Futures are green this morning as investors hold onto hopes for more economic stimulus before the election. The three benchmarks held onto modest gains last week, despite a multiple session losing streak. The Dow finished last week just 0.07% up, the S&P added .19% and the Nasdaq led with .79% gains for the week.

Clean-energy stocks and exchange-traded funds are on a tear this year, sharply outperforming the broader market and traditional fossil-fuel investments. One contributing factor is that clean power sources are more economically viable than ever before. So much so that some of the big oil majors like BP are taking alternative energy seriously. Earlier this year BP announced plans to allow oil production to decrease by 40% over the next decade while investing $5 billion in clean tech by 2030.

With a possible blue streak on the horizon, clean-energy stocks may just be gaining steam. One of our favorite clean-power companies has proven time and again that it can generate consistent steady cash flow and had made recent advancements that will likely give them a competitive advantage.

Brookfield Renewable Partners L.P. (BEP) together with Brookfield Renewable Corporation (BEPC) operates one of the world’s largest publicly-traded, pure play renewable power platforms. BEPC (the corporate sector of BEP) was created to provide investors with greater flexibility in how they access BEP’s globally diversified portfolio of high-quality renewable power assets.

Asset allocation has been and continues to be a great strength behind Brookfeild’s success. In 2017 the company exhibited their strength, jumping into the growing renewable wind area and solar through acquisition of TerraForm Power.

BEP remains strongly connected to its hydroelectric roots and is a global leader in hydroelectric power, which currently comprises approximately 64% of its portfolio. A smart move considering heavy competition in the solar industry. Not to mention, one of the benefits to hydroelectric is that storage is built in (through use of dams), which removes some of the intermittency issues of solar and wind and makes hydro a more predictable source.

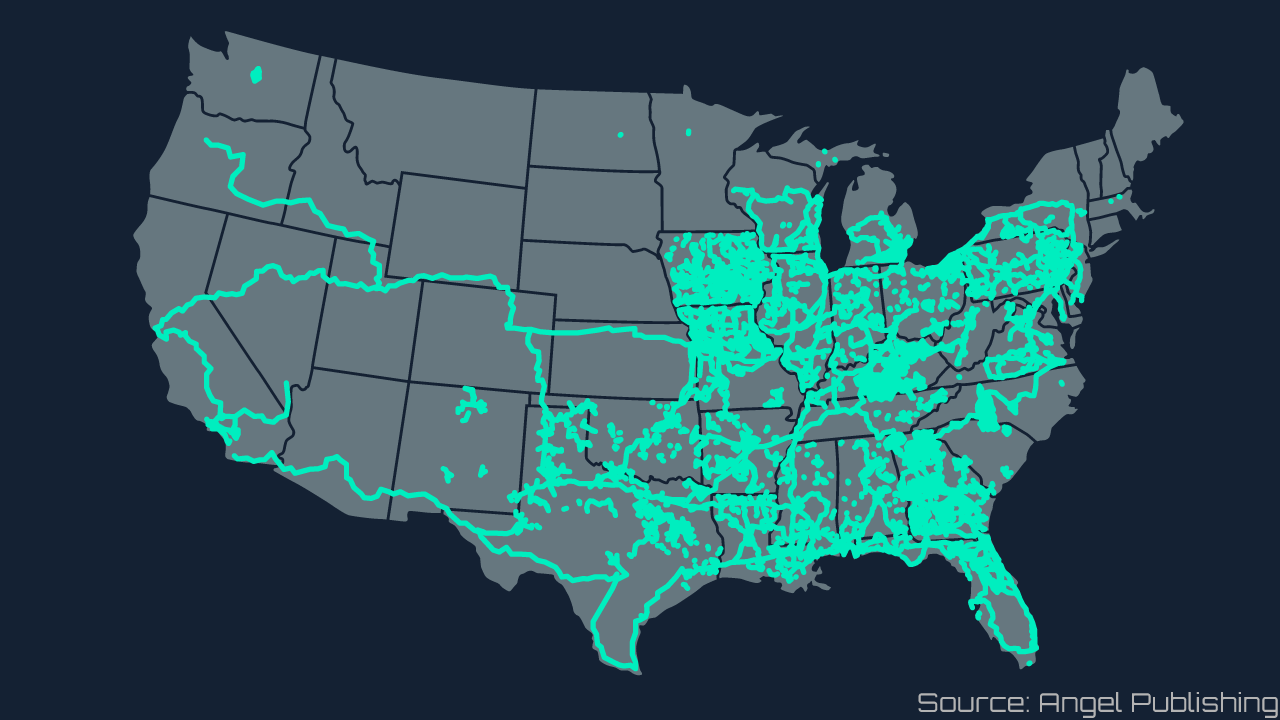

In September Plug Power announced that it would source 100% renewable energy from Brookfield Renewable to fully power one of North America’s first green hydrogen facilities. Plug Power’s plant is anticipated to be part of a future network spanning across the continent. Brookfield’s involvement in the expansion could be key, a promising sign for long term growth.

Another thing that sets Brookfeild apart from its peers is their dedication to investors. One of their primary goals when it comes to returning value to investors is to grow the distribution dividend around 8% or 9% every year. BEP surpasses that just about every year, consistently outperforming their goal.

BEPC is a great stock town because the company has a focus on making sure they own the right assets, and they can predictably generate cash flow that they can return back to investors on a consistent basis.