The stock market was on a roll all year long last year, and the rally continues in the new year. Most investors love the idea of rising markets and for a good reason. It gives everyone a feeling of getting wealthier. However, it becomes challenging if you need to put new money to work in the market. Also if you invest in 401(k) every paycheck, and still have more than 10-15 years to retire, you are getting less of a bargain each passing month. In fact, a fast-rising market is sort of a bad deal for young investors whose time horizon is long because they will be getting less number of shares for the same amount of money.

On the other hand, for retirees or near-retirees, a rising or a bull market is actually a very good thing, since they are not putting much of new money to work. On the flip side, a prolonged bear market early in the retirement can be devastating.

However, most retirees do not invest for total return, but for a regular stream of income while preserving capital. So, the big question that faces every retiree is how to get safe income without dipping into or losing principle. Obviously, bank or CD deposits pay next to nothing. Bonds have been in a bull market for nearly three decades and are expected to lose value in a rising interest rate environment. Yet, there are several viable alternatives; however, none is without flaws or risks. For our examples, we would assume that our typical investor needs $40,000 of annual income from the investment portfolio. Rest of the spending-need will be met by social security or other fixed income coming.

We will discuss three options; the first two only provide 4% income, whereas the third option will aim to provide 6% income with less volatility and smaller drawdowns.

Option 1: Traditional 4% Withdrawal Method

It is often said that as long as you have 25 times of your annual expenses, that should suffice. The traditional advice goes something like this:

- Keep 1 or 2 years of expenses in cash like securities.

- Invest the balance in a 60:40 or 70:30 stocks/bonds portfolio (generally in mutual funds or ETFs) and rebalance every year.

- Withdraw inflation-adjusted 4% every year to re-fill the 2-year cash account.

Here are some potential problems with the above advice:

- This was designed with an average retirement lasting 25 years. However, every person is an individual, and the term ‘average’ loses its relevance when we are talking about an individual. Moreover, average lifespan has been increasing, and it requires that one must work much longer than traditional retirement age.

- To be able to live off 4% of the portfolio, usually one requires a large portfolio size. Though, this can vary from person to person, depending upon their spending expenses. For our example, to be able to draw $40,000 annual income, the retiree will need an investment portfolio of $1 million. Anything less will result in an income gap. To make matters even worse, the two-year cash component would be required in addition to $1-million portfolio. After adding 2 years of cash-component, the investment capital will need to be roughly $1.1 million.

- This approach is particularly risky if there is a prolonged bear market in the early phase of retirement. A prolonged bear market at the onset of withdrawal phase can lead to large depletion of the portfolio, which can be difficult to recoup.

- Another potential problem would be a scenario where the retirement lasts much longer, say, 35 or 40 years long? Can you afford to be out of money at the age of 90? Money should be the last thing that you should be worried about at that age. In our opinion, to have a safe and worry-free retirement (at least from money perspective), you will need a retirement fund, which is roughly 35 times (instead of 25 times) of your annual expenses.

Option 2: Conservative Dividend Stock Portfolio – 4% Yield:

This option is nothing new, in fact, it is a very popular approach among DGI (Dividend Growth Investing) believers. If you still have a few years before you actually need to live off the income from your investments, and you buy and accumulate shares over a long period of time, this is a solid approach.

For a DGI portfolio of solid, large-cap, blue-chip companies, it takes something around 5+ years before it can start throwing 4-5% or higher income. Typically, such a portfolio will start with an average yield of 3% or less, and with dividend reinvestment and yearly dividend increases, the annual yield should get to 4% plus in 5-7 years. Alternatively, if you mix in a few REITs and higher yielding but relatively safe stocks such as AT&T (T) and Verizon (VZ), you could have a starting yield of 4%. Nonetheless, it is generally advisable that you start a DGI portfolio a few years before you actually plan to retire and reinvest the dividends until you actually retire, to be able to draw 4 to 5% income in retirement. Afterwards, we can safely assume that any inflation would be met by dividend increases.

This option is solid and much safer than option-1 since we are never withdrawing or depleting the capital. Another advantage is that if for any reason, the dividend income does not grow sufficiently for some years matching the inflation that would be a signal to tighten the belt temporarily and reduce spending for few years. The major flaw is that one needs to have a large sum of capital to generate the income. Besides, some folks may suggest that our investor is going to leave too much money behind. But in our view, that is a good problem to have. They could leave it for their heir or their chosen charity or some combination thereof. There may also be issues surrounding RMD (required minimum distribution) if the money is in an IRA. RMD situations can vary greatly from person to person, and as such, it is a topic too large to cover here in this article. But, generally, a large portion of RMD could be met by the dividend income generated.

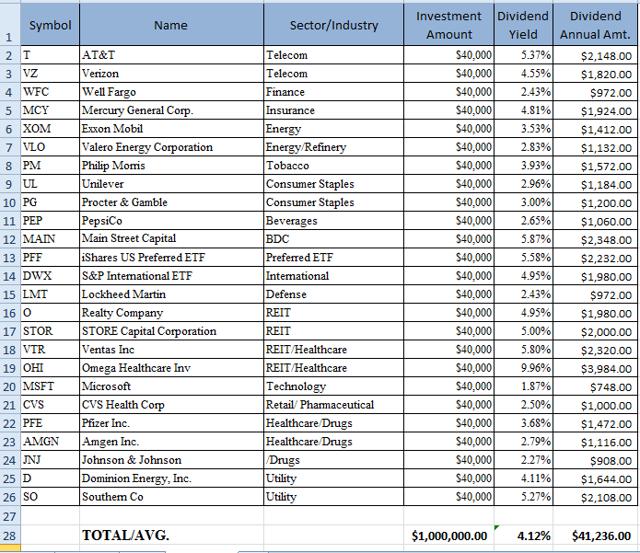

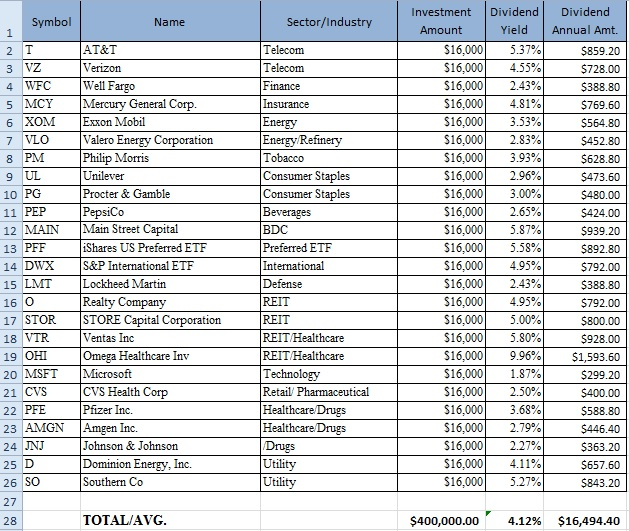

Below is a table of 25 sample dividend stocks that if invested equally (based on prices as of 01/23/2018), will provide a starting yield of 4.12%. However, the most conservative investors should aim for only about 3% starting yield.

Option 3: Nearly 6% Safe Income With Smaller Drawdowns

After all, the stock market is at an all-time high, and the run may continue for much longer. However, we know that the bull market is not going to last forever. The longer the bull-run continues, higher will be the risk of a major correction. This option is worth considering if you constantly worry about the eventual market downturn and what it is going to do to your portfolio. If your income needs are higher than 4% of the size of your portfolio and you cannot tolerate very large drawdowns, this option is worth a look.

Is the income really safe?

We believe so, on a relative basis, though nothing is 100% safe in the investing world. Now, we have seen that both option-1 and option-2 require high starting capital to be able to generate a reasonable income. In this option, we are trying to generate higher yields with less capital, and we are mitigating any additional risks by using multiple strategies. Actually, this option results in higher income, market matching total returns and smaller drawdowns. We will try to demonstrate this in a minute.

We will invest in three different portfolios, or we can call them baskets, or buckets, or any other name that you may like. For younger folks though, we recommend an additional fourth bucket for growth.

As in option 1 and 2, let’s assume we have total investment capital of $1,000,000.

Bucket 1: Core DGI Portfolio (40%)

Invested Capital: $400,000 (40%)

Total Return Target: 10-12%

Dividend Target: 4%

No retirement portfolio could ever be complete without a DGI bucket. This should make the foundation or “Core” of our investments. Just like the foundation of a house, the foundation of our portfolio needs to be strong. You should choose the strongest stocks which are available at a fair price while applying the following criteria:

- Large-cap, blue-chip company with a sizable moat in its industry.

- Dividend yield at least matching S&P500, or preferably 3%.

- Must have raised the dividends in the previous 10 years. Better yet 20-25 years. CCC list by SA Author David Fish is a good place to start.

- Not more than 3 or 4 names from the same sector. At least one company from each sector.

- Reasonable valuation at the time of buy. Alternatively, buy using DCA (dollar cost average) approach.

For the DGI portion, we could use the same stocks as listed under Option 2 (Conservative Dividend Portfolio) above in this article.

Here is the same table of 25 stocks as listed before but with a total allocation of 40% (yield as of 01/23/2018).

If you absolutely do not like to own and manage individual stocks, your second best option will be to have some low-cost dividend-centric ETFs.

|

ETF Name |

Symbol |

Expense/fee |

Distribution (12 month Yield) |

Objective |

|

Vanguard High Dividend Yield ETF (VYM) |

VYM |

0.08% |

2.81% |

High current yield |

|

Vanguard Dividend Appreciation ETF (VIG) |

VIG |

0.08% |

1.88% |

Dividend growth |

|

WisdomTree U.S. Quality Dividend Growth Fund (DGRW) |

DGRW |

0.28% |

1.80% |

Dividend growth |

|

WisdomTree SmallCap Dividend Fund (ETF) (DES) |

DES |

0.38% |

2.89% |

Small-cap dividend |

|

Powershares KBW Premium Yield Equity REIT ETF (KBWY) |

KBWY |

0.35% |

7.25% |

REIT dividend |

|

iShares U.S. Preferred Stock ETF (PFF) |

PFF |

0.47% |

5.58% |

Preferred dividend |

|

SPDR S&P International Dividend ETF (DWX) |

DWX |

0.45% |

3.85% |

International |

|

AVERAGE |

0.30% |

3.72% |

Bucket 2: Risk-Adjusted Portfolio

Invested Capital: $350,000 (35%)

Total Return Target: 10-12%

Income Target:6%

We will suggest two different strategies here. As such, you could either choose one of them or have both of them by dividing this capital between the two to provide better diversification. Of course, there will be more work if you decide to choose both of them.

Strategy#1:

Sector Rotation:

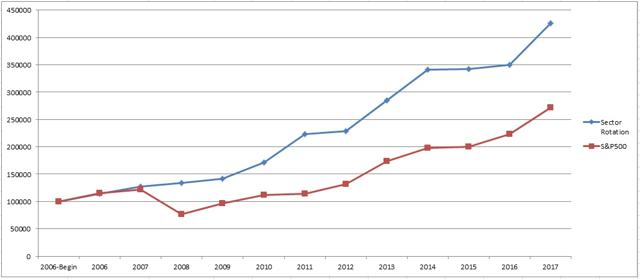

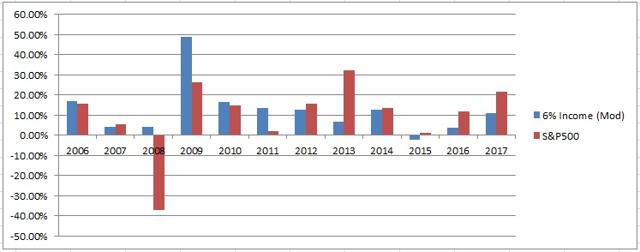

In this strategy, even though the dividend yield will be similar to S&P500 (generally around 2% most times), but we would assume that rest could come from withdrawals. The main advantage would be that we will be invested in the best performing two sectors of the economy at any time rather than invested in all 10 sectors. If none of the sectors are performing better than the risk-free assets, then we will be invested in 10-year treasuries and/or cash. Though the strategy can have so many variations, the backtesting results from one such strategy are provided below. The look-back period for measuring performance is three months with monthly rotation.

Strategy#2

Modified 6% Income Strategy:

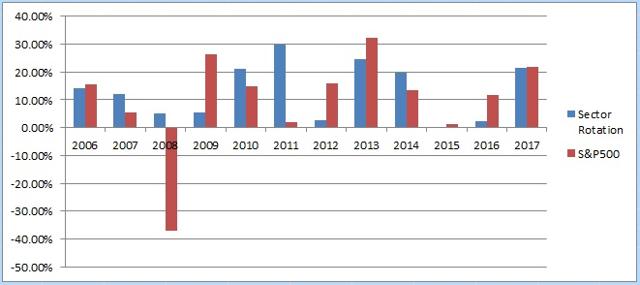

We are calling it modified because it is slightly different from our original ‘ 6% Income Strategy’, which is being used in our Marketplace service. However, the performance is comparable. This strategy invests in four CEFs (EVT, FFC, KYN, NMZ) along with TLT/IEF and using SHY or CASH as the risk-hedging asset. It is normally invested in the four CEFs (25% each) as long as each of the CEF has performed better than the risk-free assets with a 3-4 months look-back period. The look-back period can vary from 3-6 months or a combination of more than one, say 50% weight each to 3-months and 6-months. If any of the CEFs has not performed well enough, then the specific CEF will be replaced by 10-year or 20-year treasury fund for the next month. The rotation is on a monthly basis.

The main advantage of this strategy is that it would create a consistent income of about 6% due to high distribution from the CEFs. However, a word of caution: This strategy may not perform as well during a raging bull market as we see currently. However, it should make up during the times of stress or panic and preserve the capital at the same time. Just to provide a general idea, the back-testing results from one such strategy going back to the year 2006 are presented below:

List of securities:

- Eaton Vance Tax-Advantaged Dividend Income Fund (EVT)

- Flaherty & Crumrine Preferred Securities Income Fund (FFC)

- Kayne Anderson MLP Investment Company (KYN)

- Nuveen Municipal High Income Opportunity Fund (NMZ)

- iShares 20+ Year Treasury Bond ETF (TLT)

- iShares 7-10 Year Treasury Bond ETF (IEF)

Bucket 3: CEFs portfolio – 8% Income

Invested Capital: $250,000 (25%)

Total Return Target: 10%

Income Target: 8%

This is similar to our regular ‘8% Income CEF’ portfolio. We recently provided an update here.

|

Security Symbol |

Security Name |

Type of CEF |

Investment dollars |

Current Dividend Yield |

Dividend amount |

|

|

1. |

PCI |

PIMCO Dynamic Credit Income Fund ( PCI) |

Debt & Mortgage securities |

$25,000 |

8.83% |

$2,207.50 |

|

2. |

PDI |

PIMCO Dynamic Income Fund ( PDI) |

Debt securities |

$25,000 |

8.88% |

$2,220.00 |

|

3. |

KYN |

Kayne Anderson MLP ( KYN) |

Energy MLP |

$25,000 |

9.01% |

$2,252.50 |

|

4. |

RFI |

Cohen & Steers Tot Ret Realty ( RFI) |

Realty |

$25,000 |

7.70% |

$1,925.00 |

|

5. |

RNP |

Cohen & Steers REIT & Pref ( RNP) |

REIT/Pref |

$25,000 |

7.48% |

$1,870.00 |

|

6. |

UTF |

Cohen & Steers Infrastructure ( UTF) |

Infrastructure |

$25,000 |

8.03% |

$2,007.50 |

|

7. |

JPC |

Nuveen Pref & Income Opps Fund ( JPC) |

Preferred |

$25,000 |

7.81% |

$1,952.50 |

|

8. |

STK |

Columbia Seligman Premium Tech ( STK) |

Technology |

$25,000 |

8.03% |

$2,007.50 |

|

9. |

NMZ |

Nuveen Muni High Inc Opp ( NMZ) |

Utilities |

$25,000 |

5.75% |

$1,437.50 |

|

10. |

HQH |

Tekla Healthcare Investors ( HQH) |

Health Care |

$25,000 |

8.60% |

$2,150.00 |

|

TOTAL |

$250,000 |

8.01% (average) |

$20,030 |

Total Income from Combined Portfolio:

|

Invested Capital |

Total Return (over 10 year period) |

Income |

|

|

Core DGI |

400,000 |

10-12% |

16,494 (~4% dividends) |

|

Risk-Adjusted Rotation Strategies |

350,000 |

10-12% |

21,000 (~6% distributions or withdrawals) |

|

8% Income CEF portfolio |

250,000 |

10% |

20,030 (~8% distributions) |

|

TOTAL |

$1,000,000 |

10-11% |

$57,524 (~5.75%) |

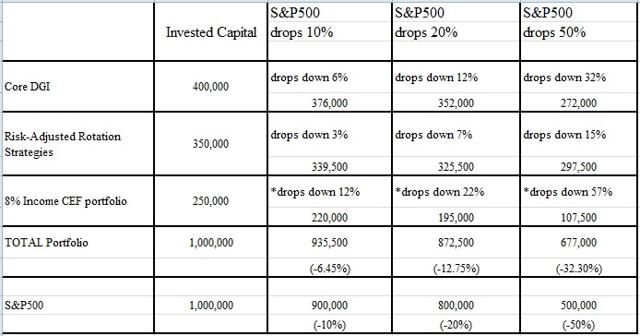

Let’s see the risk and drawdown potential:

One method is to see how specific security would behave in a crisis or recession would be to look at how it behaved during the 2008-2009 financial crisis. Though there is no certainty that next time around it would be exactly the same, it does provide some idea. Below table assumes the net-declines in each type of security based on their respective behavior in 2008-2009.

* This is the assumed NET decline in prices after subtracting the 8% distributions.

Conclusion:

We are not advocating that the high-income strategy is the best strategy for everyone. One needs to look carefully at their personal situation, particularly the risk-tolerance. If someone has a $2 Million portfolio and his or her income needs are only 2% of the portfolio size, we think a DGI strategy would be great and cover all bases. However, on smaller portfolios, it becomes difficult to raise sufficient income solely by index investing or even DGI strategy. What we need is a little more diversified approach in such situations, such as the option-3 described above. It provides much higher income, better strategic and asset diversification, market-matching returns and one-third less drawdowns.

Disclaimer: The information presented in this article is for informational purposes only and in no way should be construed as financial advice or recommendation to buy or sell any stock. Please always do further research and do your own due diligence before making any investments. Every effort has been made to present the data/information accurately; however, the author does not claim 100% accuracy. The stock portfolio presented here is a model portfolio for demonstration purposes; however, the author holds many of the same stocks in his personal portfolio.

Author’s Note: The Passive DGI Core portfolio is published as free-content. Other portfolios such as 8% Income CEF portfolio, 6% Income Risk-Adjusted portfolio, 401(k)-IRA-Conservative portfolio, Sector-Rotation ETF portfolio, and High-Growth BTF portfolio are part of our SA Marketplace service High Income DIY Portfolios. For more details or a two-week free trial, please see the top of the article just below our logo.

Disclosure: I am/we are long ABT, ABBV, JNJ, PFE, NVS, NVO, CL, CLX, GIS, UL, NSRGY, PG, MON, ADM, MO, PM, KO, DEO, MCD, WMT, WBA, CVS, LOW, CSCO, MSFT, INTC, T, VZ, VTR, CVX, XOM, VLO, HCP, O, OHI, NNN, STAG, STOR, WPC, MAIN, NLY, PCI, PDI, PFF, RFI, RNP, UTF, EVT, FFC, KYN, NMZ, NBB, HQH, JPC, JRI, TLT. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Click here to see the full story