WHAT IS A SPAC? + 5 SPACs to Buy Now

With the IPO market booming and public investors seeking better returns, blank check companies called “Special Purpose Acquisition Companies” (SPACs) have been fueling up their tanks and chasing down their merger targets. New ones are getting announced every day.

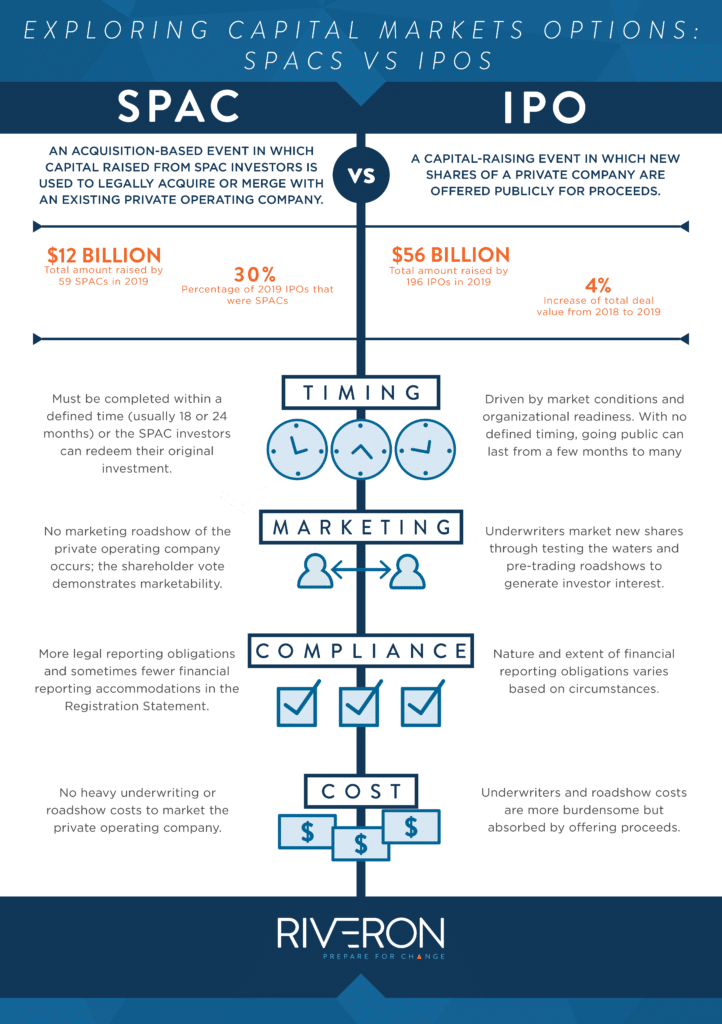

A special purpose acquisition company (SPAC) is a company with no commercial operations that is formed strictly to raise capital through an initial public offering (IPO) for the purpose of acquiring an existing company.

SPACs typically involve speculative investments. An investment before acquisition means effectively, investing in a group of people and trusting them to make a proper acquisition that will ultimately be accretive. At the time of their IPOs, SPACs have no existing business operations or even stated targets for acquisitions. SPACs have two years to complete an acquisition or they must return their funds to investors.

Blank check companies have been around for decades, but have never been as popular as they are now. Investors are pouring money into the SPAC market with hopes of better returns in a time of rock bottom interest rates.

The SPAC market in 2020 is on pace to more than triple compared to 2019. For the year through early August, there were 64 SPAC IPOs that raised a total of $25.5 billion for an average of nearly $399 million per IPO, according to SPACInsider, which tracks the SPAC market. In contrast, there were 59 SPAC IPOs for all of 2019 that raised a total of $13.6 billion — an average of $231 million per IPO.

SPACs have also attracted big-name underwriters such as Goldman Sachs, Credit Suisse and Deutsche Bank, as well as retired or semi-retired senior executives looking for a shorter-term opportunity. In fact, Bill Ackman, founder of Pershing Square Capital Management sponsored his own SPAC. Pershing Square Tontine Holdings is the largest SPAC ever, raising $4 billion in its offering on July 22nd.

Some have cited the pandemic as the reason for this year’s boom, arguing that pricing certainty of SPACs makes them more appealing than IPOs in such a volatile market. Sponsors have grown more creative with the terms of SPACs, resulting in more dealmaking flexibility. There’s also the fact that blank-check deals have proven extremely profitable: Gores Group head Alec Gores made an $80 million profit off his aforementioned SPAC deal with United Wholesale Mortgage, according to a Bloomberg report.

The bottom line is – in 2020 more established investors are stepping into the SPAC arena, so it will likely be a trend that continues to benefit investors and companies alike.

Here are some interesting opportunities if you’re considering investing in one of the many companies bypassing the traditional path to a Wall Street listing.

E2open LLC/ CC Neuberger Principal Holding I (PCPL)

Supply-chain software provider E2open LLC plans to go public through an agreement with CC Neuberger Principal Holding I (PCPL) in a deal that would value the company at about $2.57 billion.

E2open’s current majority investor , private-equity and venture-capital firm Insight Partners, whose legal name is Insight Venture Management LLC, took the cloud-based software company private in 2015 after buying it for $273 million. The company has since grown through a series of acquisitions. Its customers include Proctor & Gamble Co., Cisco Systems Inc. and Microsoft Corp.

E2open’s network-based technology funnels information from varied operations into a central platform and synchronized the data “like a giant decoder ring” to make it “all usable by software applications. “ E2open’s CEO Michael Farlekas said. “We orchestrate end-to-end supply chain for the world’s largest companies.”

“The coronavirus pandemic has raised interest in such visibility,” Mr. Farlekas said, “as the push to make supply chains more resilient with strategies such as adding more suppliers in different locations has made sourcing and distribution operations more complicated.” “The deal with CC Neuberger will give E2open access to capital as the company seeks to take advantage of increased interest in supply-chain software,” he added.

E2open is going public after a buying spree that extended its core supply-chain management technology to include transportation and trade technology. The acquisitions included container shipping booking platform Inttra in 2018 and the $425 million purchase of trade management software company Amber Road, then a publicly traded company, in 2019.

CC Nueberger is led by senior professionals of private-equity firm CC Capital Partners LLC and asset manager Neuberger Berman Group LLC, and completed its initial public offering in April.

The transaction is expected to close in the fourth quarter, with the company to be listed on the NYSE under the symbol ETWO.

Gemini Therapeutics/ FS Development Corp,. (FSDC)

Atlas Venture has been dipping its toes into these SPAC waters. Today Gemini Therapeutics announced their intention to be acquired by FS Development Corp,. (FSDC), a blank check company formed by Foresite Capital.

Gemini is the first Atlas biotech company to be the target of a SPAC merger. Earlier this year, two legacy Atlas fund portfolio companies backed by former technology partners, Draftkings and Skillz, were both targets of large and successful SPACs.

The agreement would give Gemini a pro forma valuation of $265.6 million. Gemini is a clinical stage precision medicine company developing treatments for age-related macular degeneration (AMD) by developing drugging strategies that are matched to specific genetic mutations found in patients with high clinical unmet needs.

Jim Tananbaum, M.D., CEO of Foresite Capital and President and CEO of FS Development Corp., was looking for a specific type of company when he launched Foresite Capital’s first blank check company. And he found it with Gemini Therapeutics. First off, the company had already generated $42 million in financing, prior to evaluating strategic options for going public . Additionally, Gemini has an emerging product pipeline with an expectation of meaningful clinical news flow over the next 1-3 years — the company just initiated a phase 2 study for its lead program.

The agreement came just two months after FS Development Corp landed on Nasdaq with $121 million in the bank. The merger and concurrent placement total $95 million. The transaction is expected to be completed by january 2021 and the combined company is expected to be listed on Nasdaq.

Advent Technologies Inc./ AMCI Acquisition Corp. (AMCI)

Advent Technologies Inc., an innovation-driven company in the fuel cell and hydrogen technology space, and AMCI Acquisition Corp. (AMCI) recently announced that they have entered into a definitive agreement and plan of merger.

The capital from the transaction, combined with AMCI’s expertise, will advance development and manufacturing of Advent’s next-generation fuel cell technology for the markets of transportation, aviation, and off-grid power generation.

Advent CEO Vasilis Gregoriou said, “We are very excited about this transaction and believe the business combination with AMCI will allow Advent to advance the development and manufacturing of our platform technology to unlock the hydrogen economy: the cost of infrastructure and the total cost of ownership. Our products are already in the market and we believe that the exposure and access to capital from the Nasdaq listing will allow us to accelerate product and business development efforts.”

Advent’s High Temperature Proton Exchange Membranes and Membrane Electrode Assemblies (MEA) are not only critical to advanced fuel cells, but help dramatically reduce the costs and increase the life and durability of the products to the end-user. Its MEA products are already being used and tested for use by a number of top tier customers and the company will be able to scale to a broad customer base across multiple markets. Which means Advent is positioned for growth.

The boards of directors of both Advent and AMCI have unanimously approved the proposed transaction, which is expected to be completed in the fourth quarter of 2020 or early 2021. Upon closing of the transaction, the combined company will operate as Advent Technologies Holdings, Inc., and its common stock will be listed on the Nasdaq.

The business combination values Advent at a $358 million pro forma post-money enterprise value at a share price of $10. Compared to the existing comparable companies in the space, the transaction valuation is extremely favorable, providing a potential upside for new and existing shareholders to see significant performance in the share price going forward.

Where to invest $1,000 right now...

Before you consider buying Advent, you'll want to see this.

Investing legend, Keith Kohl just revealed his #1 stock for 2022...

And it's not Advent.

Jeff Bezos, Peter Thiel, and the Rockefellers are betting a colossal nine figures on this tiny company that trades publicly for $5.

Keith say’s he thinks investors will be able to turn a small $50 stake into $150,000.

Find that to be extraordinary?

Click here to watch his presentation, and decide for yourself...

But you have to act now, because a catalyst coming in a few weeks is set to take this company mainstream... And by then, it could be too late.

Click here to find out the name and ticker of Keith's #1 pick...

Two Important EV SPAC Mergers in the Wings

SPACs offer a quicker, easier, more secretive way to take a private company public versus the conventional initial public offering, or IPO. Through a sale to a blank-check entity, a company that wants its shares traded on public markets can get there much faster — typically several months versus up to a year for an IPO — with much less disclosure of its inner workings and the associated red tape.

Once considered a sketchy alternative, in the high-momentum markets of 2020 into 2021, SPACs have become very popular. Last year, $73 billion was raised in SPAC deals, up from $13 billion in 2019, according to Goldman Sachs. For the first time last year, the volume of SPAC deals outpaced that of traditional IPOs, which came in at only $67 billion.

Electric vehicle and related companies are driving a lot of that activity. Fuel cell truck company Nikola, electric car maker Fisker, electric bus company Proterra, electric truck maker Lordstown, electric robotaxi company Canoo and many more have completed or announced SPAC deals.

Read on to learn about two important recent EV SPAC merger announcements — you’ll probably want to keep them on your radar.

EVgo, which owns one of the United States’ biggest electric vehicle charging networks, is following in the footsteps of rival EV charging provider ChargePoint in seeking to become a publicly-traded company via a special purpose acquisition company (SPAC) reverse merger.

In EVgo’s case, its move to public markets will come along with a continuing financial relationship with its current owner — LS Power, one of the country’s biggest power generation, transmission and energy storage investors.

Under the terms of the deal announced Friday, EVgo will merge with Climate Change Crisis Real Impact I Acquisition Corp. (CRIS) in a transaction that will raise about $575 million, and value the company at about $2.6 billion.

The transaction will include a $400 million private investment in public equity (PIPE) anchored by institutional investors including private funds affiliated with Pacific Investment Management Company LLC (PIMCO), a CRIS co-sponsor, as well as funds and accounts managed by BlackRock, Wellington Management, Neuberger Berman Funds and Van Eck Associates Corporation.

At the same time, LS Power and EVgo management, who own 100 percent of EVgo today, will roll all that equity into the transaction and are expected to own about 74 percent of the company when it closes, according to Friday’s announcement.

This offers LS Power a continued stake in what David Nanus, LS Power’s co-head of private equity and EVgo chairman, described in Friday’s announcement as a “crown jewel in our portfolio.”

Lucid Motors was near death and desperate for cash in 2018 when it was handed a lifeline. The savior was Saudi Arabia. The desert kingdom’s sovereign wealth fund invested $1.3 billion in the electric car start-up. Lucid regained full health.

Now, in 2021, the Saudi fund and Lucid’s founders are poised to cash in by taking advantage of the manic market in blank-check shell companies. In a deal that is near completion, according to a source familiar with the negotiations, the company would draw a hefty but as-yet undetermined amount of cash to fund its operations. If the deal goes off without a hitch, Lucid executives and board members — including Chairman Andrew Liveris, a former Dow Chemical chief executive with deep financial ties to Saudi Arabia — would get a shot at a big payday.

“Lucid Motors has always been clear about its intent to go public at some point in order to accelerate the adoption and global availability of Lucid’s exclusive electric vehicle and sustainability technologies,” the company said in an emailed statement. “Currently, our focus continues to be on bringing Lucid Air to production in spring of this year, with the strong support of key investors and our partners at the Public Investment Fund.” Lucid’s luxury Lucid Air automobile is expected to be ready to roll out of the company’s new Arizona factory in coming months. The car’s stylish interior and exterior and its electric-drive innovations have drawn widespread approval.

Should you invest in Lucid Motors right now?

Before you consider buying Lucid Motors, you'll want to see this.

Investing legend, Keith Kohl just revealed his #1 stock for 2022...

And it's not Lucid Motors.

Jeff Bezos, Peter Thiel, and the Rockefellers are betting a colossal nine figures on this tiny company that trades publicly for $5.

Keith say’s he thinks investors will be able to turn a small $50 stake into $150,000.

Find that to be extraordinary?

Click here to watch his presentation, and decide for yourself...

But you have to act now, because a catalyst coming in a few weeks is set to take this company mainstream... And by then, it could be too late.

Click here to find out the name and ticker of Keith's #1 pick...