Volatility surged last week amid escalating geopolitical tensions. The three benchmarks fell into correction territory after Russia launched attacks on Ukraine Thursday morning. A dramatic afternoon recovery lifted stocks through the end of the week to finish mostly on a high note. The Dow finished the holiday-shortened week flat. The S&P 500 gained 0.8%, and the Nasdaq got a 1.1% boost for the week.

We’ll see what impact geopolitical concerns, tightening central-bank policy, and inflation pressures will have on equities as we round the corner into March. This week Federal Reserve Chair Jerome Powell is expected to give his semi-annual monetary policy update before the U.S. House Financial Services Committee on Wednesday, with an appearance before the Senate Banking Committee to follow on Thursday. Investors will be looking for clues about the Fed’s position ahead of the pivotal March FOMC meeting that starts March 15th.

Market watchers will also get insights about February employment. ADP’s National Employment Report comes out on Wednesday, and the Labor Department will release its nonfarm payrolls report on Friday.

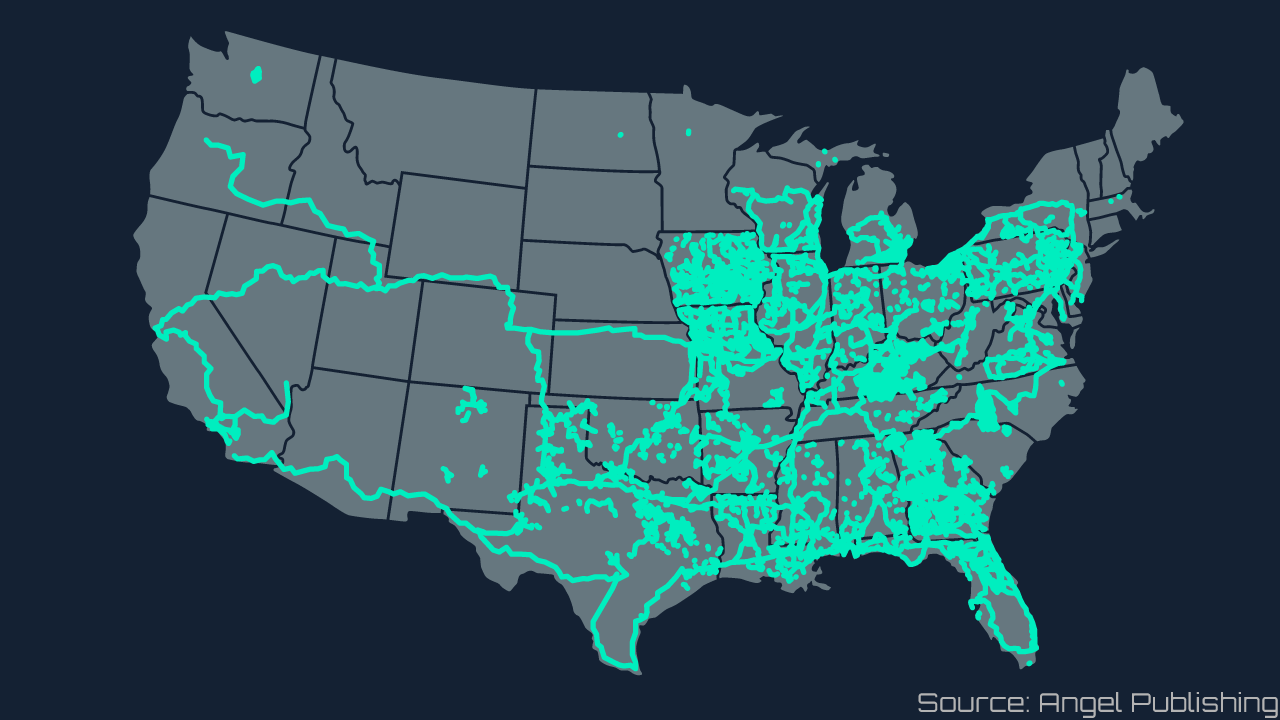

This week we have a few recommendations, including a name that stands to be among the most significant beneficiaries of the $150 billion in broadband spending over the next three years.

Leading provider of distilled branded spirits and specialty food ingredients MGP Ingredients Inc. (MGPI) just logged a record-breaking 2021 and appears to be primed for building on that strength in 2022.

Last week MPGI topped consensus estimates for the fourth quarter in a row and raised 2022 revenue guidance. The company reported quarterly earnings of $0.87 per share, blowing past expectations of $0.63, and beat revenue estimates averaging $152.69M, reporting Q4 revenue of $166.8M.

“Our record performance this year demonstrated the strength of our business model and the value each of our segments bring to our global customer base,” said David Colo, president, and CEO of MGP Ingredients.

Many know MGP as an opportunity to invest in branded spirits, but an often overlooked feature of the company is its involvement in the burgeoning plant-based protein movement, a market anticipated to grow at a CAGR of 11.2% from 2020 to 2027 to reach $27.05 billion by 2027. The company launched its line of non-GMO texturized proteins Proterra in 2020 and has been strategically building the name since.

The most recent developments are plans for a $16.7M extrusion plant expected to produce up to 10M pounds of ProTerra per year. “Achieving in-house production of our ProTerra line of products is a meaningful investment amid growing demand and increasing outsourcing costs,” said MGP’s CEO. The extrusions plant isn’t the only project MGP has in the wings. The company has expansionary projects totaling approximately $33 million over the next two years.

Lake Street analyst Ben Klieve recently initiated coverage of MGP with a Buy rating and $100 price target. The analyst views the stock as a “compelling investment” for those looking for undervalued, branded spirit opportunities in high multiple categories and those seeking to capitalize on the plant-based protein movement without the risk of directly investing in specific brands.

The company raised 2022 guidance. It now sees EPS of $3.95-$4.10 and revenue of $690M-$715M. “We are very pleased with the momentum we ended the fiscal year on and believe we are well-positioned to execute and deliver against our long-term growth strategy in fiscal 2022. We are committed to leveraging the strong foundation we’ve established over the years to position MGP for sustainable long-term growth,” concluded Colo.

Communication service cloud and software provider Calix Inc (CALX) seems likely to benefit significantly from the over $150 billion in broadband stimulus spending over the next three years. Calix customers include SCTelcom, Verizon, ALLO Communications, CityFibre, Nex-Tech, Gibson Connect, ITS Fiber, Canadian Fiber Optics, Sogetel, and over 1,400 other communications service providers globally, the majority being in North America.

The company has continued to show strength despite persisting supply chain disruptions and even increased inventory in the fourth quarter to improve responsiveness to its growing customer base. CALX is an asset-light business that outsources much of its manufacturing and warehousing to third parties. This strategy has allowed the company to stay nimble amidst supply snags and rising prices without passing the cost along to its customers.

Calix’s customer retention was off the chart in 2021, which translates to more predictable income. In 2021 recurring revenue increased 76% year-over-year to $125 million. That number is up from a 23% YOY increase in 2021. Thanks to the company’s subscription-based business model, competitive pricing, and customer satisfaction, that trend seems likely to continue over the next three years at least.

The company sees revenue increasing about 9% YOY in the first quarter of 2022, well in line with its target range of 5 to 10% for annual revenue growth. Compared to the year-ago quarter, cash and investments increased by $70.5 million primarily due to positive free cash flow of $46.3 million – yet another trend the company expects to continue in the coming years.

CALX garners a Buy rating from the 8 analysts covering the stock and a median price target of $59.50, representing a 10% increase from where the stock closed Friday.

Investors looking to preserve their precious 2021 returns may want to consider buying something that’s been tracking relatively well so far in 2022: value stocks.

The iShares Russell 1000 Value ETF (IWD) offers exposure to large-cap companies that show strong signs of value. Large-caps can benefit any well-balanced portfolio, including rock-solid stability and dividends. Companies within this segment are considered some of the safest companies to invest in and tend to be in stable industries as well.

IWD is linked to the Russell 100 Value Index, consisting of roughly 650 holdings and tilted heavily towards financials, energy, and health care. IWD is a staple in many savvy investors’ portfolios, thanks to the fund’s level of diversification and cheap price. The fund has a relatively low expense ratio of 0.19% and a dividend yield of 1.57%.

So far in 2022, IWD is down 3.3%, outperforming the S&P 500, down 8.6%. Amidst the current backdrop, the trend seems likely to continue. IWD is the perfect choice for those who are looking to invest in names like Walt Disney (DIS), JPMorgan Chase (JPM), and Johnson & Johnson (JNJ), which are among the fund’s top holdings.

Should you invest in Calix Inc right now?

Before you consider buying Calix Inc, you'll want to see this.

Investing legend, Keith Kohl just revealed his #1 stock for 2022...

And it's not Calix Inc.

Jeff Bezos, Peter Thiel, and the Rockefellers are betting a colossal nine figures on this tiny company that trades publicly for $5.

Keith say’s he thinks investors will be able to turn a small $50 stake into $150,000.

Find that to be extraordinary?

Click here to watch his presentation, and decide for yourself...

But you have to act now, because a catalyst coming in a few weeks is set to take this company mainstream... And by then, it could be too late.

Click here to find out the name and ticker of Keith's #1 pick...