Futures traded flat overnight and into the morning as investors processed a bevy of economic data and second quarter results from the financial sector.

JPMorgan Chase (JPM) and Goldman Sachs (GS) kicked off earnings season yesterday. Today, sights should be set on Bank of America (BAC), Citigroup (C), and Wells Fargo (WFC). We’ve got details on what to expect.

Stocks have been shaky so far this week. However, the popular “FAANG” tech stocks have been the notable standout; We’ve seen Apple (AAPL), Facebook (FB), Alphabet, Inc. (GOOG), and Amazon (AMZN) make jumps. Continue to the full story to find out what may be coming next, according to the pros.

Plus, the CPI (Consumer Price Index) report gave us higher numbers than anticipated yesterday, with the cost of living being at its highest since 2008. In this morning’s briefing, we’ll take a deeper look into the CPI’s significance.

Inflation rates surge high in June as the economy recovers…

The Labor Department said yesterday that inflation rose to its highest rate in almost 13 years in June, owing to an increase in used car prices, as well as price hikes in food and energy. The consumer price index rose 5.4% from a year ago, the most significant increase since August 2008, right before the financial crisis reached its apex. Dow Jones polled economists, and they predicted a 5% increase. After excluding volatile food and energy costs, the core CPI increased by 4.5%, the most since September 1991 and considerably above the forecast of 3.8%. Monthly, headline and core prices rose 0.9%, versus a forecast of 0.5%.

The index tracks how much people pay for clothes, food, restaurant meals, leisure activities, and automobiles. It climbed by 0.9%, seasonally adjusted, from May to June, the biggest one-month gain since June 2008. According to The Labor Department, prices for used cars and trucks increased by 10.5% from the previous month, accounting for one-third of the increase in the total index. This is the third month in a row that prices have risen sharply due to a vehicle supply shortfall. In June, the airline ticket and apparel indices both increased significantly.

According to a second study from the Labor Department’s Bureau of Labor Statistics, the sizeable monthly increase in consumer prices resulted in workers earning negative actual earnings. The 0.3% rise in average hourly earnings was more than offset by the CPI increase, resulting in a 0.5% drop in actual average hourly earnings for the month.

Supply-chain holdups, extremely high demand as the Covid-19 epidemic fades, and year-over-year comparisons to a period when the economy was trying to recover in the early months of the crisis have all contributed to rising inflation. Though central bank officials have admitted that inflation is higher and possibly more permanent than anticipated, policymakers at the Federal Reserve and the White House expect present pressures to begin to lessen.

When Fed Chairman Jerome Powell talks to separate House and Senate panels today and tomorrow, he will almost certainly be asked about inflation. Powell has maintained that inflationary pressures are mainly temporary, despite a Fed study released on Friday indicating that upside risks are growing.

JPM and GS are off to a surprisingly good start, with more banks reporting today and Thursday…

The Earnings Season has officially begun. Although the most recent bank results exceeded Wall Street’s forecasts, investors are anxious about how long the good times will stay. The first two large banks to disclose their second-quarter results were JPMorgan Chase (JPM) and Goldman Sachs (GS). Banks have demonstrated that they have a strong basis, but the next expansion phase is more unclear. Fixed-income trading decreased 44%, while equities trading climbed 13%, resulting in a 30% decline in trading revenue for JPMorgan. Trading revenue at Goldman Sachs was down 32%, due to decreases in both equities and fixed-income trading.

The fundamental issue with the banks’ performance is that the patterns that helped it survive and grow during the coronavirus epidemic are fading, and there’s no clear indication of what will be the next profit driver. Even if banks demonstrated their soundness throughout the epidemic and are on track to repay billions of dollars to shareholders after passing the Federal Reserve’s stress tests last month, this offers investors little cause to be enthusiastic about the industry. Like it or not, the large banks benefited from a boom in trading activity triggered by market volatility during the epidemic, but Wall Street knew it wouldn’t last. Since the global financial crisis, bank trading has been waning, but volatility is currently much lower than in mid-2020.

While both banks’ earnings were excellent, they were aided by one-time occurrences. JPMorgan said that if it hadn’t released $3 billion in loan-loss reserves built up during the previous year, profits would have been $3.03 per share, barely below the $3.13 per share expected by analysts. Profit was $3.78 per share following the announcement.

Meanwhile, Goldman Sachs said that income from its asset management division more than doubled year over year, owing to a 302% rise in equity investments.

Today, Bank of America (BAC), Citigroup (C), and Wells Fargo (WFC) are set to step up to the plate and release their earnings as well. The experts have weighed in.

In the last year, the stock price of Bank of America (BAC) has increased by approximately 72%. The stock has gained over 35% so far this year. Its stock had acquired about 65% by the end of the March quarter, and it gained nearly 30% in the first three months of the year. Analysts are largely optimistic about the bank, with 17 of 26 giving it a Buy or Strong Buy recommendation and only two giving it a Sell or Strong Sell rating. A median 12-month price target of $44.00 suggests a 10% increase in value from its current. The upside potential at the high aim of $52 is around 30%.

Citigroup Inc. (C) is the country’s fifth-largest bank, with a market capitalization of more than $141 billion, less than half of Bank of America’s and a third of JPMorgan’s. This is a drop from the fourth position after the March quarter. The stock price has risen 35% in the last year, with a 13% increase year so far. However, the rate of expansion has slowed. Analysts are still optimistic on Citigroup, with 17 out of 25 recommending the company as a Buy or Strong Buy and the rest recommending it as a Hold. The stock’s median 12-month price target is $85, implying a 24% upside from its current price of $68.50.

After closing out 2020 with a nearly 42% loss, Wells Fargo & Co. (WFC) shares have risen about 75% in the last year. The stock has gained 46% so far this year. As part of its efforts to simplify its operations, the bank recently announced that it would no longer provide new personal or portfolio lines of credit and close current accounts. The stock has a more mixed rating from analysts than other large bank equities. Eleven of the stock’s 26 analysts have given it a Hold recommendation, while 15 have given it a Buy or Strong Buy rating. The stock’s median price objective is $48.50, and shares last traded at $43.75, indicating a potential upside of roughly 11% from current levels

Big tech and streaming stocks have recently stood out among the rest…

Netflix is the only FAANG (Facebook, Amazon, Apple, Netflix, and Google) stock that hasn’t reached a new high in the last several months. Even while Facebook (FB), Amazon (AMZN), Apple (AAPL), and Alphabet (GOOG) all set new highs this month, the streaming stock is still 8% behind its January peak. JPMorgan, however, is backing the brand. Analysts reaffirmed their optimistic outlook on Monday, pointing to good second-quarter statistics and an outstanding content schedule for the rest of the year as reasons for optimism ahead of Netflix’s earnings next Tuesday.

These stocks tend to play a role in both our investment choices and our personal lives, which is why analysts’ expectations are relevant. When you see news about the growing expense of living, you may become concerned. The rise in consumer prices, on the other hand, is a result of an economy that has been fueled by the government and spurred by the Federal Reserve in unprecedented ways. This economic expansion may persist for years, with the most prominent technological businesses benefiting the most. We know who they are.

Where to invest $1,000 right now...

Before you consider buying Netflix, you'll want to see this.

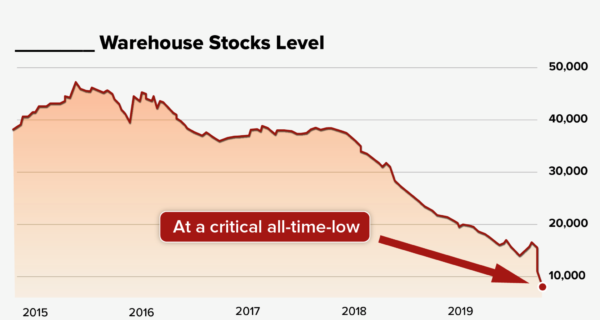

Investing legend, Keith Kohl just revealed his #1 stock for 2022...

And it's not Netflix.

Jeff Bezos, Peter Thiel, and the Rockefellers are betting a colossal nine figures on this tiny company that trades publicly for $5.

Keith say’s he thinks investors will be able to turn a small $50 stake into $150,000.

Find that to be extraordinary?

Click here to watch his presentation, and decide for yourself...

But you have to act now, because a catalyst coming in a few weeks is set to take this company mainstream... And by then, it could be too late.

Click here to find out the name and ticker of Keith's #1 pick...