1. Amazon (AMZN)

Amazon (AMZN -0.18%) reported better-than-expected second-quarter earnings on July 28, beating multiple forecasts set by Wall Street. The company’s shares soared 24% from July 26 to Aug. 18 as bullish investors put their faith in it.

However, Amazon’s stock still has room for growth, with two of its recent acquisitions looking especially promising.

Amazon went on an acquisition spree between July and August, with its first purchase being subscription-based healthcare company 1Life Healthcare (ONEM -0.32%), known as One Medical, for approximately $3.9 billion. The buyout will see Amazon venture into healthcare, an industry the company has been eyeing for some time. The acquisition might be a match made in heaven, considering One Medical’s mission and Amazon’s unique resources, which will undoubtedly boost the company.

As described in Amazon’s press release on the acquisition, “One Medical combines in-person care in inviting offices across the country with digital health and virtual care services.” Telehealth services soared in popularity throughout the worst of the pandemic, with virtual healthcare company Teladoc Health‘s stock seeing a significant rise. However, the health stock’s nosedive of 65.4% year to date could be Amazon’s gain.

If the purchase is successful, Amazon will take control of One Medical’s almost 200 locations and roughly 770,000 patients nationwide — a significantly larger reach than Teladoc. Additionally, Amazon has the chance to incorporate its own technologies, such as unmatched delivery infrastructure and an established subscription service with over 200 million members worldwide. Breaking into the healthcare industry might not come easy, but it seems that Amazon is more than capable of succeeding in its health endeavors.

On Aug. 5, Amazon announced plans to acquire consumer robotics company iRobot (IRBT -0.17%), the result of a deal valued at approximately $1.7 billion. Compared to One Medical, the purchase is arguably less risky and fits nicely into the company’s current product lineup.

Amazon has gradually pushed into the smart-home industry over the years with its line of Alexa-enabled products, such as smart speakers, alarm clocks, thermostats, and security cameras. In addition to iRobot’s incredibly popular robot vacuums, Amazon’s purchase of the company also brings on its team of consumer robotic experts who have the potential to boost the company’s range of smart products as a whole and strengthen its hold on the growing industry.

Moreover, Amazon has turned Alexa into a multibillion-dollar business through its smart devices and app store, called Alexa Skills. Developers have flocked to create various Alexa Skills, from which Amazon keeps 30% of the profits. In 2019, analysts estimated Amazon generates $2 billion a year from Alexa skills, with the company keeping $600 million. The acquisition of iRobot only increases the variety of smart products and Alexa Skills the company could offer, which could pay off in a big way for Amazon.

2. Microsoft (MSFT)

As a rule of thumb, the bigger a company is, the more difficult it will be for it to grow quickly. One apparent exception to that rule, though, is the tech behemoth Microsoft (MSFT 0.54%). Despite being a $2 trillion market-cap company, it still found a way to increase its revenue significantly over the last year.

Is this as good as it gets for Microsoft? Or is the world’s third-largest public company by market cap likely to keep delivering market-beating returns for investors?

Microsoft’s cloud division continues to drive results

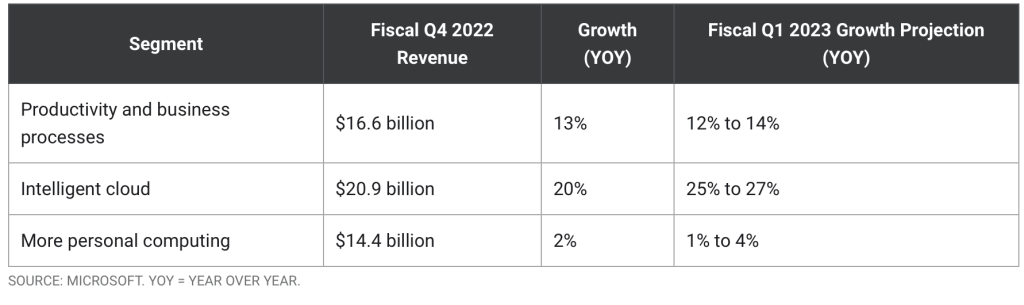

During the fourth quarter of its fiscal 2022, which ended June 30, Microsoft’s revenue rose 12% year over year. However, multiple factors affected profitability, and net income only increased by 2%.

The headline numbers, of course, don’t tell the whole story. Matters become clearer when you break the results — delivered on July 26 — down by segment.

Starting with its smallest segment, more personal computing, it makes sense that it hardly grew. That business includes consumer discretionary devices like Surface laptops and tablets and Xbox gaming consoles. Note also that this was the segment for which management gave the widest revenue growth range, reflecting its uncertainty about how strong consumers’ financial situation will be in the back half of this calendar year.

The intelligent cloud unit continues to be a monster, and its revenue growth is projected to accelerate even as many businesses tighten their belts. This strength is a testament to the fact that businesses have come to see their cloud transitions as vital. Investors should pay close attention to this space. Within this segment is Azure, Microsoft’s cloud computing service. Its revenues rose 40% year over year — faster than its primary competitors Amazon Web Services (AWS) at 33% growth and Alphabet’s Google Cloud at 36% growth during their comparable quarters. Although still behind in terms of market share, Microsoft is catching up to AWS, and will be a force to be reckoned with in this space.

Perhaps the most surprising result in Microsoft’s productivity and business products division was that LinkedIn’s revenue grew by 26%. The professional networking platform’s sales are primarily driven by premium subscriptions and advertising, which shouldn’t be as strong during difficult economic periods. Nevertheless, its strength last quarter reflects LinkedIn’s relevance in the advertising space, and its results shouldn’t be ignored. Finally, commercial Office (9%) and Dynamics (19%) products saw solid growth, which is impressive when many businesses cut spending.

These results helped drive positive investor sentiment in the days after the quarterly report was released, as they indicate many businesses are still executing despite the current macroeconomic headwinds.

3. Apple (APPL)

Inflation doesn’t seem to be slowing Apple down

The Federal Reserve has been working to combat the highest inflation the U.S. has seen in nearly four decades. There are textbook methods for getting inflation under control but investors need to understand that there are only so many levers the Fed can pull without creating new, potentially worse problems. In such a challenging economic environment, it is natural to think that companies like Apple, which primarily sells luxury consumer hardware, could struggle.

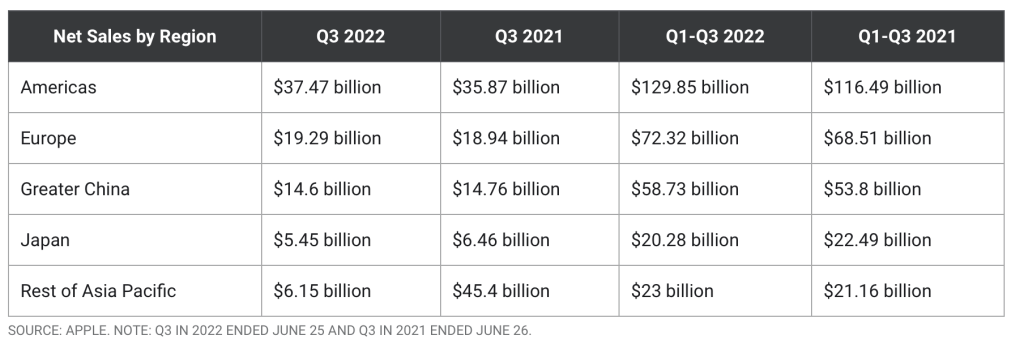

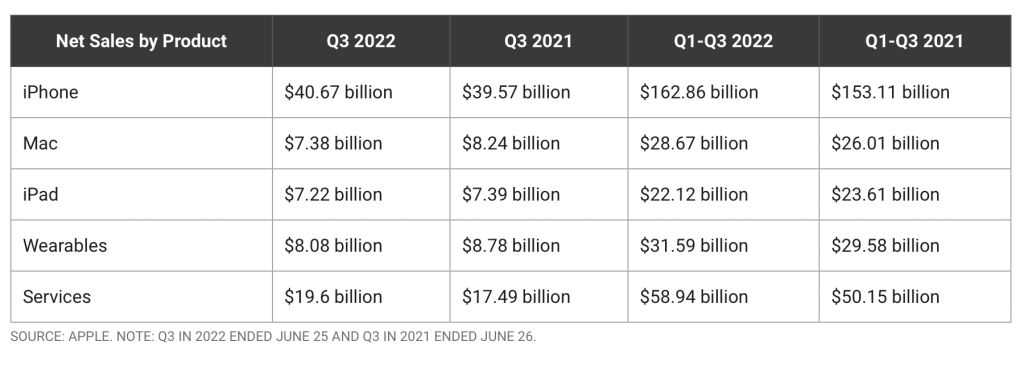

For the company’s fiscal 2022 third quarter (ended June 25), Apple reported $82.9 billion in revenue, up 2% year over year. While this growth seems unimpressive, it’s important to note where the company is seeing the most growth. The tables below break down Apple’s revenue for the three months and nine months ended June 25, 2022, across product segments and geographies.

Apple is generating robust growth across nearly all of its revenue streams, with iPhone and Services leading the charge. It’s no secret that the iPhone is an expensive product, selling for more than $1,000 depending on which specs you purchase. However, through the first nine months of fiscal 2022, Apple’s revenue from the iPhone is $162.9 billion, up 6% year over year. This level of growth at this magnitude showcases that Apple’s decisions to release newer, premium-priced versions of the iPhone in tandem with lower-cost options such as the iPhone SE has been working. Perhaps even more encouraging is that despite elevated levels of inflation, consumers still appear to be buying higher-end products around the globe.

Moreover, the strength in iPhone sales has catapulted Services revenue, which is up 18% through the first nine months of fiscal 2022. Services revenue is derived from advertising, cloud services, and in-app purchases. When more iPhones are being purchased, Services revenue should increase as well thanks to additional spending items such as cloud storage and mobile apps.

This circularity is what makes Apple so attractive as an investment. The tight ecosystem around its products and services has helped fuel the company’s growth and build a strong market position even in uncertain times.

4. Advanced Micro Devices (AMD)

AMD’s results for the second quarter of 2022 were outstanding. The company reported 70% year-over-year revenue growth to $6.6 billion and a 67% jump in non-GAAP earnings to $1.05 per share. The chipmaker saw tremendous growth across its entire business, and it also benefited from the acquisition of Xilinx (completed in February).

It is worth noting that AMD’s gaming segment recorded a 32% year-over-year spike in revenue to $1.7 billion, which was in stark contrast to Nvidia’s performance. This impressive jump isn’t surprising, as AMD has a more diversified gaming business when compared to Nvidia. For instance, AMD’s semi-custom processors are used in gaming consoles from Microsoft, Sony, and Valve.

Nvidia, on the other hand, supplies its chips for the Nintendo Switch consoles. That means AMD can move more units of its semi-custom chips thanks to a broader customer base. More importantly, sales of gaming consoles are expected to head higher at a time when sales of personal computers (PCs) are declining.

Sony, for instance, expects to sell 18 million units of the PlayStation 5 (PS5) console in the current fiscal year that ends in March 2023. That would be a nice jump over last fiscal year’s shipments of 11.5 million units. Meanwhile, Microsoft is expected to sell 21 million units of the Xbox Series X console this year compared to 12 million units last year. Valve, on the other hand, is reportedly going to ramp up the production of its Steam Deck handheld console in a bid to double shipments.

However, Nintendo has reduced its forecast for Switch sales this fiscal year by 10% compared to the last one. Throw in the fact that sales of PCs are expected to decline 8.2% this year as per IDC, and Nvidia’s addressable market for its graphics cards is going to shrink as these chips are used for powering gaming PCs.

Of course, AMD also sells graphics cards that go into gaming PCs, and the company saw a decline in sales in this segment. But growth in semi-custom sales helped it offset the decline in graphics cards, as CEO Lisa Su said on the latest earnings conference call.

Additionally, AMD sees record revenue from sales of semi-custom processors this year, indicating that its gaming business should remain solid despite the potential weakness in the PC market.

The better buy

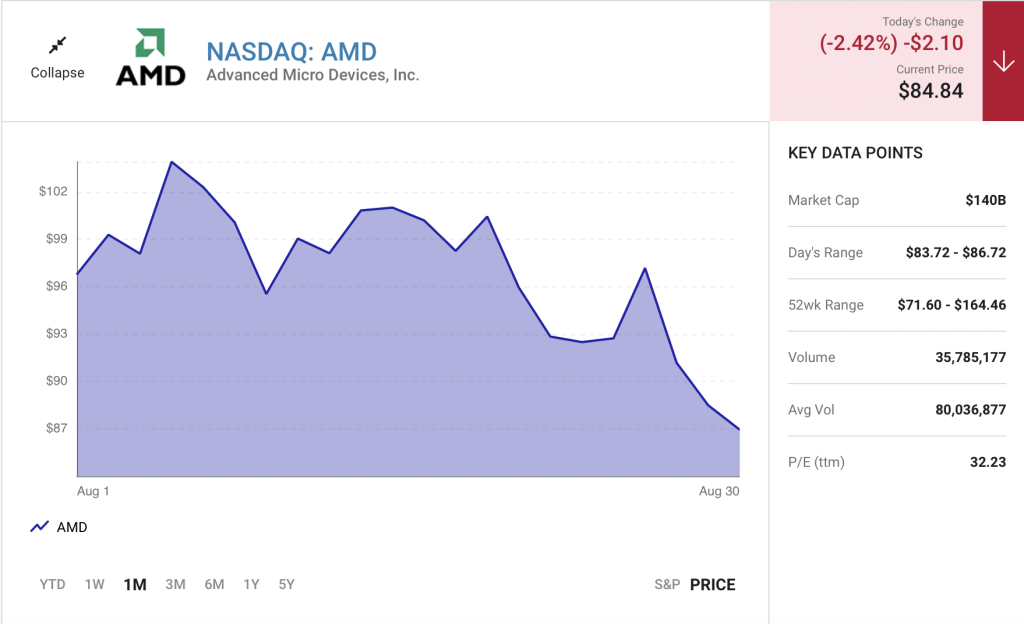

AMD forecasts 60% revenue growth in 2022 to $26.3 billion. Analysts expect Nvidia’s top line to increase 15% in the current fiscal year to $31 billion. AMD’s acquisition of Xilinx, its solid position in the semi-custom business, and market share gains in the PC and server processor markets are the reasons why the company could achieve such impressive growth this year.

More specifically, AMD gets a quarter of its total revenue from the gaming business. Nvidia, meanwhile, got 46% of its revenue from selling chips into the gaming hardware market last fiscal year. A more diversified business and AMD’s stronger access to the gaming console market should help it mitigate any weakness in the graphics card space and deliver the healthy growth management is forecasting.

What’s more, AMD is trading at 41 times trailing earnings and 23 times forward earnings. Nvidia trades at 48 times trailing earnings and 49 times next year’s earnings. Considering the much faster growth that AMD is expected to clock and its relatively attractive valuation, buying this tech stock over Nvidia looks like a no-brainer right now.

5. Alphabet (GOOG)

Alphabet (GOOGL 0.31%) delivered less-than-ideal second-quarter earnings results at the end of July, with multiple segments just missing analyst projections. Although the company’s stock persevered and soared in the first two weeks of August, prices have recently dipped.

Here’s why now could be the best time to invest in Alphabet stock.

Similar to its recent stock fluctuations, Alphabet’s second-quarter report offered some highs and lows. Several of the company’s segments underperformed, with revenue coming in at $69.69 billion versus the expected $69.9 billion. YouTube advertising brought in $7.34 billion when analysts projected $7.52 billion, while Google Cloud revenue earned $6.28 billion against the expected $6.41 billion. Moreover, revenue growth slowed to 13% vs 62% in the prior year as pandemic restrictions eased and consumer spending increased.

On a more positive note, one of the brightest spots of Alphabet’s second quarter came from its advertising segment, which increased 12% to $56.3 billion. Google’s “Search and Other” segment also rose from $35.85 billion in 2021 to $40.69 billion in 2022.

Despite underperforming second-quarter earnings expectations, Alphabet’s stock rallied considerably in the first half of August — proving investors’ long-term faith in the company. In the run-up to the company’s Q2 2022 report, Alphabet stock fell 8% between July 21 and July 26. However, by Aug. 15 it had then risen 16.2%, reaching a height the company’s stock hadn’t seen since the beginning of May.

More recently, the stock has slightly dipped, falling 5% between Aug. 18 and 23. Prospective investors may have a chance to buy Alphabet stock now, especially considering everything the company has in the works and the fact that the stock is still down 21% year to date.

Google reorganized under the name Alphabet in 2015 as its business grew to include a wide range of brands and pursuits that reached far beyond the search engine that brought the company global recognition. Alphabet’s incredibly varied endeavors now see it participating in industries such as gaming, consumer tech, video streaming, robotics software, self-driving cars, and much more. However, two of its business segments are especially promising: Advertising and YouTube.

Despite Alphabet’s many businesses, about 80% of the company’s revenue is related to advertising in some form, with 70% of that coming from Google Search ads. In its second quarter, Google’s advertising revenue was up 11.6% to $56.3 billion. Considering digital advertising spending worldwide is likely to increase from $521 billion in 2021 to $876 billion in 2026, a 68% increase, Alphabet could be in for a significant revenue increase.

Regarding YouTube, the segment saw the most prevalent deceleration in Alphabet’s Q2 2022 report, with sales rising 5% when the same figure grew 84% the year before. However, the company is making significant moves to boost the video platform with a venture into streaming and creating a worthy competitor to ByteDance‘s TikTok.

This coming fall, Alphabet is reportedly launching a streaming marketplace through the YouTube app, where users can browse various services and subscribe directly through the platform. The company is now negotiating with multiple streaming companies about joining the “channel store.” If successful, the new service would see Alphabet create a new revenue stream through its cut of subscriptions made through YouTube, taking a cut out of the $80 billion streaming industry.

In 2021, YouTube launched its “Shorts” feature to rival the fastest-growing mobile application in history, TikTok. The feature allows consumers to create short videos through the YouTube app and has already grown to 1.5 billion monthly active users. The addition to YouTube could further fuel Alphabet’s advertising revenue, as advertisers look to appeal to younger audiences who favor the condensed video style.

Despite a weaker-than-expected second quarter, Alphabet investors have plenty to look forward to ahead. The company may have its eggs in many baskets, but its biggest businesses are in markets that will see substantial growth for years to come. And the stock is currently on sale — down over 21% year to date.