Growth stocks are publicly traded shares that tend to thrive in a growing economy; if growth is very likely on the horizon, and the investor is content with remaining patient enough to witness it to fruition, then there will often be bountiful returns on their way. Now, mid-cap companies typically come with more than $1 billion in market value and less than $10 billion. They have more potential than large slow movers and less volatility than small, quick ones.

Seasoned investors are aware of this, but some of us who still might be new to proper portfolio management might not realize this simple fact: An increasing number of long-term investors seek substantial growth potential while not having to deal with huge price points— which can have an adverse effect so long as a brave soul is willing to seize the opportunity in front of them. Sadly, in today’s world, capturing the moment is the only actionable option for some of us, and moments are sparse. Let’s use this time well.

Moving ahead, after a lot of digging around, I’m finally satisfied with three mid-cappers that have performed well and are only in the position to grow from here. Expert analysts who’ve followed the stocks assign firm buy ratings. Let’s break these down the best we can:

Azenta Inc (AZTA)

Azenta, Inc (AZTA) provides life sciences solutions globally to speed the progress of specific therapies. AZTA offers worldwide cold-chain sample management, genomic services, and advanced cell treatments for pharmaceutical, biotech, academic, and healthcare organizations. AZTA’s Genomics include sample storage, clinical trials, bio-transport, IT solutions, and risk mitigation. AZTA was founded in 1978, with its headquarters in Burlington, MA.

AZTA’s stock is down 25.80% YTD, and with its market cap of nearly $3 billion, it boasts $870 million in TTM (trailing twelve-month) revenue, with a gross profit margin of 44.16% and a debt-to-equity ratio of just over 40%. AZTA shows year-over-year revenue growth of 27.72% and has managed to carry almost $69 million in free cash flow. Despite a couple of hiccups on revenue projections, AZTA beat analysts’ forecasts for FY2022, most recently by margins of 20% and 142.5% in Q4 and Q4, respectively. AZTA has a dividend yield of 0.93%, with a quarterly payout of 10 cents ($0.40/yr) per share. Analysts who publish yearly pricing predictions have marked AZTA with a median price target of $64.60. The estimate comes with a high mark of $70 and a low of $57; if AZTA does as some suspect, it will be nearing the high point of its price range, showing a 62% increase over its current price. The analysts have made it clear that AZTA is one to buy now.

Guidewire Software Inc (GWRE)

Guidewire Software Inc (GWRE)’s IT service business incorporates digital interface, A.I., and relevant analysis and is available as either a cloud service or a self-managed software firm. GWRE’s primary offerings are InsuranceNow, and InsuranceSuite, a model for independently managed deployments. GWRE’s InsuranceSuite is an adaptable bundle of cloud-based services. The insurance sector depends on AZTA‘s web-based policy, invoicing, and claims management services. In 2001, business associates James Jwak, John Raguin, Marcus Ryu, James Kwak, John Seybold, Ken Branson, and Mark Shaw collectively founded AZTA in San Mateo, CA.

GWRE currently shows $213.8 million in sales for Q12023 and has a relief in its 1.25 beta, keeping the stock reasonably safe from market volatility. GWRE beat analysts’ projections on earnings reports for all four quarters of FY2022, and its performance is only expected to continue. Over its TTM period, GWRE also held an EPS of $6.25 per share, a debt-to-equity margin of just under 33%, year-over-year revenue growth of 17.69%, and 94% earnings growth so far this year. GWRE, as of the last twelve months, is just shy of having $69 million in free cash flow. Analysts have given GWRE an average price target of $81.21, with a high of $95 and a low of $60. The estimate indicates a potential 24.5% upside from GWRE’s last price. It’s conceded among Wall Street’s brightest that we should take GWRE’s buy rating seriously.

Match Group Inc (MTCH)

Match Group, Inc (MTCH) markets and sells digital solutions to many online companies. Hinge, Match, OkCupid, Meetic, Hakuna, and Plenty of Fish are just a few examples of MTCH’s portfolio. MTCH’s social and interactive software Hakuna Live enables real-time broadcasts from one person to a large audience. MTCH’s Azar service provides instantaneous language translations, and users may have meaningful conversations with individuals worldwide without thoroughly learning the language. MTCH offers services in more than 40 different languages. MTCH was founded on February 12th, 2009, and is headquartered in Dallas, TX.

Down 8.27% YTD, MTCH has a beta measure of 1.08. Barely making the small-cap cut with its market cap at a flat $10 billion, MTCH boasts trailing twelve-month numbers such as a revenue of $3.2 billion, a gross profit margin of 70%, a return-on-equity of 56.52%, net income of $364 million, a forward P/E of 17.9x, EPS growth of 73.2%, and leveraged free cash flow of $370 million. MTCH shows every indication of turning around as it shamelessly sits on its price dip. Analysts give MTCH a median price target of $62.77, with a high of $90 and a low of $50. The median alone is a 57.6% increase, and if the price reaches $90, that’ll mean a 136.50% upside over current pricing; it’s no wonder analysts give this a strong buy rating.

Read Next – Get Your Money Out of U.S. Banks Immediately

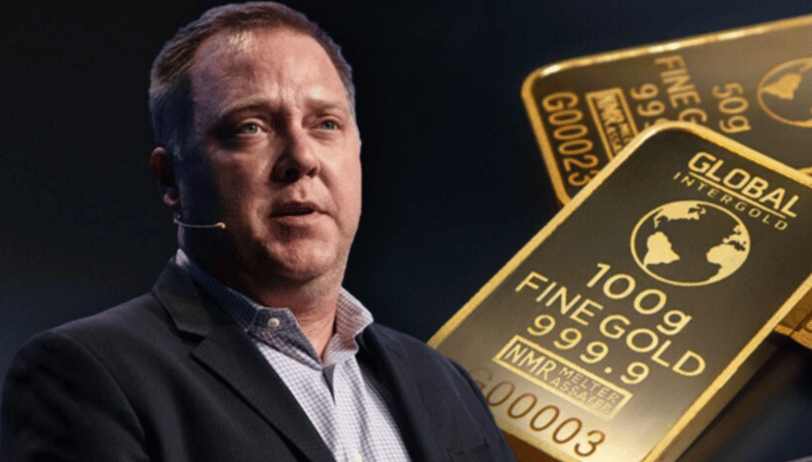

A Wall Street legend has warned 8.4 million Americans to prepare immediately.

“A historic financial reset in 2023 could cause a run on the banks unlike anything we’ve seen in our country’s history,” he says.

Marc Chaikin has already appeared on 30 different TV networks to share his warning.

Even CNBC’s Jim Cramer has taken notice.

But few people realize this could actually happen on U.S. soil.

Or what a sizable impact it could have on your wealth, especially if you have large amounts of cash in the bank right now.

Chaikin is best known for predicting the COVID-19 crash, the 2022 sell-off, and the overnight collapse of Priceline.com during a CNBC debate.

In his 50-year Wall Street career, he worked with hedge funds run by billionaires Paul Tudor Jones and George Soros.

But today, he is now urging you to move your money out of cash and popular stocks and into a new vehicle 50 years in the making.

“This is by far the best way to protect and grow your money in what will surely be a very difficult transition for most people,” Chaikin says.

Click here for the full story, and his free recommendation.