Warren Buffett is one of the most successful investors on Wall Street. The Berkshire Hathaway CEO is known for a long track record of market-beating returns, evident in the exemplary gains in Berkshire’s Class A shares since 1965. Over the past 57 years, the widely followed Berkshire Hathaway portfolio has generated returns of over 3.64 million percent. In other words, if you had invested $100 in Berkshire in 1965, that investment would be worth more than $3.64 million today. That works out to be an increase of around 20% compound annually, more than twice that of the S&P 500 over the same period. That stellar performance is why investors may want to take a page out of Buffett’s playbook and consider striking up a position in some Berkshire-held potential long-term winners themselves.

The 92-year-old investing legend maintains the same buy-and-hold investment philosophy that has defined much of his success over the past six decades. Historically, the Oracle of Omaha has favored reliable blue chips in industries like healthcare, consumer goods, financials, and energy and tended to avoid unprofitable, speculative, high-growth potential stocks. However, that doesn’t mean there aren’t any growth stocks in Buffett’s collection.

Buffett made waves on Wall Street when the most recent addition to Berkshire’s $700 billion portfolio was disclosed. In this list, you’ll get all the details on this tech winner, plus two more Buffett stocks that should not be ignored.

It should be no surprise that Buffett owns a major stake in Apple (AAPL) stock, considering its strong earnings, returns, and management. As the Number 1 stock in Berkshire’s portfolio by market value (worth a whopping $123.66 billion at the end of September), Apple makes up nearly 41% of Berkshire’s total equity portfolio. In the third quarter of 2022, Buffet added to the firm’s tech investment with a sizeable stake in the world’s largest contract chipmaker Taiwan Semiconductor (TSM).

Also known as TSMC, Taiwan Semi is at the top of the list when it comes to the semiconductor manufacturing group. The company makes chips for the likes of AMD (AMD), Nvidia (NVDA), Qualcomm (QCOM), and it’s a key chip supplier to Apple.

After hitting a two-year low due to a sharp slowdown in global chip demand, TSM’s share price jumped when Berkshire disclosed its more than $4.1 billion position in the stock. Still down more than 40% from its January 2022 peak, anyone on the sidelines might consider now an appropriate time to strike. “Only a small number of companies can amass the capital to deliver semiconductors, which are increasingly central to people’s lives,” said Tom Russo, a partner at Gardner, Russo & Quinn in Lancaster, Pennsylvania, when he reiterated the bullish case for TSM.

US investors have been cautious when betting on the Taiwan-based chipmaker as it would lose all Western contracts in the event of a Chinese takeover of the island. However, the company is working to reduce its geopolitical risk with a new $40 billion foundry in Arizona, expected to be operational by 2024. The investment has Washington’s support as it comes amid a U.S. push to boost domestic supplies of semiconductors and Congressional passage of the $52 billion CHIPS and Science Act.

Taiwan Semi reported earnings of $1.79 per share from $20.23 billion in revenue in the third quarter, surpassing consensus expectations of $1.41 EPS from revenue of $19.96. Management reiterated its outlook of Q4 revenue in the range of $19.9 billion to $20.7 billion. The gross profit margin is expected to be between 59.5% and 61.5%, and the operating profit margin is expected to be between 49% and 51%.

TSM has a 90% Buy rating from the 38 analysts offering recommendations and zero Sell ratings. Anyone on the sidelines may want to consider striking up a position in this Buffett stock and holding on for years.

At the end of the third quarter, Berkshire also disclosed its position in the leading Brazilian fintech company StoneCo Ltd. (STNE). The firm reported owning close to 10.7 million shares, currently valued at more than $110 million, amounting to a roughly 3.4% stake in the company.

Stoneco provides back-office software, loans, and other financial services to small and medium-sized businesses with a focus on reinvesting the cash it generates to acquire or build new financial products for its customer base. Since early 2019, the company has grown the number of small and medium business clients by 3x, revenue by 2.3x, and net income by 2.2×.

Stoneco has developed a range of payment solutions utilized by e-commerce for businesses and merchants all over Latin America. In the third quarter, Stoneco reported about $390 million in revenue. Small and medium-sized businesses using the platform surpassed 2.3 million, and total payment volume in the quarter also grew to close to $14 billion.

Despite its steady progress, Stoneco stock is down close to 47% this year on news of rising interest rates, macroeconomic risks in Brazil, and some operational blunders. But base interest rates in Brazil seem to have peaked, and a potential decline in the second half of 2023 is expected as Brazil’s inflation normalizes, reducing the margin pressure from rising financial expenses. Meanwhile, StoneCo’s revenue growth should benefit from rising digitization of payments, higher take rates, and elevated growth in banking and software. STNE stock currently trades at roughly 1.4 times projected forward revenue and 33 times forward earnings, which seems fair for a disruptive, fast-growing company in a developing market.

Buffett isn’t the only institutional investor who’s recently raised an investment in StoneCo. Cathie Wood’s Ark Innovation fintech exchange-traded fund (ARKF) owns roughly 2.55 million shares of the payments company valued at more than $26.5 million. STNE has a Hold rating from the pros who cover it and a median target price of $12.20, representing a 19% increase from Wednesday’s closing price.

You might also like:

- The Crypto Melt-Up has Begun

- “A.I. is a Tidal Wave” – Here’s What to Buy

- Beware Executive Order 14067

- #1 AI Stock for 2024 and Beyond

- Bank plague 2024

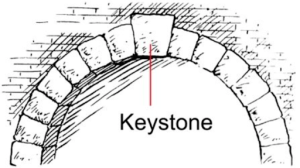

- Gates, Bezos, and Buffett invest in AI Keystone

- Congress Just Fast-tracked New A.I. Energy Breakthrough

- Elon Musk: THIS will be bigger than Tesla

- EV charging stations that pay you up to $93/day!

- Legendary Wall Street Stock-Picker Names #1 A.I. Stock of 2024, Live On-Camera