One common opinion among analysts right now is that investors would be wise to concentrate their focus on the top insurance stocks. This is due to growing expenses becoming a hard reality for consumers globally. In the past, there’s been a clear correlation between the values of insurers and interest rates: if one rises, the other does too. This makes sense when you consider the Fed’s latest initiatives.

Rising interest rates, in the words of a group of experts, “allow insurers to invest new cash flows and maturing investments into a higher-rate environment, helping insurers offer competitive yields on products sensitive to interest.” As the credit markets adjust to higher rates and less liquidity, earnings may increase as insurers buy into assets with broader credit spreads than those more common in recent years. The best insurance stocks to purchase are highly pertinent and deserve our consideration. And as more Americans return to normal, more demand should cross over to the most productive insurance stocks.

Join me while I break down three stocks from the insurance sector likely to grow significantly, which equals greater returns for investors. Experts agree that these are safe portfolio picks:

Aflac Inc (AFL)

Aflac Inc (AFL) is a U.S. insurance firm that is the country’s leading supplier of supplementary insurance. AFL was founded in 1955 and is headquartered in Columbus, GA. AFL underwrites a wide range of insurance products in the U.S. Still, AFL is arguably best known for its payroll deduction insurance coverage, which provides cash benefits when a policyholder suffers from a covered accident or sickness. AFL offers financial security to more than 50 million people globally. AFL paid $100 million to buy Continental American Insurance Company in 2009, allowing it to provide supplementary insurance.

AFL shows a track record of exceeding quarterly earnings projections. AFL surprised analysts for four consecutive quarters, beating EPS forecasts by 5.40% and revenue by 3.69% in their last report. AFL’s current quarter shows us $4.8 billion in sales, at an EPS of $1.28 per share. Growth is expected to be on the horizon as AFL finds its footing, preparing to leave a significant imprint once things return to normal. The median 12-month price target for AFL from the analysts providing annual predictions is 60.00, with a high of 67.00 and a low of 53.00. The consensus estimate reflects a 9.31% rise from its previous price, and analysts rate it as a buy and hold, meaning we should get in while we can. AFL has a dividend yield of 2.91%, with a quarterly payout of 40 cents per share.

MetLife Inc (MET)

MetLife Inc (MET), with 90 million clients in over 60 countries, is one of the world’s leading insurance providers, annuities, and employee benefit programs. MET was established on March 24th, 1868. MET was rated 43rd on the 2018 Fortune 500 ranking of the biggest firms in the U.S. by total revenue. On January 6th, 1915, MET began transitioning from a stock life insurance business owned by people to a mutual corporation. MET announced its IPO in 2000, after 85 years. MET now enjoys world-leading market positions through its subsidiaries and affiliates.

MET is set up well for near-future success. People are starting to think about enhancing or expanding their life insurance coverage. The U.S. life insurance application market gained substantial momentum in the second half of 2020, with a record surge of 14.1% in July alone and a year-over-year increase of 9.2% in Q3. The overall increase in applications was 4%, the greatest yearly growth rate on record. This benefits MET, as it remains one of the most popular and successful life insurers. MET has done well in all of its recent earnings reports, most recently exceeding EPS and revenue estimates by 27.48% and 5.46%, respectively. The analysts that provide 12-month price projections have given MET a median target of 75.00, with a high of 80.00 and a low of 68.00. The median forecast is a 23.13% rise over current pricing, and MET’s upside growth potential earns its stock a confident buy rating. MET currently has a dividend yield of 3.28%, with a quarterly payout of 50 cents per share.

Sun Life Financial Inc (SLF)

Sun Life Financial Inc (SLF) is a financial services firm that offers insurance, wealth management, and asset management solutions to people and corporations worldwide. SLF provides both term and permanent life insurance, personal healthcare, long-term care, dental, and disability coverage. In addition, SLF offers reinsurance products, financial advice and portfolio management, trust and banking services, appraisal services, and merchant banking services. SLF has direct marketing representatives, freelance agents, banks, pension/benefits advisors, and other third-party agencies to distribute its goods. SLF was founded in 1871 and is based out of Toronto, Canada.

The rising demand for life insurance products is suitable for SLF as it shows that households are interested in safeguarding their financial situation and individual interests. This positive trend should extend to SLF, one of the sector’s most uniquely qualified and discounted tickers. SLF has positive growth that looks solid and steady. Looking back, SLF’s EPS projections have been modestly but consistently bested – from Q1 2022 to Q2 2021. SLF‘s 12-month price goal from analysts is an estimated 52.84, with a high of 61.67 and a low of 48.64. The consensus forecast is a 19.04% gain over SLF’s latest stock price, and its stock comes with a proud buy rating. SLF’s dividend yield is a generous 4.92%, with a quarterly payout of 55 cents per share.

Read Next – Buy THIS stock ASAP!

The next major energy revolution is unfolding right now.

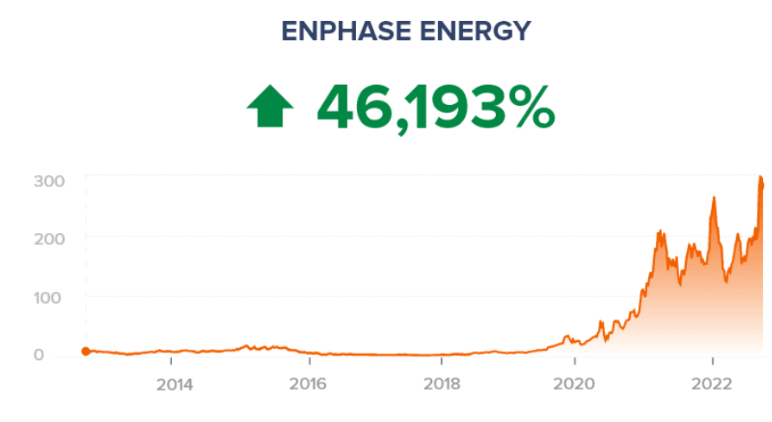

And it could hand early investors as much as 46,700% gains.

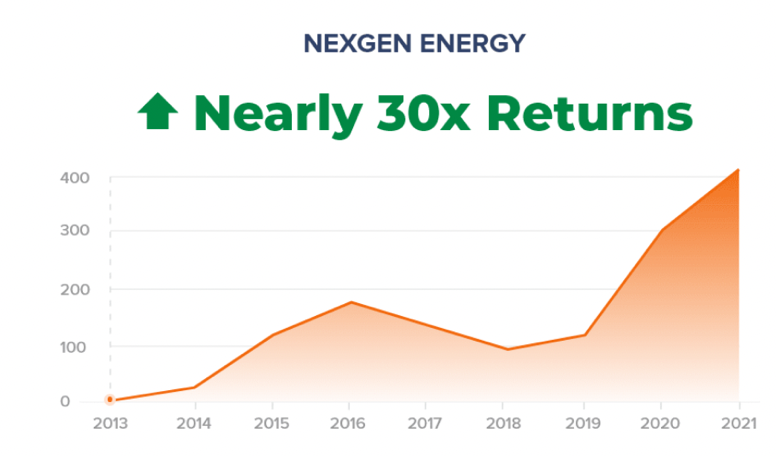

The growth of nuclear energy caused NexGen Energy to jump from $0.22 to $6.50.

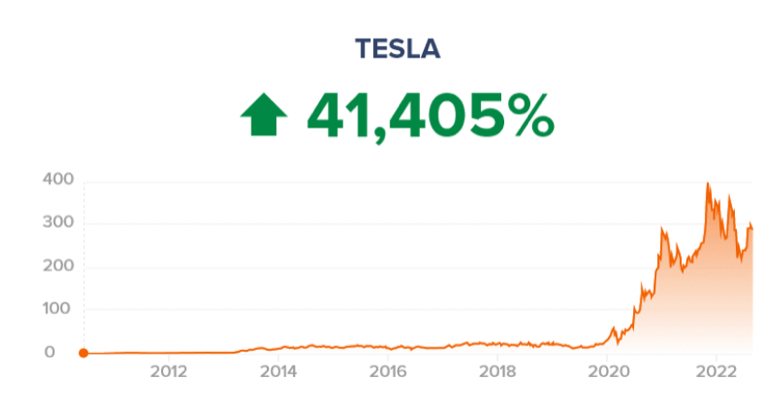

And the birth of the electric vehicle and battery market handed investors a 41,40% gain as Tesla stock mooned from $2 to $1,243.

But this new energy revolution could put those gains to shame.

Goldman Sachs estimates that it will unleash $11.7 trillion in new wealth.

10X BIGGER than the electric vehicle market.

And Forbes, Nature, and CNN have all agreed:

This new type of energy will be the fuel of the future.

Forget solar, forget nuclear, wind, water.

Forget oil even.

This new type of fuel will make them all obsolete.

And give early investors a shot at Rockefeller family wealth.

We’re talking the change to potentially turn every $500 into $234,000.

See exactly how that could happen right here.