Legendary research firm that called exact peak

of the DotCom boom issues next major warning:

Tech Melt!

Why tech stocks are about to experience

the biggest shock since the 2000 DotCom bust…

Mr. Brown recommended the #1 tech investments of 2016, 2018, 2019—and has already

picked two of the top three stocks of 2020…

To watch the Tech Melt-up presentation, click here…

HOST Buy? Sell? Hold?

If you’re in the markets right now, these are strange and stressful times…

While some experts believe we’re in store for a “greater depression” not seen in 100 years…

Others are convinced the worst is behind us.

What’s the truth?

Hi. My name is Chris Hurt.

And, today, we’re fortunate to be sitting with the one man who can probably help guide us better than anyone else…

Jeff Brown, thank you for joining us…

JEFF My pleasure, Chris.

HOST Jeff, in early March, 2000, your firm called the exact peak of the first dotcom boom, saying “a catastrophe lay ahead”…

And from there, sure enough the NASDAQ did go on to drop 77%, and it wiped out millions of investors in the process…

Your firm also predicted the housing bubble…

The top in cryptos…

And—on January 6, 2020—45 days before this year’s crash started, you were right again…

Warning Americans a big pullback was coming…

No one else I’ve found comes close to matching your firm’s accuracy in forecasting big movements in the market.

JEFF Well, Chris. I’m an optimist by nature. So, it never feels great to be right on those “down calls.” But I never shy away from telling the truth, as I see it…

HOST Right, an optimist…

Since retiring from professional life — a career where you worked on the first Boeing 777, and led teams at both Qualcomm and NXP Semiconductors…

…Where you turned that company around and helped propel it to a 761% gain in just 2 years…

You’ve been issuing a string of stock recommendations that—quite simply—have been off the charts…

In 2015, you brought people’s attention to Bitcoin… before it shot up nearly 100X…

In 2016, you singled out NVIDIA — it went on to become the #1 stock of the year…

In 2017, you did it again…

You picked AMD. And not only did it go on to top the Nasdaq 100 in 2018… It topped the chart in 2019 as well.

This year… amid all the chaos and turmoil caused by COVID-19, again you were right…

Two of the stocks you picked last year have raced out…

Becoming two of the top three stocks of 2020. Out of 500.

Jeff, it’s incredible…

How do you do it?

JEFF Well, Chris, it’s been a great run for sure. But this isn’t work for me. It’s my passion. And I enjoy every minute of it.

HOST For folks tuning in from home, today Jeff is going to share with you a major development going on in the tech world… a “tech melt” that, Jeff, I understand will catch many investors by surprise…

“On the cusp of something big we

haven’t seen in 20 years…”

JEFF That’s right Chris.

I believe we’re on the cusp of something big we haven’t seen in 20 years…

If you think something “fishy” is going on in the stock market right now… and with tech stocks in particular…

You’re absolutely right.

You see, much like in ‘99-2000…

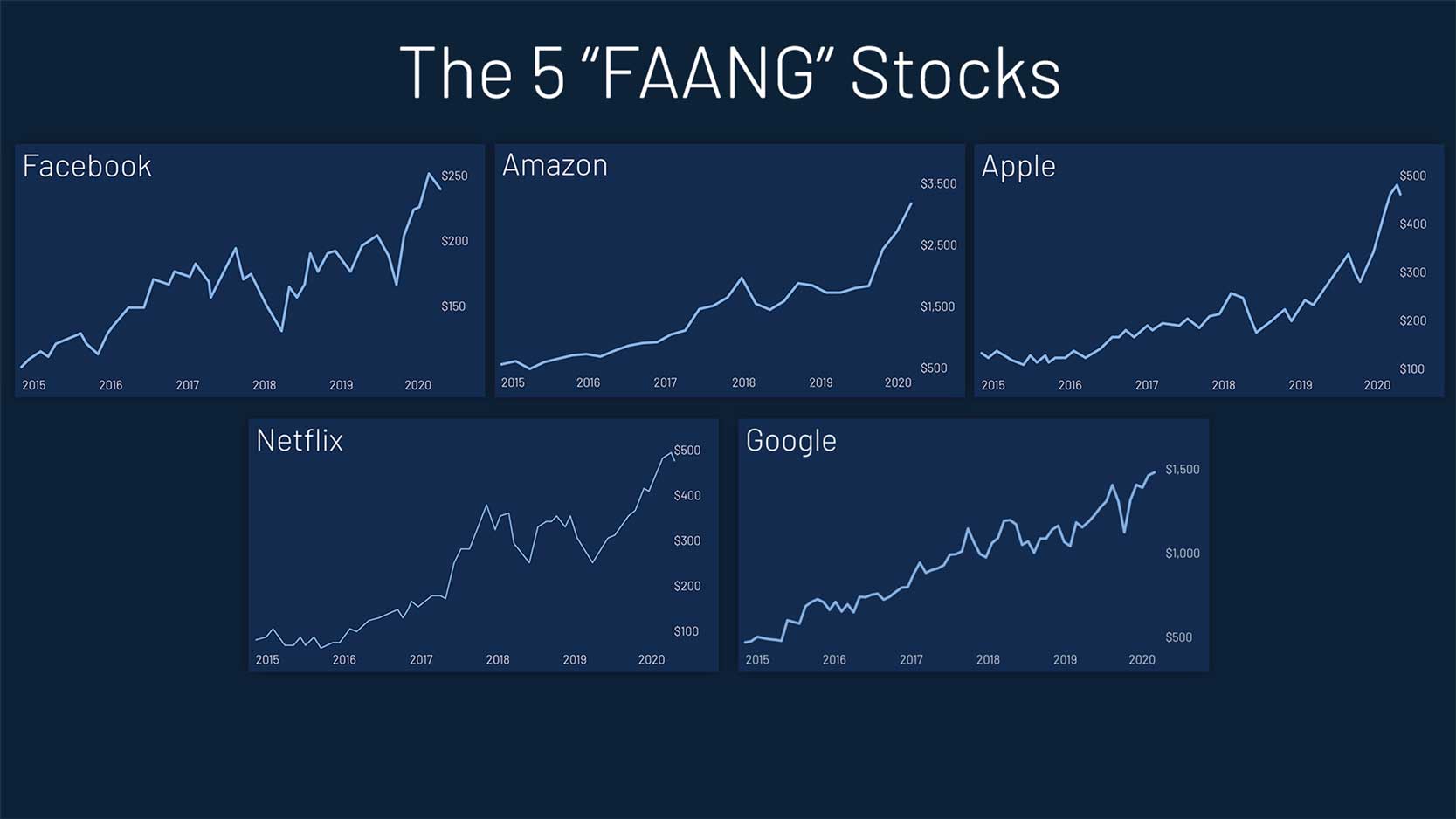

Many stocks have gotten ahead of themselves. And many — like Zoom, Peloton, and the 5 FAANG stocks — have raced out to what appears to be crazy valuations.

But what’s coming up next will be much different than the dotcom crash, Chris.

I’m not aware of any other tech experts predicting this.

Billionaires are already moving hundreds of millions of dollars ahead of this tech “shock”…

But I believe the average investor will be caught totally off guard.

HOST Jeff, the first dotcom crash…

That was frightening…

Your firm nailed it — and there was a big 77% drop in the Nasdaq. Stocks like Priceline dropped 94%. And many went straight to zero.

Savings were lost. Lives were ruined.

JEFF Yes, it was a difficult time.

But here’s the thing…

Even amidst the darkest days — and perhaps especially within those darkest days, some of the most amazing opportunities in the history of the stock market could be found.

HOST What do you mean, Jeff?

JEFF There’s a simple analogy I like to use, Chris. Pets.com vs. Amazon…

HOST Pets.com vs. Amazon?

JEFF Yes.

You see, in the early 2000s, stocks got whacked.

Absolutely hammered.

But were there winners and losers?

HOST Yes, of course.

JEFF Right.

Take Pets.com.

Say someone bought into the hype and invested in that stock…

Well, Chris, they got demolished.

I mean, absolutely slaughtered.

That stock went to zero in a hurry.

But then, there’s Amazon…

Smart investors were able to pick up shares for 10 cents on the dollar…

Cathie Wood, she started a big tech investment firm. She said she got laughed at when she bought Amazon for $10…

HOST Wow.

JEFF But who’s laughing now, Chris.

Look at it today…

“You could have literally turned $5,000

into $2.5 million”

It’s a blip on the screen!

HOST Yeah, that’s remarkable, Jeff. I can’t even see the drop back then.

JEFF Even if you didn’t get in at the bottom…

Heck, even if you were off by an entire year!

You were still able to make a life-altering fortune.

Amazon recently topped $3,000. It’s up over 500X. You could have literally turned $5,000 into $2.5 million.

That’s how millionaires are made, Chris.

In the darkest days lie some of the greatest opportunities available..

HOST But, Jeff, Amazon — you had to have been lucky to pick Amazon. That was an isolated case. Almost like finding a needle in a haystack…

JEFF Yes, Chris. Amazon was an amazing pick.

But it was far from an isolated case…

Consider…

Instead of buying eToys, which plummeted from $80 down to $0…

You could have bought eBay…

Which went up as much as 12,000%…

Or, instead of buying Webvan… a precursor to food delivery services—20 years too early…

Look at what Bezos did…

He put $250,000 in Google. And his stake morphed into as much as $4.8 billion.

Is it any wonder he’s now the world’s richest man?

HOST Alright.

So, Jeff, you mentioned the biggest shock in 20 years…

To me, this is beginning to look like 1999 all over again…

Tech stocks right now have reached record valuations…

Zoom tripled in just a few months…

Peloton… that fancy bike… doubled almost overnight.

Tesla’s gone crazy…

I’m sure you’ve seen this chart…

The top 5 biggest tech companies now make up a greater share of the total market than at any other time in history…

You take these 5 stocks out…

And the whole market falls apart…

So, Jeff, apologies for being blunt, but I don’t think your “tech melt” prediction will catch many people off guard.

I don’t think it’s a secret to anyone the market’s going to melt down…

“Melt down? Who ever mentioned anything

about a melt down?”

JEFF Melt down?

Who ever mentioned anything about a melt down?

HOST Wait, what?

I’m confused Jeff…

JEFF Chris, I’m predicting a melt up.

HOST A melt up?

JEFF Yes. More specifically. A gigantic melt up in tech stocks.

Now, to be clear, I didn’t invent that term. But I think that’s what’s going to happen.

HOST Jeff, I gotta level with you…

I mean, I know you’re the tech expert and everything…

You’ve helped tech start-ups reach over $20 billion in value…

Been responsible for dozens of triple- and quadruple-digit gains…

And you’ve probably called more #1 winners in the tech space than anyone else…

But, I mean… to me that just sounds plain nuts!

JEFF Don’t apologize, Chris. I’ve been called worse before!

Look, I get it.

What you’re thinking right now is logical…

And I do actually agree with you to a certain extent.

Valuations are nutty right now…

In fact, it wouldn’t surprise if stocks fell back a bit over the next few weeks…

HOST So, wait. Jeff, are you already giving up your prediction already? That was easy!

JEFF No. You haven’t won this battle yet.

If (and when) we see another pullback, it will be much like March…

Temporary. And short-lived.

This market won’t go up in a straight line like it did two years ago…

But I’m convinced folks who can stomach a bit of volatility will be richly rewarded.

HOST So, how high can these tech stocks rise…

I mean, they can’t keep rising forever and ever, can they?

JEFF No, it won’t last forever.

But it will definitely be a long run up.

Just look at the first dotcom boom.

It actually started in earnest in the mid ‘90s…

From January ‘95 to mid ’98… tech stocks boomed…

The Nasdaq went up 171%, jumping from 740 to 2,000…

But if you exited at that point, you left a ton of money on the table…

Look at what happened next…

Tech stocks “melted up”…

Soaring from 2,000 to past 5,000!

HOST And that’s when your firm issued a big warning…

JEFF That’s right. That was the correct time to exit the market.

Chris, look…

I absolutely believe with 100% conviction there will be a huge “melt up” in tech stocks…

That we’re going to see the most significant move since 1999-2000…

But there’s a small twist to the story…

HOST What’s that?

JEFF Not all tech stocks are created equally. And not all tech stocks will rise equally.

HOST Explain that to me…

“Some tech companies have been waiting

years for a moment like this…”

JEFF I mean, Covid-19 has changed the world.

It absolutely changed the world, Chris.

Some tech companies have been waiting literally years for a moment like this to happen…

Then—overnight—a new reality occurred…

You have many seniors who never bought anything online.

All of a sudden, they’re having groceries delivered to their house. They’re buying prescriptions online and seeing how convenient it is… they don’t have to stand in line… it’s often cheaper to do, too.

In short, the coronavirus has led to major changes in the way the world works that usually takes years… sometimes decades… to occur.

Now, for some companies, that’s meant destruction.

But, for others, it’s been a boon…

Many of the old “legacy” tech companies are—and will continue to be—replaced by new players.

So, you definitely want to be in the right stocks right now…

The Amazons of 20 years ago and not the “Pets.com.”

HOST So, Jeff, what’s your top pick?

I know you were one of the first to put 5G and AI stocks on the map for average investors…

I saw some of your recommendations are up 106% and 204% as of late last month… that’s a triple.

So, I’m guessing maybe a 5G stock or AI stock?

JEFF Chris, it’s true…

I absolutely love 5G and AI plays. And my readers have made out like bandits.

But, right now, the company I’m most excited about… the one I flew last minute out to California for… is in the one sector I believe is a powder keg of opportunity today…

Biotech.

HOST Biotech?

JEFF That’s right…

Chris, this will easily be one of — if not the — biggest bull market over the next decade.

Think about it…

What industry is getting more attention now than ever before?

Where is all the money… the VCs… the government funding…

Where’s all that money flowing to?

HOST Biotech…

JEFF Yes. VCs invested $12 billion in the first half of 2020 alone…

A new record high.

HOST I can see that makes sense. I mean, everyone is scrambling to find a cure… Seems like, every day, I’m seeing a new biotech stock jump up…

Moderna… Didn’t they jump up recently like $20 bucks when it was thought they had a cure?

JEFF Yes.

There was also Sorrento. Their stock shot up 239%—in 3 hours…

HOST Wow…

“The Smart Money is Moving In…”

JEFF Yeah, this market is hot right now Chris.

That’s why billionaires like Jeff Bezos are investing hand-over-fist. In fact, Bezos has already put over $130 million in this sector…

Even Warren Buffett, who’s typically avoided tech… recently invested close to $200 million through Berkshire Hathaway.

It’s why I recently jumped last minute to a secretive billion-dollar lab down in California… to get a jump on a stunning opportunity I believe could be worth 5,900%…

And that’s just the beginning.

HOST Wow, I can’t wait to hear the details on that, Jeff.

So, Bezos, Buffett…

What you’re saying, Jeff, is that the smart money is going “all in”?

JEFF Exactly.

They know it’s the one sector set to explode.

And, look…

What most people don’t realize about biotech stocks is…

They don’t move in the same way as other sectors…

They’re very “market resistant.”

HOST You mean they don’t crash?

JEFF Well, I wouldn’t say that. There’s risk in any stock.

But what I mean is…

Take the recent crash in March…

Do you know what the top stocks were?

HOST Biotech?

JEFF That’s right.

After the first quarter…

When stocks were the most volatile…

My team and I recommended the #1 stock in ALL the S&P 500…

HOST That’s 500 stocks in total, right?

JEFF Right.

HOST And you picked the top one?

JEFF Correct. A biotech stock.

Even during the crash of ‘08…

The top winners of that year — going up 84%… 108%… even 382% — could all be found in biotech…

Chris, look at this chart. It will drive the point home even more…

HOST OK.

I’m seeing Intuitive Surgical. I take it that’s another biotech, Jeff?

JEFF It is.

And the reason I wanted to show you and your viewers this chart is to illustrate the explosive power of picking the right biotech stock.

Chris, Intuitive Surgical went public in 2000… was that a good year for stocks?

HOST No, it was probably one of the worst.

JEFF It was horrible.

But Intuitive was (and still is) a great company.

Their surgical robot… the “da Vinci”… was a tech marvel. It still is.

And through 2000, to 2008, and this recent crash…

It’s not only resisted the market’s downward pull…

But the stock is up over 300X!

HOST Wow that’s a huge gain, Jeff.

JEFF It is.

That turns $5,000 into $1.5 million.

For most people, that’s life changing money.

It pays off your mortgage…

Chris, I don’t know if you’ve got kids…

But if so, you can pay their tuition at the most expensive Ivy League college in the country. Even with today’s sky-high tuition!

That’s why I’m so excited to share my top biotech stock.

“What’s your top play, Jeff?”

HOST I’m excited too. What’s your top play, Jeff?

JEFF Well, my top biotech is playing a critical and major role in the research going on in Covid-19 right now.

It provides the testing equipment researchers need to evaluate their different potential treatments for the coronavirus. This equipment is used by over 10,000 research labs worldwide.

HOST 10,000 labs. That’s quite a bit…

JEFF Yeah, this isn’t your “usual” type of biotech company. It’s not developing a new therapy. But, rather, is the bedrock for all of biotech. Which makes it that much more potentially explosive.

In fact, the FDA recently issued them an Emergency Use Authorization… a kind of “fast track”…

Which means, this company will be the first… the absolute first to use genome sequencing to diagnose Covid-19…

That’s critical, Chris, especially with the Second Wave now upon us…

HOST So, Jeff, I’m going to take a wild guess here…

Obviously, if this company helps treat the coronavirus, they’re going to be worth a ton of money.

JEFF Naturally.

And this company has got a phenomenal business model. One of the best in the world. In fact, in the past, another tech company used it to grow their valuation from $500K to $57 billion…

HOST Wow, that’s… I can’t even calculate the percentage.

JEFF That’s a 10,000-fold increase.

Now, obviously I’m not saying this company is going to go up 10,000X…

But they are in a unique position in terms of their testing capabilities. They’re in a sweet spot.

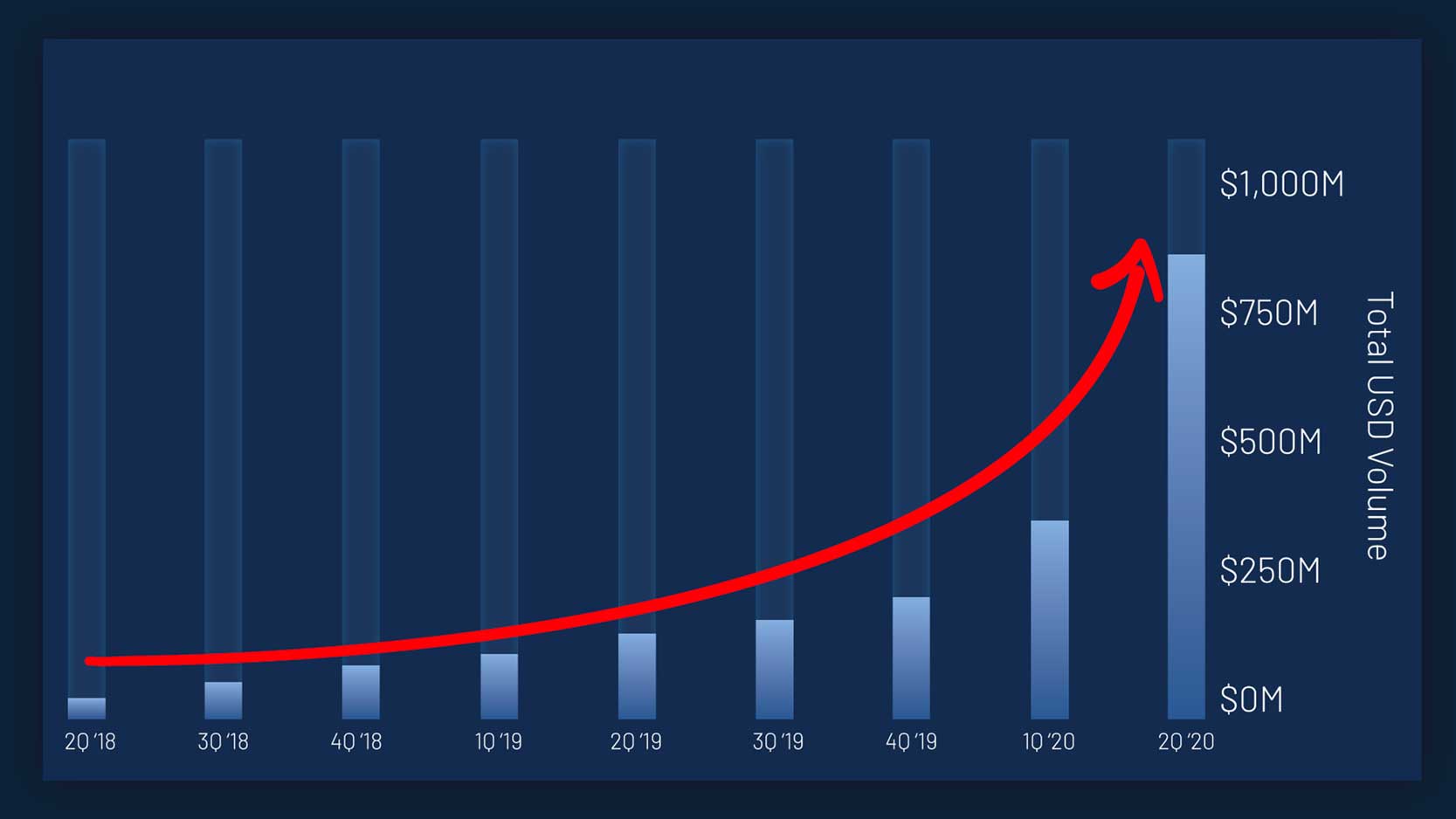

However, regardless of what happens with the coronavirus, they’re going to make a boatload of money. And here’s a chart to prove it…

As you can see—their revenues have been going up exponentially for years now.

HOST Wow, that’s remarkably stable. So, it’s not a flash in the pan?

JEFF That’s right.

HOST Alright.

So, Jeff, let’s get to this recent journey you made to Southern California…

We have a clip here of you here going into a private half-a-billion-dollar research facility…

Tell us what we’re looking at, Jeff. And what you discovered…

Watch Tech’s 2nd Phase & Learn About The Tech Melt Here

“4570 Executive Drive, San Diego”

JEFF Sure.

So, what you’re looking at here is me standing outside 4570 Executive Drive, in San Diego, California.

That’s the location of the Human Longevity headquarters…

HOST Human Longevity?

JEFF Yes. Chris, these are biotech pioneers. The company was co-founded by Peter Diamandis, who started the million-dollar X prize. And Craig Venter, a genius I’ll get back to later.

Anyway, this lab is doing cutting-edge research on life extension. A market set to reach $600 billion by 2025.

HOST So I take it that’s your #1 biotech stock for the tech melt, Jeff. Human Longevity?

JEFF No. Human Longevity is good, but it’s not my top pick.

HOST What?

JEFF They’re still private. So investors can’t buy their shares on the stock market right now.

HOST Ah, OK. So, why did you visit them?

JEFF Because, buried in their lab is advanced special equipment. Something called a “gene sequencer.” I traveled to San Diego to get my genome sequenced…

HOST Your genome?

JEFF Chris, you’ve probably heard about companies like Ancestry.com or 23AndMe…

HOST Yeah…

JEFF Well, what these companies do is send out genetic testing kits, which help people glean certain information about their family tree, and gives some basic health info…

But it actually goes much further than that.

HOST So why not just order a test kit and have it done with?

JEFF Well, that would have been easier. And saved me $19,000 for the test, plus travel.

But here’s the thing, Chris…

Each of us has a unique genome…

A specific sequence of DNA that makes us all different.

To use a simple analogy, think of a book…

Imagine every word in a book is a unique pair of DNA…

Well, depending on how these “words” or DNA are put together…

That determines the final “book,” if you will…

Whether it’s going to be a comic book… a romance novel… or an action-packed thriller.

Make sense?

HOST Sure…

JEFF Well, in the same way…

The sequence of your DNA determines who you are as a person… And it affects everything from the color of your hair, to your health, to whether you’re prone to certain genetic diseases or not…

It’s all determined by genetics.

And that’s why genetic sequencing is so important, Chris…

Because it’s a blueprint to your body.

Armed with this blueprint, scientists and doctors are now doing incredible things.

It’s being used to “hack” biology so we can avoid sickness…

And many diseases we once thought were incurable are now being effectively treated… and could be on the verge of being cured outright.

HOST Wow, like what?

JEFF Sickle cell. Blood disorders. Some forms of cancer. Even some forms of blindness.

Chris, there’s a lot of negative things going on in the world right now. But on the tech — and especially on the biotech side — we’re seeing rapid, incredible advances…

And sequencing is at the forefront. It’s like a beachball on a wave that gets pushed first.

For those who take advantage and get in early, it could mean a spectacular shift in your wealth.

HOST So why spend all this money, Jeff? Did you go to San Diego for health reasons?

JEFF Well, obviously, it doesn’t hurt to get arguably the highest-level diagnostic in the world…

But, really, the main reason I went to this lab can be found right here…

The genetic sequencer.

HOST Why is this so important, Jeff?

JEFF To use the book analogy again…

This is the machine that’s able to “read” all the words… all our DNA. The sequencer “pieces” together the whole story.

And that’s where the magic happens.

Right now, researchers are using these devices to single out dangerous genetic mutations…

Eli Lilly, for example, is using it to design custom cancer therapies.

It’s also being used to reduce deadly misdiagnoses.

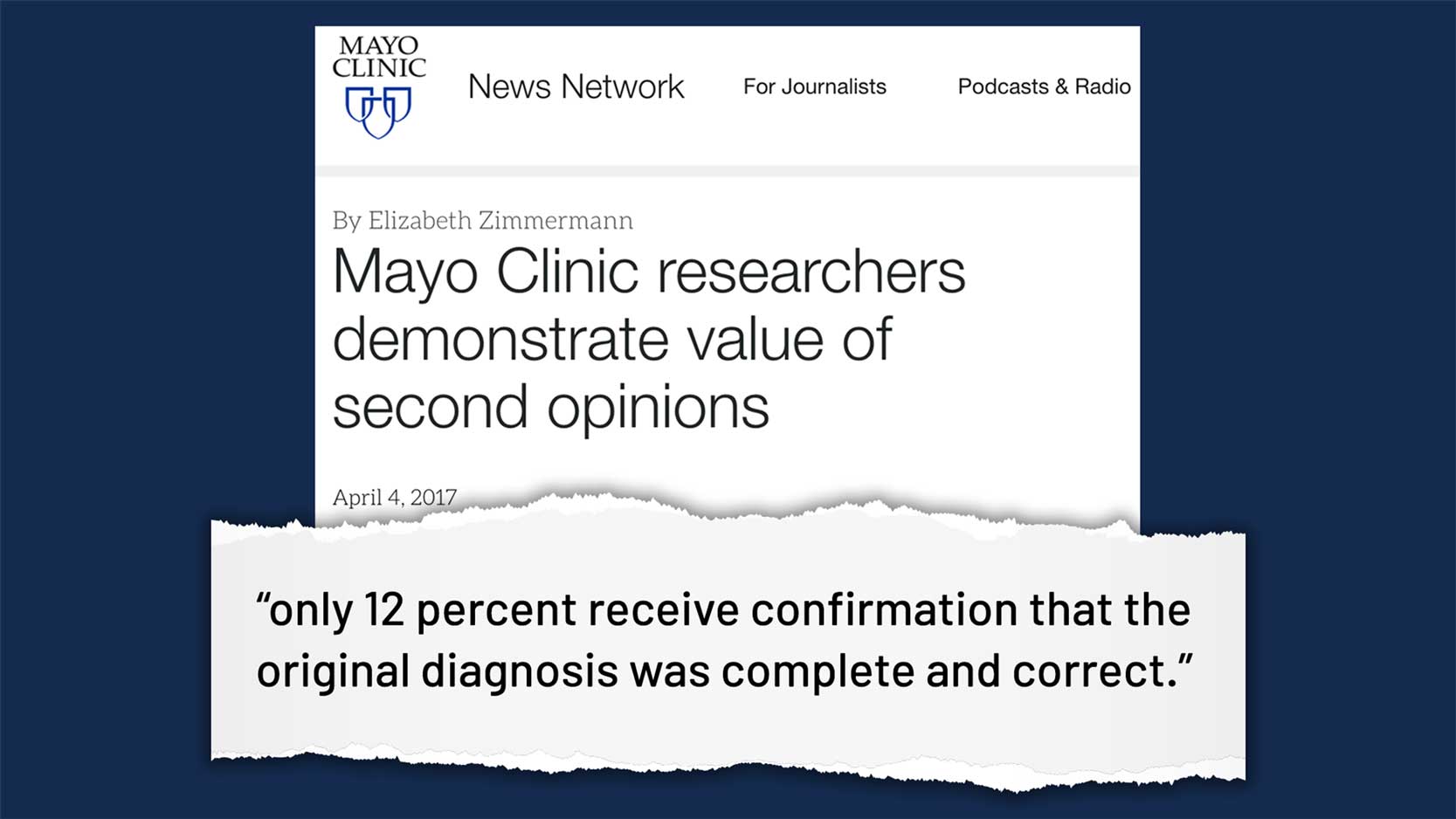

Chris, do you know that — on average — only 12% of patient illnesses are correctly diagnosed by primary care providers?

HOST 12%? That means roughly 9 out of 10 people are given the wrong diagnosis?

JEFF Yes. I know that sounds incredible. And disturbing. But those aren’t my numbers, Chris. That comes straight from the Mayo Clinic.

Johns Hopkins also did a study. And they found medical errors were actually responsible for the death of 251,000 Americans.

Each year!.

That’s more than accidents… strokes… and even more than the coronavirus so far.

HOST That’s scary.

JEFF Yeah. Medical errors are the 3rd leading cause of death in America, right behind heart disease and cancer.

One in three misdiagnoses lead to serious injury or death…

And these screw-ups cost the economy billions.

HOST So, what you’re saying is, not only will this new tech help save lives… but there’s also a lot of profits up for grabs?

“A 5,900% Technological Boom…”

JEFF Exactly, Chris.

When the first genome was sequenced, it cost over $1 billion.

Now, some labs can sequence a genome for under $500!

That’s why more and more health insurance companies are mandating people get their genome sequenced.

In fact, back in 2018, only about 1 million Americans had their genome sequenced.

But that number’s expected to explode…

60 million are estimated for 2025.

That’s a 60-fold growth. Or 5,900%.

To put that in perspective…

We’re at a point where…

It’s like buying Amazon at $50. Before its steep climb.

HOST Wow…

JEFF Yeah, I haven’t seen a set up like this since I recommended CRISPR Therapeutics back in 2016.

HOST CRISPR. That’s genetic editing, right?

JEFF Right.

HOST Jeff, weren’t you the only analyst to alert investors about that ground-breaking tech?

JEFF Well, I’m not sure I was the only one… But I was definitely one of the first. I know I alerted my subscribers about it on October 19, 2016… when the company went public.

Had you kept your shares, it shot up 5X afterwards…

HOST That’s pretty good!

JEFF Not bad.

But here’s the thing, Chris…

Without genetic sequencing, there IS no genetic editing.

Johns Hopkins… Harvard… Princeton… the Mayo Clinic… the Cleveland Clinic… the National Institutes of Health…

All the top research and medical labs in the world right now use genetic sequencers. And, specifically, the one created by my #1 pick.

Without this sequencer, all the work being done on Covid-19 and many other life-changing treatments comes to a standstill.

HOST Alright. So, Jeff, I’m not gonna jump the gun this time.

Your top pick… it’s the company who manufactures these sequencers?

JEFF Bingo. That’s right, Chris.

It has everything going for it. It’s the same type of “no brainer” setup I’ve found in all my past winning picks.

Earlier, I mentioned Craig Venter, one of the co-founders of Human Longevity…

Well, Craig is the top pioneer in the genetic sequencing space.

His lab was the first to sequence a whole genome. He did it years before anyone thought it was possible.

Well, Chris, guess who he’s working with now?

HOST Your #1 biotech?

JEFF That’s right.

HOST So, sounds like this is probably the top sequencing company in its field…

JEFF Absolutely.

By a landslide.

But it’s on almost nobody’s radar, Chris. They don’t make the news.

And that’s a shame…

“I’m guessing there’s some urgency to this play…”

HOST So, Jeff, why did you rush to San Diego? I’m guessing there’s some urgency to this play…

JEFF Absolutely.

As I mentioned earlier, because of the role they’re playing in helping solve Covid-19, this company was recently fast-tracked by the FDA… and given a rare “Emergency Use Authorization”…

In fact…

Dr. Scott Gottlieb, the FDA’s former Commissioner, just joined their Board of Directors!

But not only that…

My top biotech also has a brand-new model… a new sequencer… slated to come out in the fourth quarter!

HOST Why is that important?

“Like when Apple releases

a new iPhone…”

JEFF Well, Chris, it’s like whenever Apple releases a new iPhone. Share prices spike.

Same thing here…

Every time this company has introduced new models in the past…

It has led to a massive influx in revenue and share price.

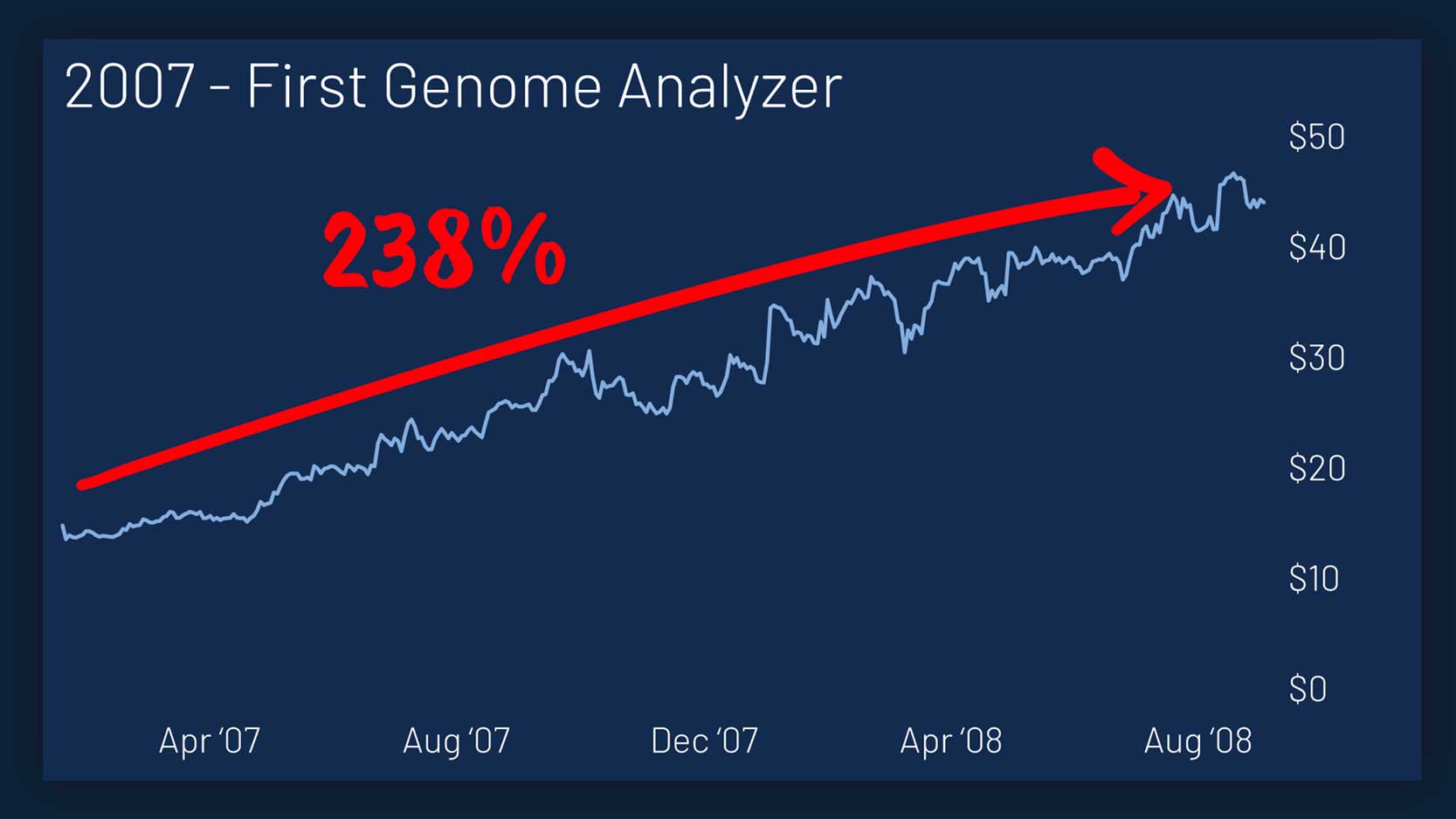

For example, back in 2007, when the company introduced its first genome analyzer, shares rose 238%…

In 2009, it happened again. Shares tripled…

In 2012, same story again. Shares surged 365%…

And in 2017, shares rose another 189%.

That’s all on the back of new models.

HOST So, basically, what you’re saying is this stock could go up again anywhere from 189% to 365%?

JEFF That’s what my analysis is telling me, Chris…

Remember, all those happened before Covid-19.

So, it’s critical people take a position now…

Before the new model comes out.

HOST Alright.

So, Jeff, I know you have a huge following.

Over 1 million folks read your daily technology newsletter, The Bleeding Edge…

100,000-plus pay to receive your monthly tech stock recommendations…

So, how can people get a hold of your #1 biotech pick?

JEFF Well, my team and I just put together a special report that outlines everything.

“The #1 Biotech Stock of 2020”

HOST It’s this one right here…

The #1 Biotech Stock 0f 2020: Why the FDA Just Fast-Tracked the “King of Genetic Sequencing”

JEFF That’s right.

HOST What can you tell us about the report?

JEFF Well, obviously, we cover the stock in full detail… and give out its name and ticker symbol…

As you’ll see, it’s an American company. So anyone with a standard brokerage account can easily buy it.

We also lay out the case for the company’s growth potential — which we believe is staggering.

HOST I see a chart here. I’m guessing that’s the one?

JEFF Yes.

HOST Now, Jeff, what’s the timeline here…

Can we wait a couple weeks… or, is this really a stock we need to buy today?

JEFF Well, obviously, I can’t give individual advice.

But, yes…

My personal recommendation would be to take a position today.

Or, the next day the stock market is open.

9:30 AM sharp.

I mentioned the catalysts…

Their great business model…

But not only that. This company mints money. Especially since their leadership team is basically run by the “Warren Buffett of biotech”.

HOST What?

JEFF Chris, the leadership team here is incredibly smart with their money.

One investment bagged them an 850% profit… another recently handed them $278 million in cash.

HOST Wow. So it’s like a “2 for 1”…

JEFF Yeah. That’s part of the reason why Baillie Gifford… the famous tech hedge fund that bought Tesla before it shot up 30X…

Owns 17 million shares…

It’s why Morgan Stanley, Blackrock, Vanguard…

They’ve all written monster checks to the company…

It’s also why Rockefeller’s venture capital arm was one of the first to fund the company.

Mark my words, Chris. This is going to be a giant. A name everyone will recognize five years from now.

HOST And, Jeff, you’re also making this report free of charge for anyone who wants a copy, right?

JEFF Correct.

Anyone who tries out The Near Future Report — my flagship technology investing letter — today, will get a free copy of my #1 Biotech Stock report…

HOST And I understand you also prepared a few more resources for our viewers…

JEFF Absolutely.

Chris, because of the strange times we’re facing today, my team and I decided to put together a comprehensive “Tech Melt Profit Plan”…

There are five reports we believe anyone who has any money in the market today needs to look at.

HOST So we covered your top Biotech pick…

Tell me about the others…

“5 Toxic Tech Stocks to Avoid…”

JEFF Sure. I’ll go over them quick…

The second report is called…

Toxic Tech: 5 Tech “Darlings” to Dump Right Now

HOST But, Jeff, you said there will be a tech melt up…

Doesn’t that run counter to your thesis?

JEFF Well, Chris, in any big move there are winners and losers.

As we mentioned before…

Back to ‘99/2000…

If you bought Pets.com, you went broke. If you bought Amazon, you got rich.

HOST Gotcha.

So, Jeff, what are some of the modern equivalents of “Pets.com”?

JEFF Well, earlier, you mentioned Zoom, Peloton…

I don’t know that these will go extinct, but they’re definitely overpriced.

But in my opinion, Chris, there’s one company right now that’s — hands down — the single worst in America. But for some reason, tech investors love it…

In fact, nearly two and a half million separate investors own this dud…

It’s in 100 different funds…

Fidelity, Blackrock, State Street, Schwab—they own gobs of it. $16 billion total.

And, according to his last financial disclosure…

Before the last election…

Even President Trump owned shares!

HOST Wow, I’ll need to check this out in detail…

JEFF Absolutely, Chris. I don’t know if you’ve got money in the market. But if you do, there’s a very good chance you’re exposed to one of these toxic tech stocks.

HOST What’s next?

“5 Stocks that Will Soar in the

‘Post-COVID’ World…”

JEFF The third report we put together is called The New Economy: 5 Stocks That Will Soar in the “Post-COVID” World…

HOST Interesting… What’s that one about?

JEFF Well, Chris, I told you earlier about how the world has changed…

But, the fact is…

Many of the companies that will profit most are names 95% of investors are unfamiliar with. They’re not the big names getting all the press. But that means their upside is that much higher…

HOST Example?

JEFF Sure.

One is quickly becoming a MAJOR player in the payment processing world… In fact, one of its “touchless” products recently processed 3 times more payments after Covid… They did $306 million — in the first quarter alone! And that jumped up to $875 million in Q2.

With companies choosing to avoid cash, this is a massive trend that will continue…

HOST Can you give me another example?

JEFF Another is proving to be absolutely essential in the nationwide rollout of 5G…

As a matter of fact, they were recently awarded $204 million from the U.S. government. But it is an absolute steal right now… trading 75% below it’s all-time highs.

My other plays are leaders in AI and the cloud computing space.

HOST So, readers are getting the full gamut of investment recommendations here, Jeff.

Biotech… 5G… AI… the “cloud”.

JEFF That’s right, Chris.

Listen, from a technological point of view, this is absolutely the most exciting time to be alive…

I mean, technology itself is progressing at an exponential rate…

But when you add in that…

Overnight, because of Covid…

The way people do things changed…

We’ve now entered into a “new economy.”

Like I said, you’ve now got 60, 65-year olds buying their groceries and prescriptions online…

People are working from home. We’re never going back to “normal.” Which may be hard for some folks to accept. But the sooner you understand why — the more money you can make.

So you can become a beneficiary of the situation, instead of a victim.

The 5 companies I’ve picked out here are the ones that will reap the lion’s share of the profits in the days and months to come.

“Top Biotech Buyout (2,200% Secret)”

HOST Awesome. I love it Jeff.

Alright, I see one more here…

The Top Biotech Buyout Candidate: The 2,200% Secret…

2,200%. I like that! What can you tell me about this one?

JEFF Well, obviously Chris.

As they say…

Past performance is no guarantee of future results…

But buyouts — especially biotech buyouts — often prove to be the most lucrative investments of all…

Take Celator Pharmaceuticals. They shot up 2,200% when Jazz Pharmaceuticals acquired them.

HOST Wow…

JEFF Forty Seven, Inc… they shot up 15X earlier this year when Gilead bought them out.

And, last fall, I recommended a small biotech firm called Synthorx. Readers of mine could have bagged a 432% profit in under 6 weeks.

HOST Wow, that’s incredible Jeff. And you think your #1 buyout stock could do the same?

JEFF Well, again, I obviously can’t guarantee how high it will go. And, for that matter, I can’t say for sure if the stock will get bought out or not.

But it has all the hallmarks of a potential buyout…

All the information I’m seeing right now leads me to believe it’s the ideal acquisition target.

However, even if there’s no buyout, to me this is an easy double Chris.

So, I recommend you take a position. Even a small one.

HOST That’s great. Are there any other reports you want to cover?

JEFF Well, there’s actually another investment report we put together that’s especially critical today, given how much new stimulus the government is pumping into the economy.

Last time I saw a set up like this, it led to a 679% profit in a month.

But I’ll let people see the details on that when they get their other reports.

There’s just one last thing…

HOST Shoot…

“One-Page Blueprint”

JEFF One thing my team and I did… which we’ve never done before… is put together a “One-Page” Blueprint…

Basically, we wrote down on one single page all of our “Tech Melt” recommendations…

So—at a glance—you’ll see…

- The name and ticker symbol for my #1 top biotech pick…

- The 5 Toxic Tech stocks…

- The 5 “New Economy” stocks…

- My top buyout…

- As well as my 679% “stimulus” play.

HOST That’s great. I can see how that makes it very easy for anyone to take action.

JEFF And that’s the most important thing, Chris.

Taking action.

This is a crucial moment…

Like with the first dotcom boom, we’re on the verge of a significant “shock” in the tech market…

Take a position in the right stocks today, and you’ll walk away rich. I mean, you could walk away with an absolute fortune.

But others will crack your nest egg…

So, we wanted to make this as simple as possible for people to take action. So, they have no excuse to position themselves on the right side of history.

HOST Great.

Alright, Jeff, so how can people get access to your research?

I understand you’ve put together a special offer for our viewers…

JEFF Right.

Chris, if any of your viewers sign up today, my team will send them — immediately and by email — all 5 reports in my Tech Melt “profit plan”… as well as my one-page blueprint… absolutely free.

All we ask in return is they try out our flagship investment letter… The Near Future Report…

And, of course, they can try that out on a completely risk-free basis.

HOST Jeff, I’ve seen the numbers…

Your track record is second to none…

You singled out Bitcoin in 2015, before it shot up almost 100X…

You picked the #1 tech investments in 2016, 2018 and 2019. And, in 2020, you’re doing it again… Nailing two of the top three stocks.

And that’s on top of a recently closed 258% winner…

So, I’m guessing The Near Future Report probably comes at a step price…

Maybe $1,000… $2,000?

JEFF Well, Chris, judging by the responses we’ve received, I certainly believe it’s easily worth that much.

But no…

My goal is to bring lucrative tech investments to the average guy.

I’ve made my money. But this is my passion.

It’s why I’m always up at 5 in the morning talking to contacts and listening to key director calls…

I can’t tell you how happy it makes me feel to read the letter of thanks I get. Like when Eric told me one of my recommendations netted him over $25,000… which was going to help him pay an unexpected medical emergency.

*The investment results described in these testimonials are not typical; investing in securities carries a high degree of risk; you may lose some or all of the investment.

Now, obviously, all investments carry risk and past performance does not indicate future success.

But it’s humbling to see our impact.

So, the regular price of a one-year subscription… if you can believe it, Chris… is only $199.

But we actually put together an even better deal for your viewers, Chris.

“I repeat. Do NOT go to our main website.

There, you’ll have to pay full price.”

So, for anyone at home, please do NOT go to our main website. I repeat. Do NOT go to our main website. There, you’ll have to pay full price.

We’ve set up a special page where your viewers can try out The Near Future Report for $49.

HOST $49. Is that… Jeff… for a full year? Or maybe for a 2-, 3-month subscription?

JEFF No, that’s for a full year.

Try it out. If, within 60 days, someone decides it’s not for them, no biggie. Let us know. Our support staff will send you back 100% of your money.

HOST So, zero risk…

JEFF Yes.

HOST Alright, Jeff. This has been illuminating. I’ve learned a ton, as I’m sure my viewers have as well.

I know your schedule is tight. But, before you go… do you have any final words for our audience?

“Jeff’s Final Thoughts”

JEFF Yes.

Chris, I’ll turn here and look at the camera… to speak directly to your viewers…

As I’ve said, we’re at a critical juncture in history…

The firm I’m a part of has a long track record of making accurate calls.

But does that mean we get it right 100% of the time?

No.

But let me ask you this:

Given what we’re facing today…

Deep down, what do you think is the one sector that’s poised to rise right now?

We’ve entered a new economy…

Many of the old standby investments – many very popular ones – are going to fall.

As several new companies… the ones that cater to this new reality… will soar…

Especially the right biotech stocks.

We’ve labored hundreds of hours…

And assembled everything you need to navigate these confusing times.

We want to help you avoid the pitfalls – and spot the winners – in the days ahead.

Including my #1 play in…

Not only biotech… but also in 5G, cloud computing, and AI.

These are all areas, as you know, that will absolutely go skyward thanks to this increasingly digital, post-Covid world.

Look…

This is an urgent situation. And I sincerely believe the decision you make today—right now—will either make or break your investing future.

Here’s what I recommend:

Invest $49.

And get a copy of the materials I’ve put together.

Is that too much to discover the top company at the head of a 5,900% technological surge…

Like Amazon was when it was $50?

I think $49 is ridiculously cheap for what you’re getting.

But that’s just me.

See for yourself.

If you don’t agree with my analysis and recommendations, no problem. You certainly won’t offend me.

All you’ve risked is two minutes of your time.

But if you agree with me… and you take action…

Those could end up being the two most productive (and profitable) minutes of your life.

Years from now, you and your family may look back to the decision you made today with profound gratitude.

The one day that made all the difference in the world.

HOST Well said, Jeff.

That’s right… I guess… going back to the start… you want to invest in the “next Amazons” today, not the Pets.com…

JEFF Yeah. Well put, Chris.

HOST Alright. For the folks at home, we’ll be putting a link to the special offer Jeff put together for you… his generous $150 discount to The Near Future Report… below this video.

Just go ahead and click on that button. Once you do, you’ll be taken to a special page where you can review everything before you decide to sign up. See Your Special Offer

Jeff Brown, it’s been a pleasure…

JEFF Thanks, Chris.

“Closing Statement from Chris Hurt”

That wraps up today’s edition of the Tech Minute.

I think you can see now why I invited Jeff Brown to be on the show.

He’s one of the brightest minds in tech. And his track record is second to none.

He’s picked more #1 tech winners than anyone else I’ve come across.

And, just days ago, he closed out on yet another triple-digit winner…

278%, to be exact.

Now, we’ve seen where Jeff has set his sights…

Biotech.

The coronavirus changed the world.

And—I think it’s obvious, but as Jeff states—some specific stocks will absolutely rise as a result.

Perhaps spectacularly.

That’s why Jeff and his team put together a comprehensive “Tech Melt profit plan…”

Which features, of course, his #1 biotech pick…

His top buyout candidate, that could shoot up as much as 2,200%…

As well as his 5 toxic tech “darlings” to avoid, among others.

And he’s offered us a special offer, too…

If you try out his #1 newsletter, The Near Future Report…

You get a full year for just $49.

That’s $150 off the retail price you can put directly in your pocket.

There’s no time left to lose.

A life-altering “tech melt” is upon us…

And just like in the dotcom era, there will be monster winners like Amazon… and big-time bankruptcies like Pets.com.

I don’t know about you… but when everything is said and done… I’d rather come out on the winning side.

To see what Jeff’s put together for us…

Click the button:See Your Special Offer

You’ll also see one last surprise addition Jeff decided to throw in…

I’m Chris Hurt. And this has been Tech Minute.

Thank you for tuning in.