Good morning and welcome to another week of trading! Here at Wall Street Watchdogs we strive to provide our community with timely and pertinent information to help our readers stay ahead of the game. One thing that we have gotten numerous requests for lately is more information about potential market catalysts, and lately, there is no shortage.

Our readers asked, and we listened.

This morning we present to you, the debut of our newest offering. The WSWD Morning Briefing. Here, we’ll bring you information on factors that could potentially influence Wall Street sentiment, and your portfolio. Our aim is to give our readers a leg up on market action. So keep an eye on your inbox before market opens.

Without further ado, we present you the premier edition of The WSWD Morning Briefing.

This week will be busy with a smorgasbord of economic data for investors to digest. Having said that, today should be quiet on that front. The big news comes later in the week. Continue reading to find out more about the report that could change everything.

A new addition to telehealth programming and software may soon send a ripple throughout the industry. We’re bringing you the lowdown on the newcomer that is here to shake things up. They’re making waves and they’re definitely worth a second look…

…and may be a worthy investment down the road.

Plus, Developments at the White House could mean big things for the pending infrastructure bill.

Read on to find out what all of this could mean for markets.

Doximity’s recent IPO announcement, and its potential to take a big bite out of the telehealth industry — Teladoc in particular

Doximity (DOCS), a medical professional networking platform, just went public. Given its network effect moat, Doximity has the potential to become a dominant player in the telehealth sector, according to its S-1 filing. — Not the moat that surrounds a castle, but in the economic world, “moat” as an economic phrase means that it instead surrounds its competitors by sustaining a competitive advantage. This is in order to protect long-term earnings and market share.

Teladoc (TDOC), the current industry leader in telehealth, is failing to generate traction in terms of membership growth and profitability. This could be Doximity’s chance to expand its market share. Doximity has the potential to dethrone Teladoc due to its extensive network of medical experts and great profitability.

Doximity (DOCS) entered the NYSE on Thursday. After generating roughly $500 million in its IPO, the company ended the week with a market worth of nearly $10 billion. Subsequently, DOCS shares stacked on more than 30% to finish the week at $55.98. As is the case with most IPO’s, this may be a bumpy ride while DOCS searches for its price. Once share price has stabilized, we’ll likely revisit this one.

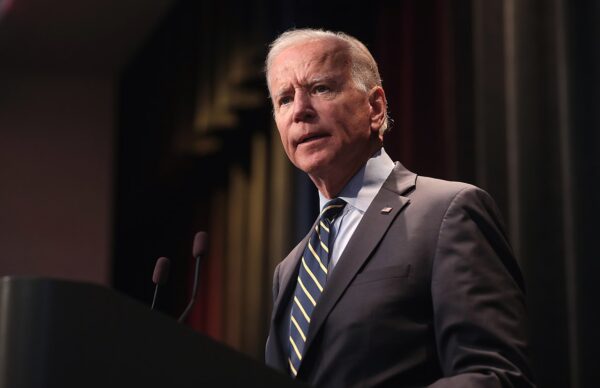

President Biden walks back veto threat of infrastructure bill

The bipartisan infrastructure bill seems to be back on track after President Biden walked back his statement last week that he won’t sign a bipartisan infrastructure deal if it’s not paired with a larger spending plan that’s focused on “human infrastructure.”

Intense pushback from Republicans after the statement threatened to jeopardize the fragile deal just a day after it was reached.

“The bottom line is this: I gave my word to support the Infrastructure Plan, and that’s what I intend to do,” Biden said in a statement released this weekend. “I intend to pursue the passage of that plan, which Democrats and Republicans agreed to on Thursday, with vigor. It would be good for the economy, good for our country, good for our people. I fully stand behind it without reservation or hesitation.”

To pass the infrastructure bill, Biden faces the challenge of keeping both Democrats and Republicans on board and has reiterated his intention to work hard to reach an agreement as quickly as possible.

As stocks approach the second half of the year on a high note, jobs data will affect markets in the coming week

Despite the instability following the Federal Reserve meeting in June, stocks have been rising in the last week. Fed Chairman Jerome Powell said Fed policymakers were discussing decreasing their purchases of mortgages and Treasury securities, laying the stage for the central bank’s ultimate departure from easy policies.

“Underlying everything is a tremendous amount of trust in the Fed, that they will do the right thing and will continue to do the right thing,” said Steve Sosnick, Chief Strategist at Interactive Brokers.

What’s here to get excited about is the potential growth. Sosnick believes that if the 10-year yield remains stable, it will be beneficial to the technology sector. “Right now, it appears that the 10-year and the NDX have that kind of relationship. People are taking lower 10-year yields as a buy signal for the Nasdaq 100. Is that a safe bet? “It isn’t perfect, but it is being used,” he remarked.

On Friday, the benchmark 10-year Treasury yielded 1.52% percent, up from 1.45% percent the week before. The market is expected to continue to rise in the second half, but at a slower pace, according to experts. Some analysts have predicted that the surge may stall in the second half of the year but may finish the year higher.

Where to invest $1,000 right now...

Before you consider buying Doximity, you'll want to see this.

Investing legend, Keith Kohl just revealed his #1 stock for 2022...

And it's not Doximity.

Jeff Bezos, Peter Thiel, and the Rockefellers are betting a colossal nine figures on this tiny company that trades publicly for $5.

Keith say’s he thinks investors will be able to turn a small $50 stake into $150,000.

Find that to be extraordinary?

Click here to watch his presentation, and decide for yourself...

But you have to act now, because a catalyst coming in a few weeks is set to take this company mainstream... And by then, it could be too late.

Click here to find out the name and ticker of Keith's #1 pick...