green energy transition and wean the country off of Chinese supplies.

The high-growth -potential small-cap has been gaining the attention of the pros on Wall Street. “We believe 2023 could be an eventful year as there could be a number of key announcements on growth projects and Argentina divesture, which could be catalysts for the share price,” explained HSBC analyst Santhosh Seshadri. To this end, Seshadri recently initiated coverage of LAC with a Buy rating, backed by a $36 price target.

Most analysts agree with Seshadri’s thesis. LAC claims a Strong Buy consensus rating, based on 13 Buys vs. 1 Hold and no Sell ratings. At $37, the average price target makes room for 12-month gains of 79%.

With shipping rates down from record levels, it’s unsurprising that many shipping stocks have been whacked hard this year, creating opportunity for investors looking for dividend stocks. According to the International Chamber of Shipping, 90% of global trade passes through the maritime shipping industry. This is a very volatile sector, but it’s essential to the world’s supply chain.

Anyone who has kept tabs on the global supply chain and shipping saga that’s been unfolding since the outbreak of covid is probably familiar with Genco Shipping (GNK). The company owns a fleet of 44 ships it leases for dry bulk transportation of goods like grain, coal, and iron ore. The going rate to rent one of Genco’s ships is no less than $27,000 per day, which provides some solid cash flow that the company uses to reward its shareholders.

Dry bulk shipping rates, along with GNK’s share price, have fallen in recent months. Still, as China recovers from recent lockdowns and seasonal demand is expected to be strong, it’s hard to see the pullback in share price as anything less than an opportunistic bargain. This is a very volatile sector, but it’s essential to the world’s supply chain.

GNK’s share price is up 6% over the past month. Although the company missed consensus EPS and revenue estimates in the third quarter, it remained consistent with its previously outlined value strategy. The company’s prudent cargo coverage in Q2 resulted in significant benchmark freight outperformance in Q3, allowing Genco to pass the savings onto its investors via a 56% quarterly dividend increase on a sequential basis. Over the last four quarters, the company has declared dividends of $2.74 per share, delivering on its commitment to return substantial capital to shareholders. GNK currently pays a 20% dividend yield.

You might also like:

- The Crypto Melt-Up has Begun

- “A.I. is a Tidal Wave” – Here’s What to Buy

- Beware Executive Order 14067

- #1 AI Stock for 2024 and Beyond

- Bank plague 2024

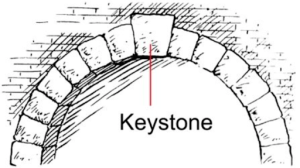

- Gates, Bezos, and Buffett invest in AI Keystone

- Congress Just Fast-tracked New A.I. Energy Breakthrough

- Elon Musk: THIS will be bigger than Tesla

- EV charging stations that pay you up to $93/day!

- Legendary Wall Street Stock-Picker Names #1 A.I. Stock of 2024, Live On-Camera