Stocks ticked higher in early trading this morning, to kick off the first session of May. Investors are gearing up for another busy earnings week. Lyft, Inc (LYFT), GM (GM), Square (SQ) and PayPal (PYPL) are just some of the headliners reporting this week.

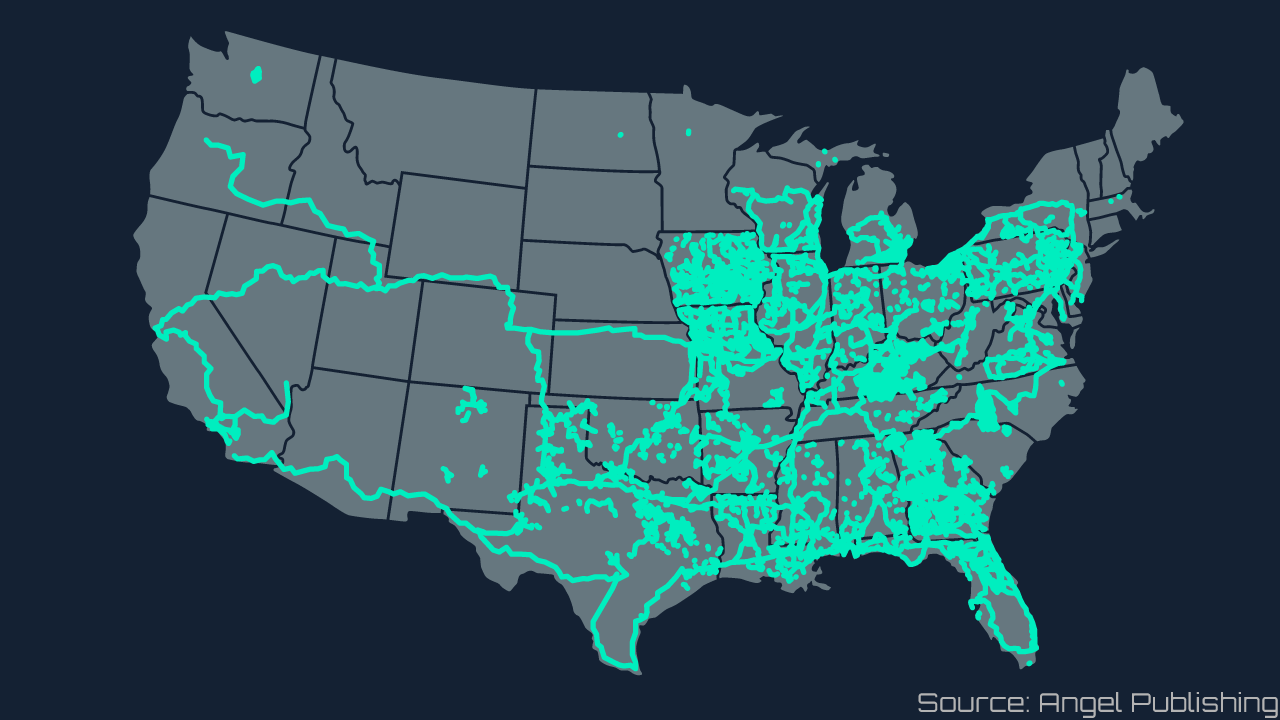

There has been a massive turn-up for 5G over the past year, but the industry is still very much in its infancy. Today’s trade alert highlights one company that is poised to benefit from increased infrastructure spending, 5G expansion and broadband upgrades.

Clearfield, Inc. (CLFD) designs, manufactures, and distributes fiber optic management, protection, and delivery products for communications networks. The company’s “fiber to anywhere” platform serves the unique requirements of traditional and alternative carriers and cable companies while also catering to the broadband needs of the utility/municipality, enterprise, data center and military markets. The company deploys more than a million fiber ports each year.

Clearfield maintains a strong competitive position in a rapidly growing multi-billion-dollar fiber optics industry, especially with the roll-out of 5G. While there has been a rapid turn up for 5G, the industry is still in its infancy. The 5G market is believed to have a 20+ year sustainable opportunity.

According to Clearfield management, these next three years will be pivotal to gain a foothold in 5G. Clearfield is well positioned to meet growing demand, equipped with their proven business model and management execution.

“Clearfield remains committed to fulfilling the increased demand of smaller providers across the country. We began investing early last fall in our drop-cable production facilities because we anticipated take rates would increase among existing providers as potential subscribers were added to existing networks. This timely investment has proven to be a meaningful competitive advantage as we continue to offer superior lead-times compared to the competition. We anticipate this market-based demand will continue moving forward,” said company President and CEO Cheri Beranek

She continued, “The government-financed broadband program under the Rural Digital Opportunity Fund (RDOF) is in the planning stages for providers and will start to be deployed later this summer and fall. In addition, while the recently announced American Jobs Plan within the Biden infrastructure bill is still being debated in Congress, the White House’s request for $100 billion in funding for sustainable high-speed broadband is a positive reflection on expanded fiber opportunities we believe are possible in the years ahead.”

Founded in 2008, Clearfield has 12 out of 12 profitable fiscal years under its belt. That’s a twelve year history of positive free cash flow. If that’s not enough to pique your interest in CLFD stock – the small-cap company also boasts an impressively healthy balance sheet with $48.4 million in cash and investments and zero debt.

Where to invest $1,000 right now...

Before you consider buying Clearfield, you'll want to see this.

Investing legend, Keith Kohl just revealed his #1 stock for 2022...

And it's not Clearfield.

Jeff Bezos, Peter Thiel, and the Rockefellers are betting a colossal nine figures on this tiny company that trades publicly for $5.

Keith say’s he thinks investors will be able to turn a small $50 stake into $150,000.

Find that to be extraordinary?

Click here to watch his presentation, and decide for yourself...

But you have to act now, because a catalyst coming in a few weeks is set to take this company mainstream... And by then, it could be too late.

Click here to find out the name and ticker of Keith's #1 pick...