By Tom Anderson

Gold just posted its strongest annual gain since 1979.

Not since Jimmy Carter was president, not since inflation ravaged the American economy in the stagflation era, has gold performed like it did in 2025, surging 64% in a single year and smashing through $4,000 per ounce for the first time in history.

And here’s what makes this moment so extraordinary for coin investors:

We’re sitting at the convergence of two milestone anniversaries, record-breaking metal prices, and institutional forecasts that read like something out of a 1970s time capsule.

J.P. Morgan projects gold will average $5,055 per ounce by the fourth quarter of 2026. Goldman Sachs sees $4,900. Bank of America has a $5,000 target. UBS says we could touch $5,400 if geopolitical risks escalate.

Meanwhile, silver has gone absolutely parabolic, up roughly 150% over the past year, trading above $80 per ounce as I write this.

These aren’t fringe predictions from newsletter writers. These are the world’s largest investment banks, putting their reputations on the line with forecasts that would have seemed absurd just 18 months ago.

But here’s what most investors miss: Buying physical coins isn’t just about price appreciation.

It’s about owning something real. Something you can hold. Something backed by sovereign governments and recognized anywhere on Earth. Something that doesn’t require an internet connection, a brokerage account, or faith in a digital ledger to be valuable.

The coins I’m about to show you represent the best combination of purity, liquidity, historical significance, and collector appeal available in 2026. Whether you’re allocating $500 or $50,000, there’s an option here for you.

Let’s begin.

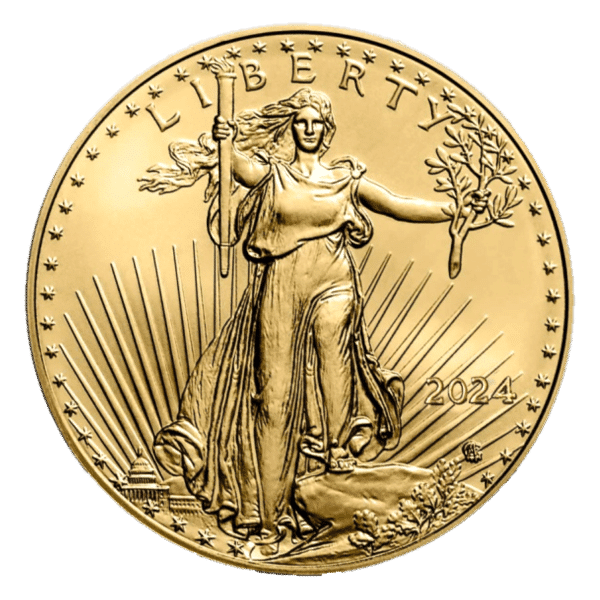

NO. 1: THE 2026 AMERICAN GOLD EAGLE

If I could only recommend one gold coin for American investors in 2026, this would be it.

The 2026 American Gold Eagle marks a double milestone: the 40th anniversary of the American Eagle program and the 250th anniversary of the United States itself. For the first time ever, every finish in the 2026 Gold Eagle lineup will be crafted using master dies created through advanced laser-engraving technology, replacing the older hubbing process that was slower and more prone to imperfections.

What you’re getting: One troy ounce of 22-karat gold (91.67% pure, alloyed with small amounts of silver and copper for durability), bearing a $50 face value backed by the United States government.

Current dealer pricing runs approximately $4,700 for a 1 oz Brilliant Uncirculated coin, representing a modest premium over spot gold at $4,460.

The obverse features Augustus Saint-Gaudens’ iconic Walking Liberty design, originally created in 1907 for the $20 Double Eagle and widely considered one of the most beautiful coin designs in American history. The reverse showcases Jennie Norris’s modern bald eagle portrait, introduced in 2021.

Why it matters for 2026: The combination of anniversary significance and technological advancement in the minting process means the 2026 edition will likely command collector premiums for years to come. This coin offers exceptional liquidity, immediate recognition at any dealer worldwide, and favorable IRS reporting treatment for U.S. investors.

Fractional sizes (1/2 oz, 1/4 oz, and 1/10 oz) are also available for investors with smaller budgets or those seeking more flexibility.

NO. 2: THE 2026 AMERICAN SILVER EAGLE

This is where smaller investors can participate in the precious metals rally without committing thousands of dollars.

The 2026 American Silver Eagle contains one troy ounce of 0.999 fine silver, carries a $1 face value, and represents the same 40th anniversary milestone as its gold counterpart.

Current dealer pricing runs approximately $84-96 per coin depending on quantity purchased. At Provident Metals, tubes of 20 coins are available at roughly $6.99 per ounce over spot price.

Now, let me be direct about something: Silver Eagles carry higher premiums than most other silver bullion options. At current silver prices near $80 per ounce, you’re paying roughly 7-10% over melt value.

But there’s a reason for that premium.

The American Silver Eagle is the most liquid silver coin in the United States. Period. When you need to sell, every coin dealer in America will buy it instantly at competitive prices. That liquidity has real value, especially in volatile markets.

The 2026 edition features Adolph A. Weinman’s “Walking Liberty” design on the obverse, originally created for the half dollar from 1916 to 1947. The reverse displays Emily Damstra’s bald eagle landing with an oak branch, introduced in the 2021 Type II redesign.

Why it matters for 2026: With silver up 150% over the past year and analysts projecting further gains, the Silver Eagle offers accessible entry into precious metals ownership. The U.S. Mint Proof edition releases February 26, 2026 at $95 direct from the Mint.

For budget-conscious buyers seeking maximum silver per dollar, consider purchasing tubes of 20 coins to capture volume discounts.

NO. 3: THE 2026 CANADIAN GOLD MAPLE LEAF

If purity is your priority, this is your coin.

The Canadian Gold Maple Leaf, produced by the Royal Canadian Mint, contains one troy ounce of 0.9999 fine gold, making it one of the purest gold bullion coins available anywhere in the world. That’s 24-karat gold, compared to the American Gold Eagle’s 22-karat composition.

What makes the Maple Leaf particularly compelling for 2026:

First, the Royal Canadian Mint’s security features are industry-leading. Every Maple Leaf includes radial line backgrounds that produce unique light-diffracting patterns, plus a micro-engraved maple leaf privy mark with laser-etched security details. These features make counterfeiting extraordinarily difficult and verification straightforward.

Second, the 2026 edition features the effigy of His Majesty King Charles III, designed by Canadian artist Steven Rosati, marking only the second full year of this new portrait.

Third, and perhaps most importantly for cost-conscious investors: Canadian Gold Maple Leafs typically carry lower premiums than American Gold Eagles. According to Goldprice.org, premiums generally range between 2% and 6%, making the Maple Leaf one of the more economical ways to acquire high-purity gold.

For those seeking even higher purity, the Royal Canadian Mint offers its “Our Purest Maple Leaf” in 0.99999 fine gold (five nines purity), the highest purity standard of refined gold available.

Why it matters for 2026: The combination of exceptional purity, advanced security features, and competitive pricing makes this coin ideal for investors prioritizing gold content over collector premiums. Strong international recognition ensures liquidity in markets worldwide.

NO. 4: THE 2026 AMERICAN GOLD BUFFALO

This is the coin for purists who want pure American gold.

The American Gold Buffalo, first released in 2006, was the first 0.9999 fine (24-karat) gold coin ever produced by the United States Mint. Every ounce of gold used in its production must, by law, come from newly-mined sources within the United States.

The 2026 edition marks the 22nd release in this beloved series, currently priced around $4,553 at dealers.

What sets the Buffalo apart is its design heritage. Both the obverse and reverse are adapted from James Earle Fraser’s legendary 1913 Buffalo Nickel, widely regarded as one of the most beautiful coins in American numismatic history.

The obverse features Fraser’s composite portrait of a Native American, reportedly modeled after three chiefs: Big Tree of the Kiowa, Iron Tail of the Oglala Lakota, and Two Moons of the Cheyenne. The reverse depicts an American bison, modeled after Black Diamond, who resided in the Central Park Zoo in the early 20th century.

Unlike the Gold Eagle’s 22-karat composition, the Buffalo’s pure 24-karat gold gives it a richer yellow color. That softer metal is slightly more susceptible to scratching, but for investors prioritizing gold content over handling durability, this is often considered a feature rather than a bug.

Why it matters for 2026: The Buffalo satisfies investors who want 99.99% pure gold with a purely American provenance and iconic American imagery. The coin is IRA-eligible and enjoys strong demand in the secondary market.

NO. 5: THE 2026 SOUTH AFRICAN GOLD KRUGERRAND

No list of essential gold coins would be complete without the coin that started it all.

The South African Gold Krugerrand, first minted in 1967, was the world’s first modern gold bullion coin. Before the Krugerrand, there was no standardized way for ordinary citizens to invest in gold bullion. This coin literally created the category.

The 2026 edition continues nearly six decades of unbroken production, containing one troy ounce of actual gold content in a 22-karat alloy (91.67% gold, 8.33% copper). That copper content gives the Krugerrand its distinctive warm, orange-gold tone and exceptional durability.

The obverse features Paul Kruger, the last president of the South African Republic, whose portrait has appeared on the coin since its 1967 debut. The reverse depicts a springbok antelope, one of South Africa’s most recognized national symbols.

Here’s what makes the Krugerrand strategically valuable:

Krugerrands typically trade at lower premiums than American Gold Eagles. According to JM Bullion’s historical data, the gap between Krugerrand prices and Gold Eagle prices can be meaningful for larger purchases. If your goal is maximum gold content per dollar spent, the Krugerrand deserves serious consideration.

The coin also carries exceptional international liquidity. With an estimated 50+ million Krugerrands produced since 1967, dealers worldwide recognize and trade this coin instantly.

Why it matters for 2026: For investors seeking the lowest possible premium on a globally recognized, government-backed gold coin with proven liquidity across five decades, the Krugerrand remains the benchmark against which all others are measured.

BUILDING YOUR 2026 COIN STRATEGY

Here’s how I’d think about allocation across these five coins:

For the budget-conscious investor ($500-$2,000): Start with American Silver Eagles. Buy in tube quantities (20 coins) to minimize per-ounce premiums. The 2026 anniversary edition offers both investment value and collector significance.

For the moderate investor ($2,000-$10,000): Consider a mix of fractional gold (1/10 oz or 1/4 oz American Gold Eagles) and silver. This approach provides gold exposure without requiring enormous capital commitment while maintaining liquidity across multiple coins.

For the serious investor ($10,000-$50,000): Anchor your position in 1 oz American Gold Eagles and/or Canadian Gold Maple Leafs. Add diversification through Gold Buffalos (for pure American gold) and Krugerrands (for premium savings). Consider Silver Eagles as a tactical position given silver’s explosive momentum.

For the major allocator ($50,000+): Purchase in volume to capture dealer breaks. Mix eagles, Maple Leafs, and Krugerrands for geographic diversification. Consider sealed Monster Boxes (500 coins) for silver, which offer the lowest per-ounce premiums and maintain mint-sealed provenance for resale.

A FINAL WORD

The institutional forecasts we’re seeing, with J.P. Morgan’s $5,055 target, Goldman Sachs at $4,900, Bank of America at $5,000, all point to sustained demand for physical gold through 2026 and beyond.

Central banks purchased an average of 585 tonnes of gold quarterly through 2025 and show no signs of slowing. ETF inflows are running at their strongest pace since the post-2008 era. The structural case for precious metals remains compelling.

But regardless of where spot prices go, owning physical coins gives you something no paper asset can provide: actual possession of tangible wealth, free from counterparty risk, recognized across every border and throughout every crisis.

That’s why I collect them. And that’s why, in 2026, you should too.

SOURCES:

J.P. Morgan Global Research gold price forecasts: https://www.jpmorgan.com/insights/global-research/commodities/gold-prices

JM Bullion 2026 American Gold Eagle: https://www.jmbullion.com/gold/gold-coins/american-gold-eagles/2026-gold-eagle/

APMEX 2026 Silver Eagle pricing: https://www.apmex.com/product/316705/2026-1-oz-american-silver-eagle-coin-bu

U.S. Mint 2026 product schedule: https://www.usmint.gov/product-schedule/2026/

Royal Canadian Mint 2026 Gold Maple Leaf: https://www.mint.ca/en-us/shopping/archives/2025/2026-our-purest-maple-leaf-1-oz-99-999-pure-gold-coin-premium-bullion-

Hero Bullion American Gold Buffalo: https://www.herobullion.com/2026-1-oz-american-gold-buffalo-coin/

JM Bullion Krugerrand overview: https://www.jmbullion.com/gold/gold-coins/south-african-gold-krugerrands/

Trading Economics gold prices: https://tradingeconomics.com/commodity/gold

USAGOLD daily market report: https://www.usagold.com/daily-silver-price-history/

Newsweek gold and silver predictions: https://www.newsweek.com/gold-and-silver-price-predictions-for-2026-after-huge-gains-this-year-11289726

Wall Street Watchdogs is committed to uncovering the truth about financial markets and helping individual investors prepare for systemic risks that mainstream media won’t discuss. We receive no compensation from the companies or assets we analyze. This article is for educational purposes only and should not be construed as investment advice.