Seeking out great stocks to buy is essential, but many would say it’s even more important to know which stocks to steer clear of. A losing stock can eat away at your precious long-term returns. So, figuring out which stocks to trim or get rid of is essential for proper portfolio maintenance.

Even the best gardens need pruning, and our team has spotted a few stocks that seem like prime candidates for selling or avoiding. Continue reading to find out which three stocks our team is staying away from this week.

Rising interest rates and a red-hot housing market cooling off create a challenging backdrop for mortgage provider Rocket Companies (RKT). Mortgage interest rates have increased about 90 basis points year to date, and the average rate for a 30-year mortgage is currently 4.19% versus an average of 3.09% in 2021. This is likely to drive origination volumes lower and could also lead to elevated competition as mortgage originators compete in a smaller market.

Rocket has struggled to meet expectations for the past few quarters as it laps 2021’s blockbuster numbers. Most recently, the company came out with quarterly earnings of $0.32 per share, missing the consensus estimate of $0.38 per share. This compares to earnings of $1.14 per share a year ago. Revenue was reported as $2.59B, missing consensus expectations of $2.62B.

Rocket’s been underperforming the broader market so far in 2022. RKT shares have lost about 25% since the beginning of the year versus the S&P 500’s decline of 7%. The pros on Wall Street say to Hold RKT. Of 15 analysts offering recommendations, 3 rate the stock a Buy, 10 rate it a Hold, and 2 say to Sell the shares.

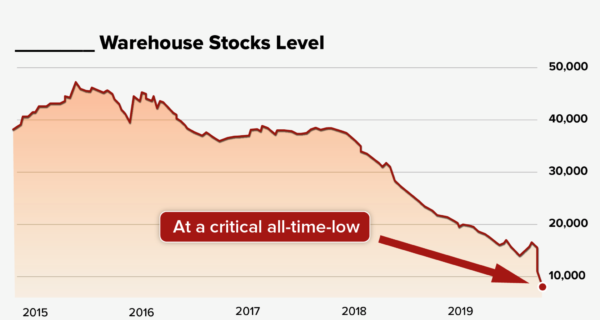

Next up is offshore oil rig service provider Transocean (RIG) suffered severely in the wake of 2020’s economic shutdown and travel bans (when crude prices plummeted to all-time lows), but the company was in bad shape long before that. In 2019 before the pandemic, Transocean reported an EPS loss of $1.45. Bank of America analyst Mike Sabella projects that losses will continue through at least 2023.

He’s projecting Transocean will generate a negative $50 million in 2022 free cash flow. Bank of America has an Underperform rating and a $1 price target for Transocean. Since Transocean has more than $8 billion in debt and $600 million in 2022 debt maturities, Sabella’s forecast doesn’t seem unrealistic.

The current consensus among the 15 analysts offering recommendations is to Hold RIG. The stock has 1 Buy rating, 6 Hold ratings, 4 Sell ratings. A median target of $3 represents a 30% decrease from where the stock closed Friday.

Healthcare facility maintenance and food service provider Healthcare Services (HCSG) made our list of stocks to avoid after reporting horrific Q4 results. The company reported Q4 earnings of $0.03 per diluted share, down from $0.37 in Q4 2020 and 57% lower than consensus expectations. What’s more, EBITDA missed the mark by 54%.

HCSG spending has been on the rise for the past few quarters and spiked more than 7% quarter over quarter in Q4. Management doesn’t expect cost of service to come back to their historical target of 86% until the end of the year, which seems like an optimistic estimate.

“Our fourth-quarter results reflect continued margin pressures resulting from workforce availability, inflation, and supply chain disruption. We remain actively engaged with our customers to modify our service agreements to adjust for the extraordinary inflation experienced during the second half of 2021, as well account for future inflation on a real-time basis,” said CEO Ted Wahl.

With occupancy rates at nursing facilities across the U.S. making a much slower recovery from the pandemic than expected, the industry has shed more than 220,000 jobs in the past year. Healthcare Services struggled to find footing in 2021, and the prospects for 2022 are not looking great.

HCSG has underperformed significantly when compared to the broader market. Over the past 12 months, the S&P 500 is 14% higher, while HCSG is lower by 38%. The pros on Wall Street give the stock a Hold rating. We’ll stay away until headwinds subside.