Futures are mixed this morning, indicating a possible continuation of bumpy movement. It is highly likely that we will finish the week down, for the fourth week in a row.

There could be overlooked bargains within the industrial sector with valuations that are hard to pass up. Our research team has been focused on select stocks within the sector. One in particular stands out for its value and momentum.

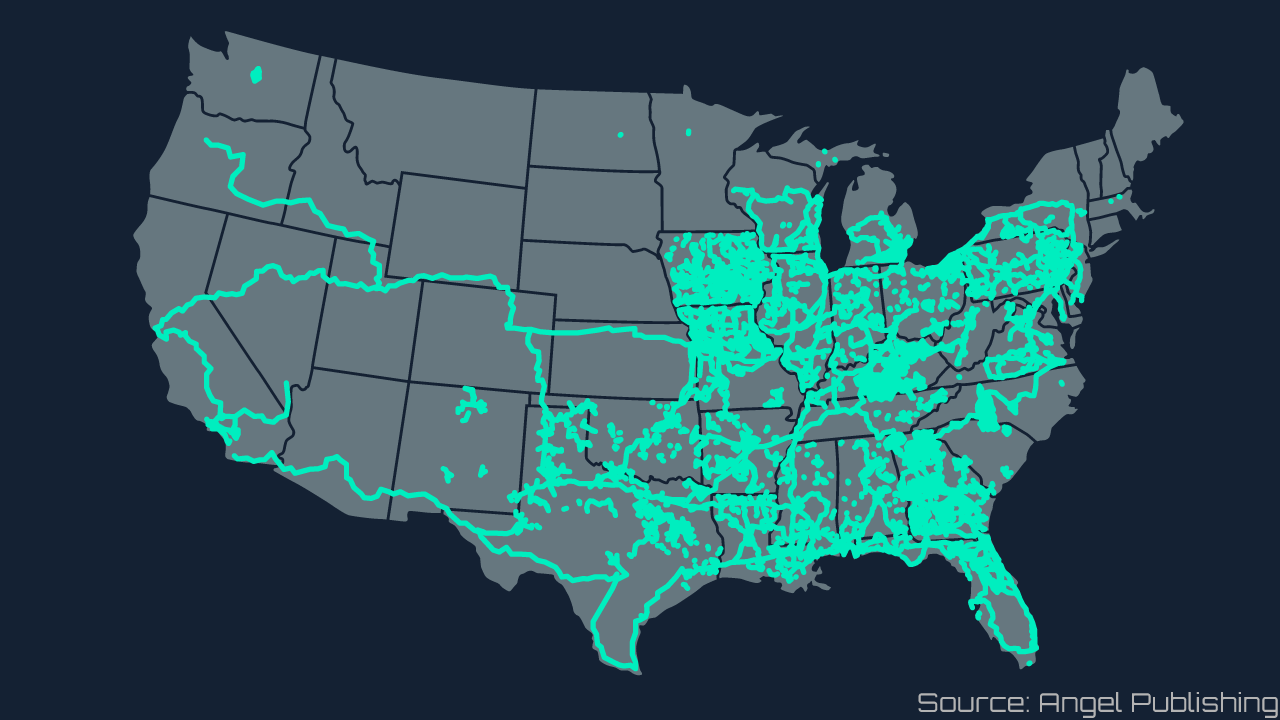

United Rentals Inc. (URI). is an equipment rental company with a network of locations throughout the U.S. and Canada. The company offers rentals to businesses in the construction industry, industrial commercial firms, as well as homeowners and other individuals.

The company reported a 21.5% decline in net income as revenue fell 15.3% in Q2, due to the slowdown in economic activity stemming from the COVID-19 pandemic.

URI is currently trading at $166.63 and has a low 12-month trailing P/E ratio of 11.8. URI has the wind at its back with a 12-month trailing total return of 68.6%.

Short term volatility is certainly to be expected for industrials, but many analysts are shifting focus to the sector which has significantly lagged the broader market. The Industrial Select Sector SPDR ETF (XLI) has provided a total return of 8.6% over the last 12 months. Paltry compared to the S&P 500’s total, 12-month return of 23%. Which means there may be plenty of runway ahead for industrials.