Seeking out great stocks to buy is important, but many would say it’s even more essential to know which stocks to steer clear of. A losing stock can eat away at your precious long-term returns. So, determining which stocks to trim or eliminate is essential for proper portfolio maintenance.

Even the best gardens need pruning, and our team has spotted a few stocks that seem like prime candidates for selling or avoiding. Continue reading to find out which three stocks our team is staying away from this week.

Despite rising consumer prices, Americans kicked off the holiday season with record spending on Black Friday and Cyber Monday. As a result, many retail and e-commerce stocks are seeing a nice holiday boost. However, some names will enjoy the holiday cheer more than others.

One e-commerce firm to be cautious about is online furniture and home goods seller Wayfair Inc. (W). Wayfair saw a dramatic recovery from its pandemic lows as consumers focused on their homes. With shelter-in-place orders in effect and mortgage rates at record lows, Americans snapped up spacious family houses, leaving behind once-desirable apartments in the city. As a result, Wayfair’s share price rocketed 572% from its March 2020 low to a high of $340 by August 2020. Sadly for anyone who jumped on the post-pandemic bandwagon, W stock has fallen nearly 90% since then and is currently trading at $42.10, 50% below its pre-pandemic price.

Opportunistic bargain hunters may be eyeing the stock’s momentum due to a 12% increase over the past four weeks. However, those looking for e-commerce stocks to ride the holiday wave would do better looking elsewhere. Not only has demand shifted, but consumers are also now met with economic pressures, which inevitably affects discretionary spending, and Wayfair is feeling the pinch. The online retailer’s active customers shrunk by 1 million quarter-over-quarter in Q3 or more than 4% to 22.6 million, down a whopping 22.6% from the year-ago period. The trend of dwindling customers may continue amid rising consumer prices.

Wayfair has only managed to turn an annual profit once – in 2020. From the looks of it, 2022 will not be the year that changes. Operating loss for the year has already surpassed $1 billion, while the year-to-date net loss is $980 million. Over the past six weeks, the median consensus forecast has been slashed by nearly 25% to $40, representing a loss of 5% from its current price.

According to CME data, investors expect to see short-term interest rates jump to a range of 4.25% to 4.5% by the end of the year, pointing to an increasingly likely recession in the wings. According to The Economist, a recession formed within two years in six of the past seven rate hiking cycles where rates increased this rapidly.

One stock that has been especially vulnerable during recessions that may surprise you is aircraft maker Boeing (BA). The share price has dropped an average of 40% in the past five recessions, underperforming every other S&P 500 stock by the same metric. Shares of Boeing sank 56% in the recession that began in 2020, 43% in the one that started in 2007, and 47% in the 2001 recession.

Despite its role as a leader in commercial airplanes, demand seems to evaporate for Boeing products during recessions, along with its typically healthy backlog and demand for the stock. That presents a real hazard for anyone eyeing BA after plunging 37% so far this year. This could be just the beginning of Boeing’s losing streak if a recession is forming.

At their September lows, Boeing shares were approaching levels comparable to the early days of the pandemic. If the economy is indeed heading toward an extended slowdown, it could take years for Boeing to reach previous heights. Given all of the uncertainties combined with the lack of any significant positive catalyst for the company heading into 2023, we’re sticking to the sidelines on the stock.

Over the past two years, the dramatic shift from brick-and-mortar shopping to e-commerce has been a tremendous obstacle for investors in malls and shopping centers. The demise of cornerstones like Sears and JCPenny hastened the decline as shopping malls are now left without anchor tenants. Recent data suggests that 25% of America’s 1,000 malls will be closed in the next 3-5 years.

Rising interest rates are cooling off the entire housing sector, with mortgage applications in their fourth month of declines, dropping to the lowest level since 1997. The 30-year fixed mortgage rate is currently 6.46%, more than double what it was just one year ago. Home resales are sitting at a two-year low. According to the latest data from the US Department of Housing and Urban Development, new residential construction fell 8.1% month over month across the US in November. More pain is expected as the Federal Reserve is widely forecast to continue lifting interest rates through the remainder of 2022 and into 2023 to dampen inflation.

As the largest homebuilder in the U.S., Texas-based D.R. Horton (DHI) is likely to be impacted by the slowdown in the housing market. DHI’s share price is down 33% already this year, outpacing the decline of the S&P 500. As the housing market slows further heading into winter, more declines can be expected. The company has been slowing its number of housing starts in response.

In its most recent Q3 earnings, D.R. Horton forecasted a slowdown, saying it now expects full-year revenues from $33.8 billion to $34.6 billion, down from its previous guidance of $35.3 billion to $36.1 billion. The company also reported a Q3 cancellation rate of 24%, up from 17% the previous year. With an increasing number of analysts predicting a housing recession, the company could be forced to further lower its earnings forecast.

You might also like:

- The Crypto Melt-Up has Begun

- “A.I. is a Tidal Wave” – Here’s What to Buy

- Beware Executive Order 14067

- #1 AI Stock for 2024 and Beyond

- Bank plague 2024

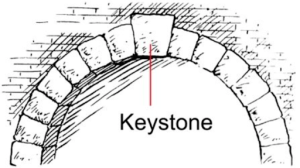

- Gates, Bezos, and Buffett invest in AI Keystone

- Congress Just Fast-tracked New A.I. Energy Breakthrough

- Elon Musk: THIS will be bigger than Tesla

- EV charging stations that pay you up to $93/day!

- Legendary Wall Street Stock-Picker Names #1 A.I. Stock of 2024, Live On-Camera