In 2017 and 2018, investors piled into cannabis stocks as word spread of the “next big thing.” Canada made global history when it became the second country in the world and the first G7 nation to legalize cannabis federally. Emerging players spoke of big plans, which stoked investor enthusiasm. Amid the initial excitement, legislative progress was slow, and competition in the stifled marketplace kept prices low. By April 2019, early-stage growth hiccups caused share prices to change direction, and since then, the vast majority of pot stocks have seen a 50% decline in value.

37 U.S. states and four U.S. territories have laws that permit the use of marijuana. While it is still illegal on a Federal level, President Biden’s proclamation on October 7th included a request for the attorney general “to initiate the administrative process to review expeditiously how marijuana is scheduled under federal law.” Many see this as a significant step in the right direction, but it’s expected to be a slow road.

The cannabis industry may not have been the explosive growth opportunity that early investors had anticipated, but there is still tremendous long-term upside, as more states jump on the bandwagon of legalizing recreational marijuana use. A recent study showed that those who engage with marijuana consider it a secondary necessity. In other words, consumers will likely find other things to cut out of their budget if needed, making the demand for marijuana products virtually recession-proof. Plus, the correlation between the performance of marijuana stocks and the overall market is lower, which makes them helpful portfolio diversifiers.

Along with the possibility of tremendous upside opportunity, uncertainty is there. No one can predict when significant legislative changes will occur or how taxation will affect costs. Stock selection is critical in the Marijuana space. Investors should look for competitive companies with the liquidity to sustain themselves. In this list our team takes a look at three cannabis stocks that seem likely to weather a recession.

The potential legalization of cannabis is likely to be a major positive catalyst for the leader in net cannabis revenue, Tilray (TLRY). The company has a presence in all key markets, with a focus on recreational and medicinal cannabis; the addressable market is significant and expanding.

TLRY surged following the recent announcement that President Biden would encourage the reassessment of marijuana laws but gave back some of those gains when the company reported Q1 2023 revenue and EPS misses. The company has its sights set on Revenue of $4 billion by 2024, a realistic target if regulatory hurdles wane. At $3.72 per share, TLRY currently trades at -6.5x forward earnings. The stock remains deeply oversold and is worth buying even after the recent uptick.

As long as marijuana remains illegal at the federal level, access to credit markets for pot companies will be spotty at best. Marijuana-focused real estate investment trust Innovative Industrial Properties (IIPR) buys medical marijuana cultivation and processing facilities in legalized states with cash and leases these properties back to the seller. It’s a win-win agreement that provides cash to cannabis companies while netting IIP long-term tenants.

IIPR provides investors ground floor access to exponential growth potential along with the reliability of a REIT. As of early September, Innovative Industrial Properties owned 111 properties covering 8.7 million square feet of space in 19 states. Moreover, 99% of its tenants were on time with their rent as of the end of June. Over the past five years, IIPR’s quarterly payout has grown by 1,100%. The REIT currently boasts a 6.61% yield.

Trulieve Cannabis (TCNNF) stands out as one of the few cannabis companies that have been able to turn a steady, meaningful profit, with four years of consistent quarterly profitability under its belt. That is, until its most recent quarter, when the company reported a net loss on the bottom line of $22.5 million, compared to the net income of $40.9 million reported for the previous year’s quarter. However, much of the loss can be attributed to one-time charges related to Trulieve’s recent acquisition of Harvest & Recreation Health. The quarterly net loss came in at around $1.1 million without the one-time charges.

While the company’s recent loss might be looked at as a step in the wrong direction, it’s common to see this following a major acquisition. Trulieve’s cannabis revenue has been following a steady upward trajectory since well before the acquisition took place. During the second quarter, Revenue increased by 49% year over year to $320.3 million.

The company has been steadily expanding operations, nearly tripling in size over the past few years. Since June of 2020, when it had just 52 dispensaries, all located in the state of Florida, the company operates 177 market-leading dispensaries throughout 11 states. It has successfully done so to preserve its position as a major player in this increasingly competitive market. Trulieve Cannabis garners a 100% Buy rating from the 18 analysts offering recommendations. A median price target of $28.71 represents a 169.62% upside. TCNNF stands as potentially one of the best picks to profit from the cannabis opportunity.

You might also like:

- The Crypto Melt-Up has Begun

- “A.I. is a Tidal Wave” – Here’s What to Buy

- Beware Executive Order 14067

- #1 AI Stock for 2024 and Beyond

- Bank plague 2024

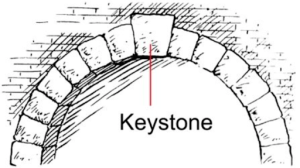

- Gates, Bezos, and Buffett invest in AI Keystone

- Congress Just Fast-tracked New A.I. Energy Breakthrough

- Elon Musk: THIS will be bigger than Tesla

- EV charging stations that pay you up to $93/day!

- Legendary Wall Street Stock-Picker Names #1 A.I. Stock of 2024, Live On-Camera