Stocks rose to kick off the week’s final trading session as investors weigh positive corporate earnings against the possibility of a recession. The major averages were on track for a losing week. As of Thursday’s close, the Dow was down for the week by 0.6%, the S&P 500 was lower by 1.2%, and the Nasdaq had lost 1.6%. Stocks could remain in a negative trend as recession concerns deter investors from riskier parts of the market.

Traditionally one of the most stable and recession-resistant sectors, everyone needs healthcare at some point regardless of income status. “The defensive aspects of the sector, while not fully appreciated at times over the past few years, is beginning to kick-in in a rather meaningful way,” said Jared Holz, a healthcare strategist at Oppenheimer.

Today we’re focusing on a name offering defensive growth from the desirable healthcare sector with a bevy of built-in advantages over peers from the group.

A name offering defensive growth from the desirable sector currently is UnitedHealth Group (UNH). As the most significant health insurance company by market cap and market share, UNH’s size gives it built-in advantages over peers from the group.

Despite the market slowdown this year, UNH’s share price is up more than 3%, outperforming its peers and the broader market. The Health Care Select Sector SPDR Fund (XLV) is down nearly 5% YTD, while the S&P 500 has shed more than 17%.

Due to UnitedHealth’s rapidly expanding reach, Q3 revenue was up 12% from the same quarter last year to $80.89 billion. Earnings came in at $5.79 a share, surpassing the consensus estimate of $5.42 per share. The company reported expanding its customer base by approximately 850,000 this year, including 185,000 in the third quarter. “The strength of our performance reflects the diligence and determination of our colleagues to improve people’s experience across the health care system and make high-quality care simpler, more accessible, and more affordable,” said Andrew Witty, CEO of UNH. The company also increased its 2022 EPS view to $21.85-$22.05 from $21.40-$21.90. The consensus expectation is at the low end of the company’s forecast, at $21.87, suggesting that the pros on Wall Street may not be giving enough credit to the health insurance giant.

Momentum should be supported in the coming years thanks to UNH’s strong market position and attractive core business. Its international business expansion provides substantial diversification benefits and shields against the impact of tightening U.S. regulations while allowing the Dow giant to tap into the $8.3 trillion spent annually on global healthcare.

UnitedHealth has a solid history of rewarding investors with a steady paycheck. The company went to a quarterly dividend in 2010 and, since then, has increased its dividend every year. That includes a 16% bump last year to $1.45 a share, which works out to a yield of 1.10% at its current price. UNH’s payout has increased 31% over the past five years, and the stock has a 5-year annualized dividend growth rate of 17.18%. The stock looks like a value at about 25 times earnings, compared to the healthcare industry, where the average P/E is around 34.

You might also like:

- The Crypto Melt-Up has Begun

- “A.I. is a Tidal Wave” – Here’s What to Buy

- Beware Executive Order 14067

- #1 AI Stock for 2024 and Beyond

- Bank plague 2024

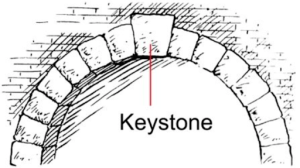

- Gates, Bezos, and Buffett invest in AI Keystone

- Congress Just Fast-tracked New A.I. Energy Breakthrough

- Elon Musk: THIS will be bigger than Tesla

- EV charging stations that pay you up to $93/day!

- Legendary Wall Street Stock-Picker Names #1 A.I. Stock of 2024, Live On-Camera