Copper is, and has long been, a critical metal for the electrification of today’s economy, not only because of its great conductivity as an energy source but due to it being one of the cheapest of the precious metals available. When you factor in the recent moves to reopen China, one of the world’s most significant copper markets, you can’t help but be optimistic about the future of this sector. At least, I can’t. You could do much worse if you want to play the precious metals trend.

Copper is used in many renewable energy technologies, including electric cars, charging stations, solar panels, and wind turbines. As the renewable energy industry only continues to surprise and grow, copper demand is expected to expand, even if on a gradual basis. According to market analysts, copper demand and subsequent consumption will double within the next 20–30 years. This makes copper, like its precious metal peers, a smart long-term investment; most of them pay dividends as well, so we can always lean back on that passive income. Traditional industries such as construction (plumbing is a huge factor) drive the increasing demand, but so does the push toward low-carbon energy.

I’ve landed on three copper mining stocks I like best right now. I accounted for recent market performance in addition to analyst sentiment, which sits somewhere between buy and hold. While showing high potential returns in addition to dividends, let’s consider these tickers:

Hudbay Minerals Inc. (HBM)

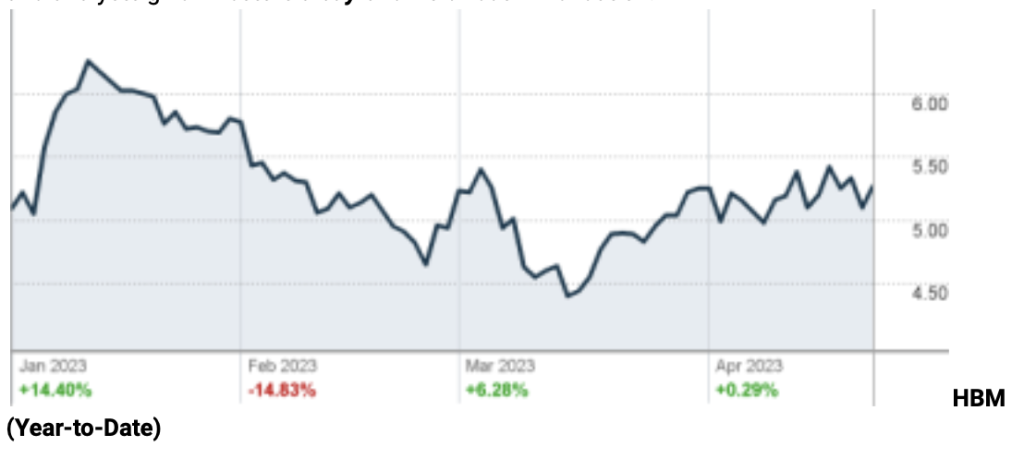

Hudbay Minerals Inc. (HBM) is a diversified mining company that, through its properties in North and South America, primarily focuses on producing copper and zinc concentrates, in addition to dealing with other metals. HBM was founded on January 16th, 1996, and is headquartered in Toronto, Canada. HBM is up by 3.85% YTD, with a market cap of around $1.3 billion and an enterprise value of $2.3 billion. HBM has reported a TTM (trailing twelve-month) income of a remarkable $1.46 billion, well above its cap, from which it made a profit of $70 million from its modest 4.77% net margin. HBM shows a P/E ratio of 8.8x, a P/S (price to sales) ratio of 0.93x, a P/B (price to book) of 0.87x, around $500 million in free cash flow, and a 10-day average trading volume of 3.61 million shares. HBM has a dividend yield currently at 0.28%, with an ever-modest one cent ($0.04/yr) per share. Analysts have marked HBM with a median price target of $7.46, with a high of $9.73 and a low of $5.91. This gives HBM the opportunity for a potential 85% price jump over recent pricing, and analysts give investors a buy-and-hold recommendation.

Freeport-McMoRan Inc. (FCX)

Freeport-McMoRan Inc. (FCX) engages in precious metals, with a recent emphasis on copper. FCX holds active mining properties in North and South America and Indonesia. FCX was founded in 1987, and its headquarters are in Phoenix, AZ. Like HBM, FCX is also up slightly YTD, a little more so in fact (+4.05%), but it’s also a larger business with bigger numbers on its balance sheet. FCX has a market cap of almost $57 billion and a forward P/E (price to earnings) ratio of 16.5x. Over the last twelve months, FCX showed revenue of $23.3 billion at $2.38 per share, from which it profited $3.5 billion with a 14.83% net margin. FCX has surprised analysts well during its quarterly earnings reports, most recently beating EPS and revenue projections by 16.24% and 2.74%, respectively. Growing in popularity, FCX currently has a 10-day average trading volume of 13.20 million shares. FCX has a dividend yield of 0.76%, with a quarterly payout of 8 cents ($0.32/yr) per share. Analysts who provide yearly pricing estimates have assigned FCX a median price target of $47, with a high of $60 and a low of $29, representing a potential 52% price upside. One to consider for sure, analysts are essentially split on whether to buy and/or hold.

Rio Tinto PLC (RIO)

Arguably saving the best for last, which only time can tell us, we finally have Rio Tinto Plc (RIO). The well-known mining firm has a large business division devoted to copper. RIO was founded in 1873 and is headquartered in London, U.K. RIO is down YTD by 9.47%, giving it a nice dip to take advantage of. As it sits in the middle of its existing price range, it has a safe beta score of 0.69, a market cap of $104.5 billion, a P/E ratio of 8.5x, a P/S of 2.09x, and a P/B of 2.04x. RIO reports TTM revenue of $55.6 billion at $7.62 per share, showing a net profit of $12.4 billion off its 22.36% profit margin. RIO has a free cash flow of $7.36 billion and a 10-day average trading volume of 3.22 million shares. With a payout ratio of over 90%, RIO has a dividend yield of 7.63%, with an impressive quarterly payout of $2.25 ($9.00/yr) per share. Analysts responsible for pricing forecasts have given RIO a median price target of $82.85, with a high of $95 and a low of $70, which suggests a possible price leap of 47.5% over its most recent price. Analysts are split on RIO, but the numbers are objective, and no one suggests we sell. Buy and/or hold.

Read Next – Protect Yourself from Biden’s Dollar Destruction…

Take a look at this:

What I’m holding in my hand is a completely new form of money…

As we speak, it’s being used as an alternative currency across the U.S. minting in places like Utah, New Hampshire and Nevada…

And since it’s made out of a thinly printed sheet of REAL gold…

It may be the single best way to protect your wealth from a sinister plot by president Biden to completely DESTROY your money.

Because rest assured…

Biden has already set the stage for a government-controlled digital dollar – which I believe is a DIRECT threat to your wealth and financial security.

That’s why I’m sounding the alarm about this important new form of money called a “Goldback”…

And why I want to get your hands on it right away.

There’s just one catch.

Since I have a limited number of these…

I need you to respond to this message immediately.

If you don’t, you may miss out on this opportunity forever.

I’ve recorded a short 2 minute message that explains everything here.

Including what this new money is, why it’s so important that you have some, and how to claim yours right away.