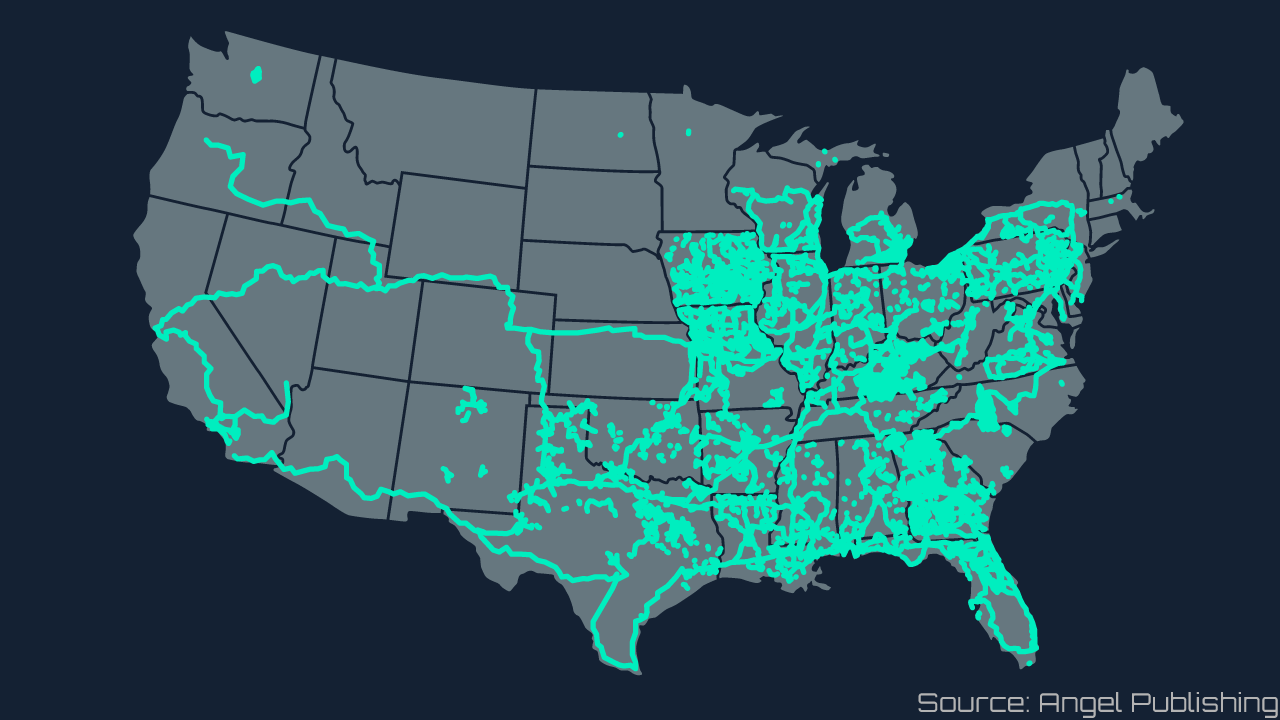

The Electric Vehicle revolution is going mainstream.

As consumers have become more concerned with reducing carbon emissions, major players in the EV industry have responded to this concern, finding ways to make owning an EV more accessible, by bringing costs down and expanding EV range.

Additionally, government incentives in the form of tax credits and exemptions, purchase rebates and additional perks for owning an EV have been established around the world to support policy-driven adoption of EVs.

The International Energy Agency, who works with countries around the world to shape energy policy, thinks that by 2030, global EV sales could measure anywhere between 20 million and 30 million cars, implying 10-fold to 15-fold growth from 2018.

Growth will be huge in the EV industry from this point. Investors are piling into EV stocks like Nikola (NKLA) and Tesla (TSLA).

Tesla, the king of EV stocks, is up about 140% year to date. It’s trading about 40% above analysts’ average call.

Fuel-cell and electric-trucking pioneer NKLA is up about 120% since the company became publicly traded company on June 3. Nikola is roughly 20% above.

NIO is trading 20% above the average analyst price target of $5.25 a share.

With volatility in the forecast we may see share prices pull back to an enticing level for buying into these favorite names, or increasing your existing position.

Here are a few other ideas to consider if you’re interested in starting or expanding your position in stocks that could benefit from the EV revolution.

BMW (BMWYY)

Last year, the BMW 530e, i3 and X5 were among some of the top selling EV models in the U.S. This year, many of those same models are again some of the top-selling EVs in America, alongside the luxury i8, which has seen its U.S. delivery volume grow ten-fold.

The company plans to have 25 EVs on its vehicle roster by 2023, many of which will be luxury EVs, positioning itself for revenue and profit growth over the next several years.

BMW is currently trading at more than 40% off of it’s decade high, indicating that this growth has not been priced in. Robust luxury EV growth over the next several years should spark a nice recovery rally in BMW stock.

Workhorse Group Inc. (WKHS)

In its early stages Workhorse was at the forefront of the EV movement, producing electrification packages for companies like GM, Mercedes Benz and Jeep. In 2016 the company pivoted to focus on commercial vehicles and now its laser focused on last-mile delivery vehicles.

The company’s partner and customer list includes such formidable names as UPS, USPS, DHL, FedEx and Ryder.

The small-cap company with big goals announced on Wednesday that its electrically powered delivery and utility vehicles passed federal safety tests. Share price rose 60% last week and is up 130% YTD. It’s still a relative bargain trading at just 17% above average analyst targets. We could see a pull back after last week’s big run up, which would be a gift.

Panasonic Corp. (PCRFY)

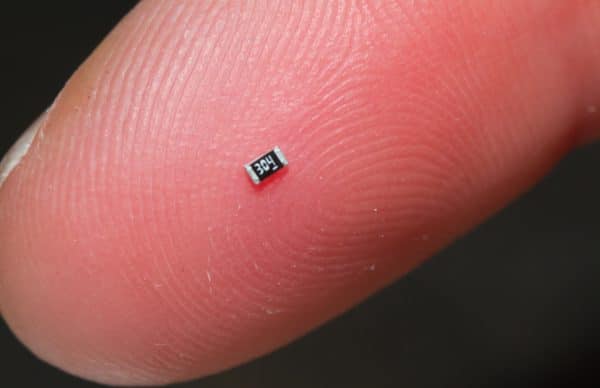

This decline in cost of lithium-ion batteries is set to make it the ideal source of energy for long-range EVs ahead.

According to a report published by Fior Markets, the global automotive battery market is expected to reach $85.41 billion by 2025, at a compound annual growth rate of 7.02%.

Last year PCRFY partnered with Toyota to manufacture batteries for electric vehicles. The companies plan to raise the battery capacity by 50 times as compared to the ones used in current Toyota hybrid vehicles. Mazda, Subaru and Daihatsu will be utilizing batteries from the aforementioned joint venture. In fact, Honda already uses Panasonic’s batteries and will also gain from the said partnership.

Panasonic has expected earnings growth of 89.5% for the next year.