Electric Vehicle sales soared 65% year over year in 2022. According to Bloomberg NEF, 10% of all new autos purchased globally last year were E.V.s, which is expected to jump by 40% by the end of the decade. Meanwhile, new tax credits for E.V.s are being phased in this year in the U.S., and. more automakers are ramping up their production of E.V.s.

Established automakers like Ford, GM, and Mercedes unveiled plans for dozens of new electric vehicles. Mass production of most of these vehicles will kick into gear starting in 2023 and 2024. Our recommendation for today is a small cap with extreme growth potential over the next few years on the crest of the upcoming E.V. production wave.

By 2029, electric vehicles could account for a third of the North American market and about 26% of vehicles produced worldwide, according to AutoForecast Solutions. Lithium Americas Corp (LAC) is one company hoping to ride the wave of anticipated global E.V. demand. Launched in 2007, the Canada-based firm searches for lithium deposits in the U.S. and Argentina. While the company is still a pre-revenue concern, its pipeline is brimming with potential, including one project set to enter production stages this year.

The company has full ownership of two development-stage operations in Argentina. One of which is approaching initial production, expected to come later this year. Due to ongoing legal and regulatory discrepancies, LAC’s U.S. project –The Thacker Pass, Nevada lithium mine – has disrupted the timeline. However, a U.S. judge said last week that she would rule “in the next couple of months” on whether former President Donald Trump erred in 2021 when he approved the company’s right to begin mining the U.S.’s largest-known lithium resource. It seems likely that the outcome of the case will be positive for LAC, considering Washington’s push to boost domestic production of metals crucial to the green energy transition and wean the country off of Chinese supplies.

The high-growth -potential small-cap has been gaining the attention of the pros on Wall Street. “We believe 2023 could be an eventful year as there could be a number of key announcements on growth projects and Argentina divesture, which could be catalysts for the share price,” explained HSBC analyst Santhosh Seshadri. To this end, Seshadri recently initiated coverage of LAC with a Buy rating, backed by a $36 price target.

Most analysts agree with Seshadri’s thesis. LAC claims a Strong Buy consensus rating, based on 13 Buys vs. 1 Hold and no Sell ratings. At $37, the average price target makes room for 12-month gains of 79%.

You might also like:

- The Crypto Melt-Up has Begun

- “A.I. is a Tidal Wave” – Here’s What to Buy

- Beware Executive Order 14067

- #1 AI Stock for 2024 and Beyond

- Bank plague 2024

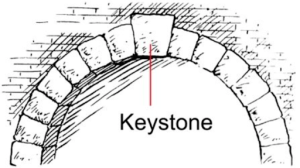

- Gates, Bezos, and Buffett invest in AI Keystone

- Congress Just Fast-tracked New A.I. Energy Breakthrough

- Elon Musk: THIS will be bigger than Tesla

- EV charging stations that pay you up to $93/day!

- Legendary Wall Street Stock-Picker Names #1 A.I. Stock of 2024, Live On-Camera

NEXT:

Get Free Stock Picks via SMS by Signing Up Below!

I would like to receive timely trade ideas and stock watchlists from Wall Street Watchdogs at the phone number provided. Message frequency varies. Message and data rates may apply. Reply HELP for help or STOP to cancel.(Watchdogs SMS Terms of Service & Privacy Policy)