Investors seem to be willing to take on more risk now that the election is over and thanks to receding COVID fears, as recent movement into small-caps suggests.

Market strategists have been touting small-caps in recent weeks. Their Q3 earnings declines were less drastic than those of large-caps, and their earnings estimates for 2021 have been raised higher than large-cap revisions.

2021 could be a great year for small-caps which tend to grow faster than larger-cap stocks when the economy is expanding because they’re more focused on their niches and it takes less water to raise their boat. If economic output reaches pre-pandemic levels, smaller companies might benefit the most. But in the shrinking universe of smaller firms, investors need to be selective. Look for small-caps that are well managed and well positioned in important sectors. Here are a few small-cap recommendations for 2021.

Green Brick Partners (GRBK)

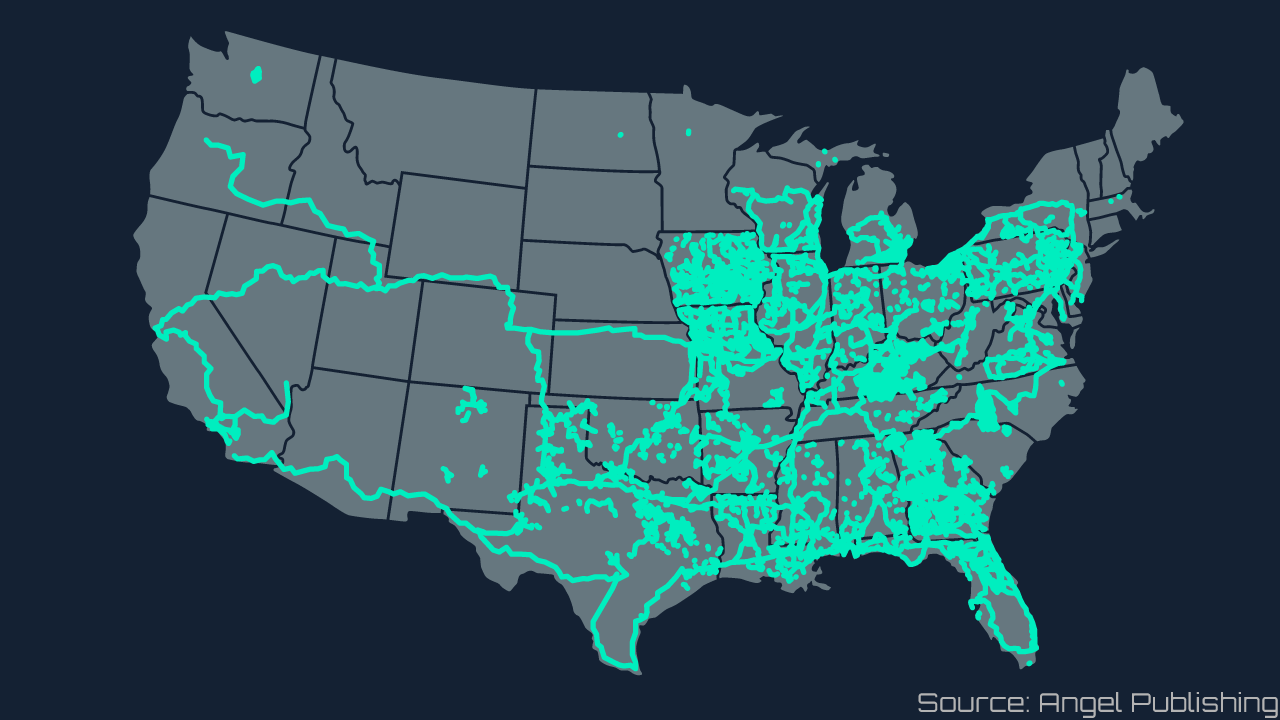

Texas-based Green Brick Partners (GRBK) is a growing home developer in some of the hottest markets in the country. The company started in Dallas then expanded to Atlanta. Now, it has properties in Colorado Springs and Vero Beach as well.

GRBK acquires property in a market and then works with local builders to build the houses, townhomes or communities. GRBK provides the underwriting and support for the builders as well as the buyers. In some communities it acquires an interest in the builder or will launch a building company with an experienced local management team.

Record low interest rates and a supply shortage in the market are bullish signs for GRBK.

Zuora (ZUO)

The shift to subscription-based business models has been one of the most influential and profitable trends of the last decades. Zuora (ZUO) provides software services that allow businesses to easily implement and scale subscription-based businesses.

As influential as the growth of the subscription economy has been, the overall transformative impact of the shift remains at an early stage. When economic challenges hit and uncertainty is on the horizon, businesses tend to pull back on growth initiatives and become more hesitant — and that includes decisions to implement new software systems or move into new markets. This has made it more difficult for Zuora to bring on new customers, but momentum should bounce back.

ZUO trades at a valuation that leaves plenty of room for growth.

FormFactor (FORM)

FormFactor (FORM) provides its service to semiconductor manufacturers. The company makes high-performance probe cards which can be used to test for defects during the chip-making process.

For the first six months of 2020, FormFactor’s revenues grew almost 18% year over year to $270.2 million, while adjusted profits jumped 66% to $51.9 million. FormFactor’s exposure to 5G technology, where sales are expected to be strong in 2021, should inspire an upward swing in demand. Furthermore, FORM’s strong cash generation and deepening reserves position the company to expand into new markets.