Investing in dividends can always provide a stable income source and portfolio growth opportunities. Dividends have been responsible for around 40% of the total return of the S&P 500 over the last century; Historically speaking, dividend-paying equities have outperformed businesses that don’t offer a dividend through their stock. However, a high quarterly payout or annual dividend yield cannot rescue a stock that doesn’t offer a return on investment or one that represents a firm with poor metrics.

Poorly performing companies that pay consistent, generously distributed dividends don’t interest me. It probably shouldn’t interest anyone because, although passive income may be nice, one still has to pay a literal price for each share. If there aren’t other positive factors, even the smartest investor can still lose

a potential return on their investment. The stocks on today’s list have other things going for them; the most exciting is that they show extraordinary promise in addition to their decent yields and payouts.

I’ve landed on three inexpensive dividend-payers that each offer lucrative payouts given their pricing, in addition to receiving bullish sentiment from the experts. Let’s break them down:

Charles Schwab Corp (SCHW)

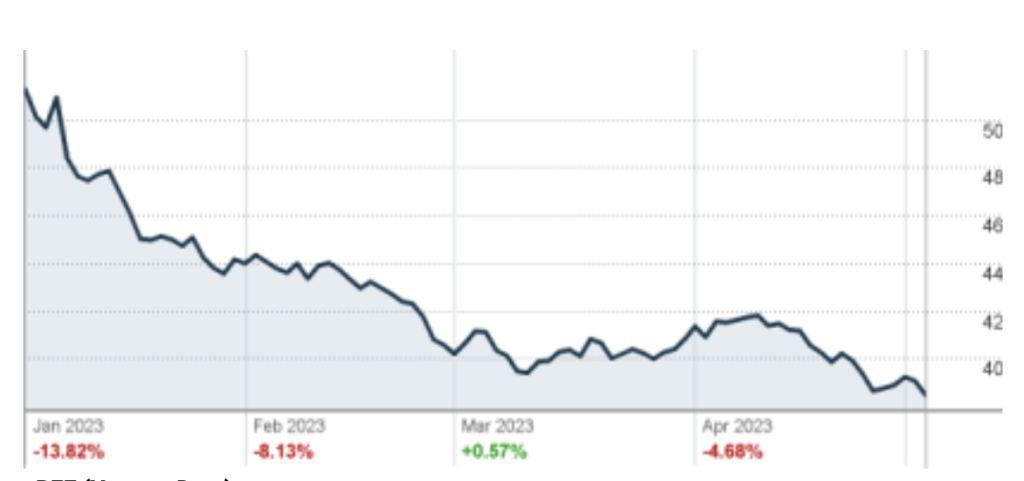

Charles Schwab Corp. (SCHW) is a financial advisory and asset management firm. SCHW offers corporate brokerage services to businesses and their employees, as well as retail brokerage and banking services to individual investors. SCHW is headquartered in Westlake, TX, and was founded by Charles R. Schwab in 1986. SCHW’s stock is presently down by 42.31% YTD, and is mostly considered slightly undervalued. SCHW has a market cap of $96.8 billion, a safe beta score of 0.88, a P/E (price to earnings) ratio of 14.42x, and a PEG (price-earnings-growth) ratio of 0.48x. SCHW shows TTM (trailing twelve months) revenue of $23.8 billion at $3.67 per share, and it profited $7.2 billion in the same period, with a net profit margin of 32%. SCHW has either met or beat analysts’ EPS projections for the last four fiscal quarters and shows positive YOY (year over year) growth in critical areas. SCHW has a dividend yield of 2.08%, with a quarterly payout of 25 cents ($1.00/yr) per share. With a 10-day average trading volume of 17.65 million shares, SCHW has a median price target of $65.75, with a high of $85 and a low of $46. This represents, at its high mark, a potential 77% price jump from where it currently sits. SCHW has 15 buy ratings and 5 hold ratings.

SCHW (Year-to-Date)

Energy Transfer LP (ET)

Energy Transfer LP (ET) runs over 19,000 miles of natural gas pipeline in addition to owning and operating a vast transportation network and several storage facilities. ET markets its resources to utility companies, distributors, and marketers. Originally known as Energy Transfer Equity LP until its name change in 2018, ET was founded in 1996 in Dallas, TX, where its headquarters remain. ET is up 6.49% YTD, with a market cap of almost $40 billion and an enterprise value of $87 billion. From TTM revenue of $89.87 billion—well over its market cap—at $1.37 per share, ET profited $4.8 billion via a 5.29% net margin. ET has a P/E ratio of 9.42x, a forward P/E of 8.25x, a P/S (price to sales) ratio of 0.41x, and a P/B (price to book) of 1.18x. ET has a free cash flow of $3.31 billion and a 10-day average trading volume of 10.09 million shares. ET has a 9.72% dividend yield, a quarterly payout of 31 cents ($1.24/yr) per share, and a payout ratio of 62.14%. ET has a median price target of $17, with a high of $21 and a low of $15, a range that only suggests upside potential (as high as over 66%). ET has 16 buy ratings and one hold rating.

ET (Year-to-Date)

Pfizer Inc. (PFE)

Pfizer Inc. (PFE) researches biopharmaceuticals worldwide. PFE develops, markets, and distributes medications. PFE’s aim is to advance treatments and cures for ailments of all kinds in established and developing nations. Charles Pfizer Sr. and Charles Erhart founded PFE in 1849, and it is based in New York. PFE is getting a lot of attention from analysts right now; its stock is down by 24.96% YTD, yet it shows great strength. With a safe 0.62 beta, PFE has a market cap of just over $218 billion, a P/E ratio of 7x, a D/E (debt to equity) of 37.45%, and an ROE (return on equity) percentage of 36.29%. PFE shows TTM revenue of $93 billion at $5.07 per share, from which it profited $31.4 billion with a 31.28% net margin. Earnings-wise, PFE recently surpassed analysts’ EPS and revenue forecasts by 24.68% and 10.88%, respectively. PFE has a dividend yield of 4.27%, with a quarterly payout of 41 cents ($1.64/yr) per share. With a 10-day average trading volume of 23.78 million shares, PFE has a median price target of $45, with a high of $75 and a low of $40. This shows robust upside potential from its existing 52-week range, going as high as an over 95% price increase from PFE’s current position. PFE has 13 buy ratings and 12 hold ratings. I can only speak for myself, but I see a nice opportunity with PFE’s current dip.

PFE (Year-to-Date)

Read Next – Protect Yourself from Biden’s Dollar Destruction…

Take a look at this:

What I’m holding in my hand is a completely new form of money…

As we speak, it’s being used as an alternative currency across the U.S. minting in places like Utah, New Hampshire and Nevada…

And since it’s made out of a thinly printed sheet of REAL gold…

It may be the single best way to protect your wealth from a sinister plot by president Biden to completely DESTROY your money.

Because rest assured…

Biden has already set the stage for a government-controlled digital dollar – which I believe is a DIRECT threat to your wealth and financial security.

That’s why I’m sounding the alarm about this important new form of money called a “Goldback”…

And why I want to get your hands on it right away.

There’s just one catch.

Since I have a limited number of these…

I need you to respond to this message immediately.

If you don’t, you may miss out on this opportunity forever.

I’ve recorded a short 2 minute message that explains everything here.

Including what this new money is, why it’s so important that you have some, and how to claim yours right away.