Solar equities have been significantly affected by the Inflation Reduction Act, signed into law by President Biden in August 2022. The legislation mandates financial incentives for the widespread adoption of renewable energy sources like solar power across the United States. The White House claims the measure would allow an extra 7.5 million households to use a 30% tax credit to install solar panels on their rooftops. Stocks in the solar industry soared after the bill was passed, reflecting rising consumer demand for the technology.

There are certainly more pros right now than cons when it comes to investing in solar. The expanding energy market and the surging demand for renewable energy are two major tailwinds for the alternative energy marketplace. Global energy investments, in general, increased by 8% in 2022, according to the International Energy Agency (IEA), reaching a total of $2.4 trillion— higher than pre-pandemic levels.

In the last several years, solar energy (and the alternative energy market as a whole) has shown tremendous promise. For the world to reach net zero emissions by 2050, however, IEA experts predict that production would have to expand 25% yearly. Not only interest in their stocks but actual usage of these renewable energy sources is skyrocketing. According to the IEA, yearly investments in alternative energy are expected to reach $2 trillion by 2030, an increase of more than 50% from current levels.

That said, join me while I break down three solar stocks to which I narrowed my focus. Each is down year-to-date, but they likewise show healthy metrics and have Wall Street experts watching closely. The analysts say that we investors should watch these tickers, too:

Hannon Armstrong Sustainable Infrastructure Capital Inc (HASI)

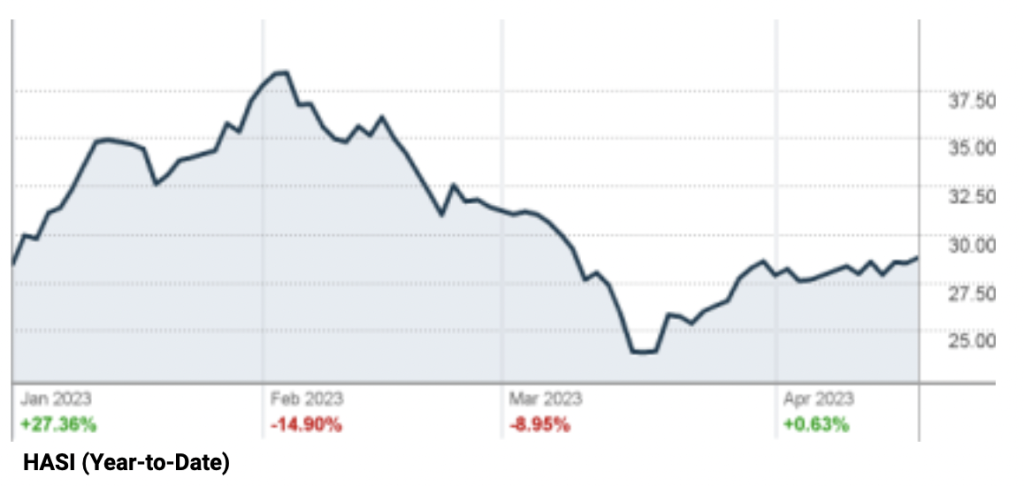

Hannon Armstrong Sustainable Infrastructure Capital, Inc. (HASI) funds and serves the U.S. energy efficiency, renewable energy, and sustainable infrastructure industries. HASI‘s initiatives primarily include solar-generated and energy-efficient buildings. The Annapolis-based firm was founded in 1981. YTD, HASI’s stock is down only slightly at the time of writing, but it sits quite close to the bottom of its 52-week range. HASI has a market cap of $2.6 billion, a forward P/E ratio of 12.87x, and a 10-day average trading volume nearing 500 thousand shares. From its TTM (trailing twelve-month) revenue of $240 million at 47 cents per share, HASI profited $40.8 million with a net margin of 17.02%. HASI has a dividend yield of 5.49%, with a quarterly payout of 39 cents ($1.56/yr) per share and a reported payout ratio of a whopping 319%. The analysts who provide 12-month price projections have given HASI a median price target of $48, with a high of $52 and a low of $34. This represents a potential 80.75% price upside for HASI, which analysts consider undervalued, and they tell us investors to buy and hold.

Ameresco Inc (AMRC)

Ameresco Inc (AMRC) offers a comprehensive variety of renewable energy services in the U.S. and Canada, focusing mostly on the maintenance and sale of solar power products. AMRC was founded by George Peter Sakellaris on April 25th, 2000, and is based in Framingham, MA. Down by 21.44% YTD and sitting at the very bottom of its existing 52-week range, AMRC is still up a massive 600% over the previous five years, AMRC has a market cap of $2.4 billion and forecasted 5-year EPS growth of nearly 30%. AMRC reports TTM revenue of $1.82 billion at $1.77 per share, from which it made a profit of $94.8 million on a modest net profit margin of 5.20%. With a forward P/E ratio of 24.94x, AMRC has a PEG of 1.00, a P/S (price to sales) of 1.35x, and a P/B (price to book) of 2.91x. Analysts who provide yearly pricing projections have assigned AMRC a median price target of $64, with a high of $81 and a low of $44, representing 42.57% pricing upside at its average and over 80% at its high point. The analysts agree that now is the time to buy and hold AMRC.

Shoals Technologies Group Inc (SHLS)

Shoals Technologies Group Inc. (SHLS) produces electrical balancing systems and components for the use of solar energy and battery charging applications throughout the U.S. SHLS primarily sells to construction companies that install solar panels. SHLS, located in Portland, TN, was founded in 1996. SHLS, just like its peers, is considered undervalued, is near the bottom end of its existing 52-week high-low, and is down YTD by 9.40%. SHLS has a market cap of $3.5 billion, and a TTM revenue of $327 million at 47 cents per share, from which it made a profit of $127.6 million, with a decent net margin of 39.03%. SHLS has an ROE (return on equity) ratio of 86.83% and is evidently growing in popularity, as evidenced by its 10-day average trading volume of 2.17 million shares. Most notable among SHLS’ metrics are its incredible YOY (year over year) growth numbers: revenue (+97%); EPS (+5207.62%); net income (+6230.16%); and profit margin (+3214.4%). Analysts that give annual price estimates have marked SHLS with a median price target of $30, with a high of $41 and a low of $22, representing a potential 84% jump from current pricing. The experts also agree on SHLS’ buy-and-hold rating.

Read Next – Biden is a LIAR – Video Proof 🔴

Did Biden just get caught in the BIGGEST lie of his presidency?

This presentation contains video evidence that incriminates him in a shocking “act of war”…

And that could have a deadly impact on millions of American citizens.

WARNING! What you’re about to see is extremely controversial.

In fact, the White House has flat out DENIED what you’re about to see.

But it’s important that you and EVERY American patriot sees it right away.

>>Click here to view it now, before they make us take it down.