According to a report by Space Capital, space infrastructure companies received a record-breaking $14.5 billion of private investment last year, up more than 50% from 2020. Thanks to “mega-rounds” of $250 million or more by Planet Labs, Sierra Space, and Elon Musk’s SpaceX, more than $4.3 million was added in the fourth quarter alone. But billionaires aren’t the only ones with a vested interest in intergalactic innovation.

There is a great effort from not only high-profile investors and startups to develop new space technologies but also from Governments and Aerospace & Defense giants from around the world with tremendous R&D power.

The Space Economy is a multi-billion dollar industry today. Still, many expect it to surpass $1 trillion in the coming decades, bringing new opportunities for investors to capture this growing segment of the global economy. The Commerce Department is already throwing its support behind the American space industry with ambitious goals for regulatory reform and promotional efforts.

Space stocks have been under intense selling pressure in the rotation out of speculative growth investments. “Many endeavors will indeed fail, but there will be generational winners that emerge out of the rubble, ” Deutsche Bank analyst Edison Yu reminded investors in a recent note to clients. Today we’ll look at a pure-play space infrastructure company with out-of-this-world potential that should appeal to our long-term-minded readers at these levels.

Momentus (MNTS) is a pure-play space infrastructure company. Unlike Virgin Galactic, which is geared towards being a luxury travel provider, Momentus aspires to be a space infrastructure company for commercial endeavors. This Santa Clara, California-based company states the following as its goal for 2025:

“We aim to be able to provide a full range of infrastructure services in microgravity and deep vacuum, which will open the door to infinite manufacturing possibilities. Impossibly large next-generation structures will continue to pave new paths for even greater human development in space.”

For 2035, they talk about asteroid and moon mining! Before we get carried away, let’s focus on the here and now.

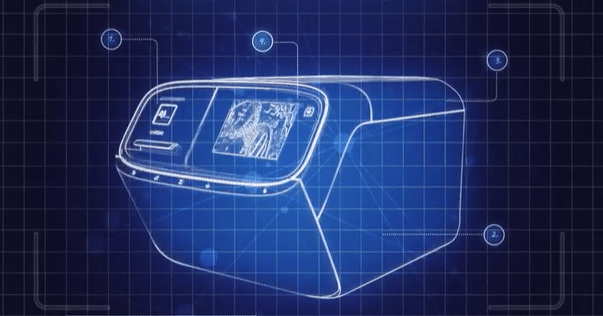

Momentus has developed what they call a space transfer vehicle. In short, it aims to offer a ride-sharing service for satellites. You see, most satellites need highly precise orbits. Booking your own launch on, say, a SpaceX Falcon 9 rocket to accomplish that precise orbit is mighty expensive. What Momentus does is allow multiple satellites to hitch a ride on their Vigoride vehicle. In turn, that vehicle will take each satellite to its needed orbit.

Momentus recently announced that it had signed multiple launch agreements with SpaceX for four upcoming SpaceX Transporter missions, including the Transporter-6 mission targeted for October, Transporter-7 targeted for January 2023, Transporter-8 targeted for April 2023, and Transporter-9 targeted for October 2023.

Momentus hopes to meet the needs of customers that want to move their payloads to specific orbits that aren’t accessible directly from Earth-based launches. As of Wednesday’s close, MNTS stock was down 51% in 2022.

Should you invest in Momentus right now?

Before you consider buying Momentus, you'll want to see this.

Investing legend, Keith Kohl just revealed his #1 stock for 2022...

And it's not Momentus.

Jeff Bezos, Peter Thiel, and the Rockefellers are betting a colossal nine figures on this tiny company that trades publicly for $5.

Keith say’s he thinks investors will be able to turn a small $50 stake into $150,000.

Find that to be extraordinary?

Click here to watch his presentation, and decide for yourself...

But you have to act now, because a catalyst coming in a few weeks is set to take this company mainstream... And by then, it could be too late.

Click here to find out the name and ticker of Keith's #1 pick...