The major averages ticked higher this morning but were still on track for a losing week as the market processed Wednesday’s 75 basis point rate hike. Investors looking for hints of Fed dovishness were disappointed to find no indication that the Fed may be poised to pause its tightening campaign. Fed Chair Jerome Powell said Wednesday that the central bank still has “some ways to go” before the current rate hike cycle is over, noting that “incoming data since our last meeting suggests that the ultimate level of interest rates will be higher than previously expected.”

Labor data released this morning further fueled concerns that the Fed will push the economy into a recession with its aggressive stance in the battle against inflation. This morning’s payrolls release showed 261,000 jobs were added in October, surpassing the expectations of 205,000 additions. As of Thursday’s close, the S&P 500 and the Nasdaq were down 4.64% and 4.84%, respectively, and on track to snap two-week winning streaks. Meanwhile, the Dow was down 2.62%.

Anyone who wants to benefit from the push and pull of inflation and climbing rates will appreciate today’s trade. Whether you’re looking to hedge your portfolio and protect your precious long-term returns or looking to turn a quick profit when things take a turn, this short-term play is accessible to all levels of investors.

Traders who are looking to benefit from sliding stocks often turn to short-selling. The main risk of traditional short-selling is that while profit is capped (a stock can only fall to zero), the risk is theoretically unlimited. Of course, other tactics can be used to cover a position at any time, but with a short-selling position, inventors risk receiving margin calls on their trading account if their short position moves against them.

Inverse or “short” ETFs are another option that allows you to profit when a certain investment class declines in value. Some investors use inverse ETFs to profit from market declines, while others use them to hedge their portfolios against falling prices.

Over short periods, you can expect that the inverse ETF will perform “the opposite” of the index, but a disconnect may develop over more extended periods. Inverse ETFs will decline as an asset appreciates over time. For that reason, inverse ETFs typically are not seen as good long-term investments. Furthermore, frequent trading often increases fund expenses, and some inverse ETFs have expense ratios of 1% or more.

When approached correctly, inverse ETFs can be excellent day-trading candidates and highly effective short-term hedging tools. Several inverse ETFs can be used to profit from declines in broad market indexes, such as the Russell 2000 or the Nasdaq 100. Also, there are inverse ETFs that focus on specific sectors, such as financials, energy, or consumer staples.

With $4 billion in assets, the ProShares Short S&P 500 (SH) is the largest inverse fund by value. Commonly used by investors as a hedging vehicle, the fund strives to deliver the inverse performance of the S&P 500 (SPX). If you’re concerned about the stock market falling, this is the fund that moves in the opposite direction of the largest 500 U.S. corporations and is the simplest way to protect yourself.

It’s important to note that SH is designed to deliver inverse results over a single trading session, with exposure resetting monthly. Investors considering this ETF should understand how that nuance impacts the risk/return profile and realize the potential for “return erosion” in volatile markets. SH should definitely not be found in a long-term, buy-and-hold portfolio. The fund comes along with an expense ratio of 0.9%.

You might also like:

- The Crypto Melt-Up has Begun

- “A.I. is a Tidal Wave” – Here’s What to Buy

- Beware Executive Order 14067

- #1 AI Stock for 2024 and Beyond

- Bank plague 2024

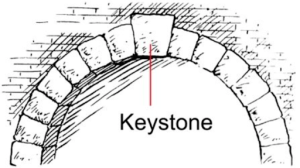

- Gates, Bezos, and Buffett invest in AI Keystone

- Congress Just Fast-tracked New A.I. Energy Breakthrough

- Elon Musk: THIS will be bigger than Tesla

- EV charging stations that pay you up to $93/day!

- Legendary Wall Street Stock-Picker Names #1 A.I. Stock of 2024, Live On-Camera