I don’t remember at what age the fleeting childhood memories began. Either way, it’s safe to say that I’ll never forget my father’s mint-green American Express credit card, nor will I forget how he would use it for certain things—even the scribbling of his unique signature on receipts. I knew there was more behind it than what I was seeing. Well, I eventually found out the hard way that whether or not you want to spend your money through revolving credit lines, it was, and in some ways still is, the benchmark gateway to having good, lasting credit.

I had enough time with my father to pick up a thing or two from his MBA knowledge and experience as CEO of several businesses—8th grader questions like, “What the heck is interest, why is it there, and what does the interest rate do?” I didn’t know then that I’d be selling mortgage loans in my early 20s or being educated on and writing about the stock market like I do today. I own a credit card, but it’s not American Express—sorry, Dad. Visa? Doesn’t matter. What I really want to do is compare two stocks in the same sector by breaking down their metrics and trends to decide on a winner. Times are tough. Let’s be picky.

Both V and AXP are great stocks, but if you have to choose, I may help by breaking them down thoroughly and offering my take. Get this industry peer comparison in the full article here:

Bank cards, the places where we personally store them, and the entity providing fraud insurance on the funds were all physically tangible objects as little as 6-7 years ago. Maybe it’s been closer to a decade. No matter how long it takes, there’s no denying that the transition from physical to digital banking is being done more and more through easier, but less personal, ways. Interestingly, as I’ve seen stock sectors or industries loosely applied to categorize stocks—aand there are endless crossovers—II learned that AXP and V are now considered part of the “Transaction Processing Services” industry.

Alright. Let’s compare these two household-name creditors and figure out which one is the best portfolio addition and which one we should either sell, disregard, or keep a close eye on!

Visa (V) was formed in 1958, and its main office is in San Francisco, CA. V runs VisaNet, a network for processing transactions that lets payment transactions be authorized, cleared, and settled. V also offers credit, debit, prepaid cards, tap-to-pay, Visa Direct, and Visa DPS. Approx. 26,500 people work there full-time. V also offers Cybersource, a payment management platform with risk and identity solutions like Visa Advanced Authorization, Visa Secure, and Visa Consumer Authentication Service. V operates under the names Visa Electron, VPAY, and Interlink. Always Visa (V), the company appears to have fully embraced the prosperous promise of digital payments over physical cards.

Meanwhile, American Express (AXP), with around 64,000 employees, has a slew of segments that offer charge/credit cards and travel services worldwide. AXP provides payment and finance services, network services, accounts payable and expense management, and travel and lifestyle services. AXP also offers merchant acquisition, processing, servicing, settlement, point-of-sale marketing, and fraud prevention services. In order to embrace the digital space, AXP markets and sells through mobile and web apps, third-party affiliates, and direct-response ads. AXP was founded in 1850 in New York.

V has a beta score of 0.94, making it less vulnerable to volatility than the broader market. Over the last twelve months, V has been working with a P/E ratio of 27x, revenue of $29.31 billion, EPS of $6.99 per share, and gross and net profit margins of 80.53% and 51.03%, respectively. Also notable is V’s PEG ratio (P/E except that it accounts for earnings growth) of 1.76x. As usual, V‘s most recent quarter easily beat analyst expectations and showed great growth from one year to the next. V currently has a dividend yield of 0.83%, with a quarterly payout of 45 cents ($1.90/year) per share.

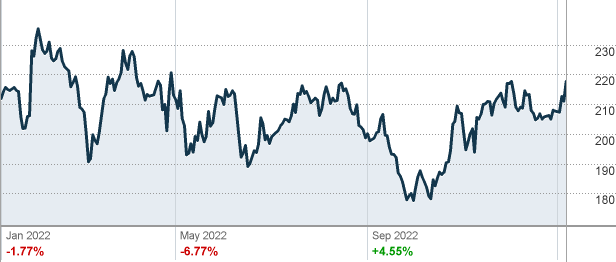

Visa (V)’s Price Movement Over Past 52 weeks (12mo)

Do remember that this is for the trailing twelve months (ttm), as of writing (January 2023). Analysts have given V a forecasted 12-month consensus median price target of $250, with a high of $290 and a low of $210. This leaves room for a potential price upswing of 33%, and the consensus among the experts also gives V a strong buy rating that we should keep in mind.

American Express (AXP)’s Price Movement Over Past 52 weeks (12mo)

AXP, per its trailing twelve-month months peformance, has been working with revenue of $51.7 billion at an EPS of $9.95 per share, with its stock trading at a P/E ratio of 14.8x, a P/S ratio of 1.9x, and a PEG ratio of 2.97x. AXP currently has gross and net profit margins of 67.30% and 14.82%, respectively—not to mention a healthy return on equity margin of 31.15%. AXP has had no problems exceeding analyst projections in its quarterly earnings reports; it has surpassed the earnings estimate for each fiscal quarter since the fourth quarter of 2020. AXP presently has a dividend yield of 1.39%,with a quarterly payout of 52 cents ($2.08/year) per share.

When it comes to price predictions, analysts have given AXP a median price target of $168, with a high of $201 and a low of $128. This is a very solid price estimate. The median target would be an 11.39% increase over the current price, and if the stock hit the high end of its price range, it could go up by 40%. Like V, AXP is certainly a stock worth buying and even holding.

The case can be made for both, but a couple of the sharper contrasts between the two stood out, such as the safer volatility measure despite its much larger market cap of over $400 billion (against AXP’s $110 billion), Meanwhile, V trades within a higher price range than AXP does, but it’s AXP that pays more in dividends. And while AXP is anticipated to finish the year a little ahead of V, it still doesn’t seem to have as much variety in its payment platforms—and the digital space, crucially, is where V has more power right now—as other creditors, digital cards, and even digital wallets. AXP also seems to be one of those companies that still has the same old pointless fees. You must know what I’m talking about.

While most financial institutions have benefited from the Fed’s enforced heightening of interest rates on lending, I don’t think American Express (AXP) is going anywhere real soon, and make no mistake; I’m not bearish on the stock. Regardless, despite a slightly higher price range, V still has a very solid dividend and has room to grow as it continues to act as a capable leader in the digital payments arena. Which is the better buy? Hm, go with Visa (V).

Read Next -Financial rapture warning

The financial renegade who predicted America’s riots, lockdowns, and rampant inflation has just released a shocking new documentary.

It exposes how two unelected billionaires from New York have engineered a reset of not just your personal wealth, but the entire U.S economic system.

These two men have been working on this “reset” for decades, and unless you know how to protect yourself from what they have planned next… you could lose everything.

Your 401(k), stock portfolio, crypto, cash, bonds… it’s ALL on the brink of being wiped out by these two men.

As you’ll learn here, however, that’s not even the worst of it…

The shockwaves from this looming event will rip our country even further apart, leading to a surge in violence, protests, and economic disruption.

That’s why it’s critical that you watch this new documentary immediately – to discover the steps you can take to protect your wealth, your loved ones, and your way of life.

To stream it at no cost, click here now.