Stocks surged on Friday to end this week of trading on a high note, with the major indices each stacking on 2% or more as investors assessed a busy past few days of corporate earnings along with supportive comments from the Fed. The Wall Street Journal reported Friday that some Fed officials had expressed concerns about overstressing the economy with large rate hikes. Friday’s gains contributed to a positive week on Wall Street that brought 4% or more of weekly gains for the major indices.

The solar industry has had a bumpy 2022 as supply chain disruptions, rising production costs, and labor shortages have hampered the sector. Still, there’s no denying its potential for long-term exponential growth. Our first buy recommendation is one of the best-positioned names to benefit from solar’s expansion as governments and corporations around the globe transition to solar energy.

Over the last decade, solar energy has witnessed an average annual growth rate of 49%. This phenomenal growth is due partly to strong federal policies like the Solar Investment Tax Credit, which currently provides a 26% tax credit on solar investments. This summer, the industry caught tailwind gusts from the approval of the Inflation Reduction Act, a $430 billion climate bill aimed to reduce the budget deficit via tax reform while investing in renewable energy.

Arguably one of the best-positioned names to benefit from the Inflation Reduction Act, First Solar Inc. (FSLR) is a leader in the solar industry. Unlike many burgeoning solar companies, they have a rock-solid balance sheet that can handle the challenges of an economic downturn.

One of the most popular solar stocks to buy, First Solar, provides solar panels and photovoltaic power plants. What sets the company apart from the competition is its ultra-thin semiconductor technology, which provides enhanced resilience and efficiency for its modules.

There is plenty of upside in the sector and room for growth. Overall, solar energy only accounts for around 2% of the total grid usage. First Solar is preparing for growing demand as that number is primed to increase.

FSLR was the beneficiary of multiple upgrades recently, including one from JPMorgan’s Mark Storuce, who upgraded the stock from Neutral to Overweight. “FSLR has nearly 3 GW of US-based module capacity, expanding to 5.9 GW by year’s end 2024 that will qualify for the domestic manufacturing tax credit,” he wrote, adding that the value of the credits could add $931 million to the company’s 2024 net income.

Anyone who has kept tabs on the global supply chain and shipping saga that’s been unfolding since the outbreak of covid is probably familiar with Genco Shipping (GNK). The company owns a fleet of 44 ships it leases for dry bulk transportation of goods like grain, coal, and iron ore. The going rate to rent one of Genco’s ships is no less than $27,000 per day, which provides some solid cash flow that the company uses to reward its shareholders.

Dry bulk shipping rates have fallen in recent months, along with GNK’s share price, but as China recovers from recent lockdowns and seasonal demand is expected to be strong, it’s hard to see the pullback in share price as anything less than an opportunistic bargain.

GNK pays a handsome 14.8% dividend yield. The share price is up 6% over the past month. The company will be looking to display strength ahead of its November 2nd earnings release. The company is expected to report EPS of $0.88, down 38.89% from the prior-year quarter. Meanwhile, the latest Zacks consensus estimate is calling for revenue of $91.06 million, down 22.47% from the prior-year quarter.

Investors expect to see short-term interest rates jump to a range of 4.25% to 4.5% by the end of the year, pointing to an increasingly likely recession in the wings. According to The Economist, a recession formed within two years in six of the past seven rate hiking cycles where rates increased this rapidly.

One stock that has been especially vulnerable during recessions that may surprise you is aircraft maker Boeing (BA). The share price has dropped an average of 40% in the past five recessions, underperforming every other S&P 500 stock by the same metric. Shares of Boeing sank 56% in the recession that began in 2020, 43% in the one that started in 2007, and 47% in the 2001 recession.

Despite its role as a leader in commercial airplanes, demand seems to evaporate for Boeing products during recessions, along with its typically healthy backlog and demand for the stock. That is a real hazard for anyone eyeing BA after plunging 32% this year. This could be just the beginning of Boeing’s losing streak if a recession is forming.

At their September lows, Boeing shares were approaching levels comparable to the early days of the pandemic. If the economy is indeed heading toward an extended slowdown, it could take years for Boeing shares to reach previous heights. Given all of the uncertainties combined with the lack of any substantial positive catalyst for the company heading into 2023, we’re sticking to the sidelines on the stock.

You might also like:

- The Crypto Melt-Up has Begun

- “A.I. is a Tidal Wave” – Here’s What to Buy

- Beware Executive Order 14067

- #1 AI Stock for 2024 and Beyond

- Bank plague 2024

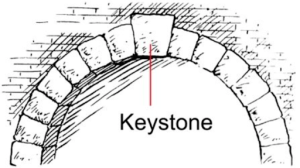

- Gates, Bezos, and Buffett invest in AI Keystone

- Congress Just Fast-tracked New A.I. Energy Breakthrough

- Elon Musk: THIS will be bigger than Tesla

- EV charging stations that pay you up to $93/day!

- Legendary Wall Street Stock-Picker Names #1 A.I. Stock of 2024, Live On-Camera