Amid unrelenting inflation and a potential for a recession, volatility is widely expected to continue throughout 2023. A logical move in times like these is dividend stocks, which pay you just to hold them. Dividend-paying companies regularly reward investors directly with a portion of the cash flow. The most desirable dividend stocks have a history of raising payouts over time as the company’s profits grow.

In addition to the potential for capital gains, the stocks covered in this list also offer sizable dividend yields. Moreover, these three companies seem likely to continue increasing their yields moving forward.

Pioneer Natural Resources Company (PXD) has long viewed sustainability as a balance of economic growth, environmental stewardship, and social responsibility. Its emphasis is on developing natural resources in a manner that protects surrounding communities and preserves the environment.

In the wake of the pandemic, when energy prices were, cheap PXD struck an almost perfectly timed agreement to buy fellow Permian Basin producer Parsley Energy for $4.5 billion. If you’re wondering how PXD managed to finance that transaction, the answer lies in the fact that it was an all-stock deal that ensured Pioneer didn’t have a new giant debt load hanging over its head. The fact that Parsley operated primarily in the same region of West Texas, where Pioneer had both expertise and existing staff, has paid off over time.

That deal was a coup for Pioneer shareholders, built on the fact it was large and well-capitalized at a time when stressed and debt-reliant shale plays were looking for a white knight. On top of that acquisition, PXD also boosted its dividend by 25% at the start of the year as further evidence of its strong balance sheet.

Investors can look forward to upcoming tailwinds, including Pioneer’s recently announced partnership with the world’s largest renewable energy producer, NextEraEnergy (NEE), to develop a 140-megawatt wind generation facility on Pioneer-owned land. The project will supply the company’s Permian Basin operations with low-cost, renewable power and is expected to be operational next year.

In the second quarter, revenue was up 22% YOY to $6.09 billion, smashing the consensus estimate of 4.57 billion. The company reported earnings of $7.48 per share, beating consensus expectations of $7.27 per share. So far, in 2022, the company has rewarded its investors handsomely with $20.73 per share through its generous 10.78% cash dividend. Even after gaining 30% this year, Pioneer shares likely still have valuation upside in addition to their tremendous dividend income potential.

Boston-based, Information management services company Iron Mountain Inc. (IRM) provides information destruction, records management, and data backup and recovery services to more than 220,000 customers in 58 countries. The company has around 1,500 leased warehouse spaces and underground storage facilities worldwide.

As a testament to Iron Mountain’s leadership in its core storage business, the company serves 225,000 customers, including about 95% of the Fortune 1000 companies. As for what the company stores, the wills of Princess Di and Charles Darwin are housed in their facilities, as well as the original recordings of Frank Sinatra and Bill Gates’ Corbis photographic collection.

The need for Iron Mountain’s physical facilities will likely never disappear. Still, as digital storage becomes more widely adopted, the company should continue to grow along with its global data-center business, contributing 8% of adjusted earnings in 2021. It continues to generate over $2 billion per year in revenue from its core storage business while strategically growing its data center portfolio, which is an optimistic sign for steady growth in the coming years.

IRM has maintained a $0.62 per share quarterly dividend since 2019 as it has been focused on steadily recovering its payout ratio from the pandemic. The AFFO came in at $0.93 for the second quarter, a 9.4% year-over-year improvement. The company uses its recurring income to pay an attractive dividend — it currently yields 4.68%. Management’s target for a low to mid 60’s percent dividend payout ratio seems to be quickly approaching, after which they see the dividend increasing.

It should be no surprise that the defense giant Lockheed Martin (LMT) has outperformed the market this year. There are obvious geopolitical implications with the war in Ukraine. When Russia decided to invade its neighbor, both U.S. and European forces rushed in to help Ukraine. It may be some time before LMT stock pops again, as it did at the onset of Russia’s invasion of Ukraine. However, its order books are likely to improve due to rising defense budgets in the U.S. and abroad. Along with Lockheed providing support to Ukrainian resistance fighters, the looming uncertainties in Russia could lead to massive economic problems and gaps in power in former Soviet Union-controlled areas.

Given the recession-proof nature of defense contracting, Lockheed Martin should continue reporting positive results and rewarding shareholders through its quarterly 2.7% forward yield. In other words, even if the market dives again, LMT will likely stand firm. The company runs a P/E ratio of 24 times, below the sector median of 28.3 times. As well, LMT features excellent longer-term growth and profitability metrics.

You might also like:

- The Crypto Melt-Up has Begun

- “A.I. is a Tidal Wave” – Here’s What to Buy

- Beware Executive Order 14067

- #1 AI Stock for 2024 and Beyond

- Bank plague 2024

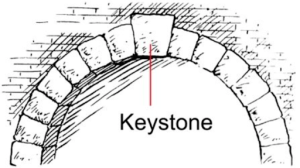

- Gates, Bezos, and Buffett invest in AI Keystone

- Congress Just Fast-tracked New A.I. Energy Breakthrough

- Elon Musk: THIS will be bigger than Tesla

- EV charging stations that pay you up to $93/day!

- Legendary Wall Street Stock-Picker Names #1 A.I. Stock of 2024, Live On-Camera