Seeking out great stocks to buy is essential, but many would say it’s just as important to know which stocks to steer clear of. A losing stock can eat away at your precious long-term returns. So, figuring out which stocks to trim or get rid of is an integral part of proper portfolio maintenance.

Even the best gardens need pruning, and our team has spotted a few stocks that seem like prime candidates for selling or avoiding. Continue reading to find out which three stocks our team is staying away from this week.

TripAdvisor’s (TRIP) stock price has been making the voyage downward since mid-March and doesn’t seem likely to make the return trip anytime soon. Especially not after major hotel chains joined forces last month to force TripAdvisor to reverse course on its subscription to a cash-back instead of hotel discounts, seemingly taking the wind out of the company’s Tripadvisor Plus program.

“This shift is a big departure for Tripadvisor, having previously pushed Tripadvisor Plus as offering ‘no brainers’ to customers and enticing them with best in class rates,” said Bernstein analyst Richard Clarke. “The new model makes sense and could offer good deals to customers, but will be in a competitive space with Booking.com, Hopper and Revolut also offering cash back/credit on bookings with also charging a $99 fee. This might ultimately be a test if Tripadvisor Plus can be a full-service travel subscription offer, not just a discount club.”

Earlier this week, Mizuho analyst James Lee lowered the firm’s price target on TripAdvisor to $42 from $50, citing the disruption in travel trends in Q3 by new delta cases, which caused student travel restrictions and consumer hesitancy heading into the October holiday. The analyst believes the travel recovery story has been pushed back to fiscal 2022 instead of the second half of 2021.

Recent heavy put volume for TRIP is another cause for concern and could indicate that investors are becoming more bearish on the stock ahead of the November 4th earnings call. The most active are those that expire on October 29th with a strike price of $30. The Put/Call Ratio is 4.10. The consensus analyst recommendation is to Hold TRIP stock. We’ll be keeping an eye on the stock as the next earnings release nears, but we’ll stay away until headwinds clear.

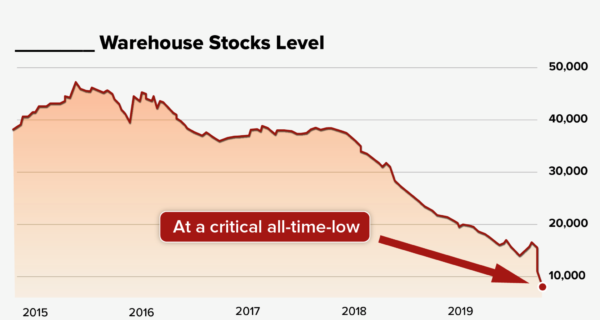

Challenges that Big Lots (BIG) is facing include supply chain bottlenecks, increasing freight expenses, labor challenges, and competition in food-/consumables.

The stock has been the recipient of numerous downgrades recently, including one from Piper Sandler analyst Peter Keith. The analyst downgraded Big Lots to Neutral from Overweight, saying in a note to clients that the economic environment was turning sour for the retailer.

“We see a trifecta of macro headwinds impacting fundamentals through the first half of 2022,” Keith wrote.

“These include the end of two years of stimulus check tailwinds in next year’s first half; ocean freight rates continue to intensify to all-time highs and are likely a gross-margin drag through the first half of 2022, and retail industry wage pressure seems unlikely to materially abate any time soon,” he added.

Big Lots missed Wall Street estimates for earnings and revenue when it reported its second-quarter results in August. For the quarter ended July 31st, the company reported earnings of $37.7 million, compared to $452 million in the year-earlier quarter, according to the earnings release. Revenue declined to $1.45 billion, compared to $1.64 billion reported a year earlier.

The stock has been on a major descent, dropping almost 30% over the past three months. Piper Sandler lowered its price target on the stock to $50 per share from $60. That’s 10% above where shares of Big Lots closed on Friday.

Blackberry (BB) stock has been a rollercoaster in 2021, thanks to the company’s meme stock status. An insane spike in January sent the share price rocketing more than 200%, from less than $8 a share to more than $28 a share in less than 2 weeks. After an embarrassing security scare (and attempted cover-up), BB settled at a price around $10, which is considerably less than its $25.10 close from January 27th. Considering its meme stock status, wild price action would not be surprising, but a closer look reveals a bleak picture for BB in the long term.

In terms of forward EV/EBITDA, BB is currently trading at 285.29, which is 1,560.9% higher than the 17.18 industry average. Its 9.33 forward Price/Sales multiple is 128.5% higher than the 4.09 industry average.

BB’s revenue declined 32% year-over-year to $175 million in its second fiscal quarter, which ended August 31st. Its operating loss stood at $74 million, while its net loss and loss per share came in at $144 million and $0.25, respectively.

Analysts expect BB’s revenues to decline 14.6% year-over-year to $785.14 million in the current year. The company’s EPS is expected to remain negative until at least 2023.