All because the Coronavirus fear factor is in full effect creating what some are calling the biggest buying opportunity investors will see in their lifetime.

There’s only a short window of time investors will be able to take advantage of this once in a lifetime opportunity.

We’ve identified 5 ridiculously under-priced stocks sitting at bargain prices that could explode within the next three weeks…

#5 CLIX ProShares Long Online/Short Stores ETF

CLIX tracks a fixed-selection, tier-weighted index of both long and short positions in US-listed securities.

CLIX is founded on the premise that the brick-and-mortar retail industry will wither under pressure from online shopping. The fund provides 100% long exposure to online retailers and 50% short exposure to traditional in-store retailers. (Note that this gives CLIX only 50% long beta exposure to the broader retail industry.) The underlying index is actually built from two sub-indexes, one long and one short.

To be included in the longs, a company must draw none of its revenue from physical stores and must be listed on a US exchange, though it is not required to be a US company. Long constituents are market-cap-weighted. For the shorts, in-store sales need to account for at least 75% of revenue, with the same US exchange requirements as the longs. Short positions are equally weighted. CLIX gains its short exposure through the use of swaps.

#4 Stitch Fix Inc (NASDAQ: SFIX)

Spending on artificial intelligence (AI for short) is expected to nearly triple between now and the year 2023. And there are really only two “buckets” that expose you to the money that’s being made from AI.

The first is to invest in the manufacturers of AI products. AI products include devices with “personal assistants” like Amazon’s “Alexa” to manufacturers of the chips that will allow the computing power AI will require to become possible.

The second is one that uses artificial intelligence to improve their own products and services. Enter our target, Stitch Fix, an online, personalized apparel company that millennials and boomers alike are raving over.

Stitch Fix’s President and Chief Operating Officer just state that the company is already on track to hit $2 billion in sales this quarter.

Partially due to its lack of overhead since it doesn’t operate any stores, this company has been profitable since 2014. But what makes it most exciting is its future. After spending years serving women, they have only just started selling men’s and kids and are already finding success.

#3 MicroVision, Inc. (MVIS)

MicroVision is the creator of PicoP® scanning technology, an ultra-miniature sensing and projection solution based on the laser beam scanning methodology pioneered by the Company. MicroVision’s platform approach for this sensing and display solution means that its technology can be adapted to a wide array of applications and form factors. We combine our hardware, software, and algorithms to unlock value for our customers by providing them a differentiated advanced solution for a rapidly evolving, always-on world.

MicroVision has a substantial portfolio of patents relating to laser beam scanning projection and sensing. MicroVision’s industry leading technology is a result of its extensive research and development. The Company is based in Redmond, Washington.

#2 The Tiny firm set to win race to deploy 5G

We’ve all heard about investing in 5G.

But while everyone is talking about the fancy new 5G chips or antennas…

Nobody’s talking about the most significant piece of the 5G puzzle…

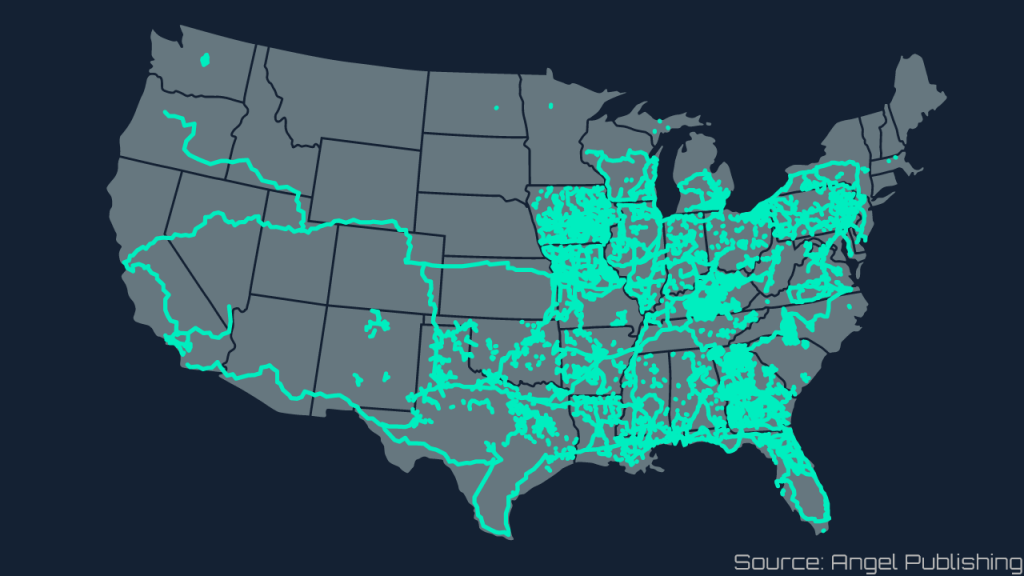

The web of networking cables crisscrossing the country that will bring information from all over the world right to your fingertips.

This is the backbone of America’s 5G network.

It simply can’t be built without those fiber-optic connections.

And there’s one company that literally owns this entire fiber network.

All of the wireless carriers and pretty much every big name in communication already have contracts in place with this company.

In fact, the ONLY cities in the entire country with 5G coverage are located right on this company’s fiber network.

Even the U.S. government is paying to get its secured communications on this critical piece of infrastructure.

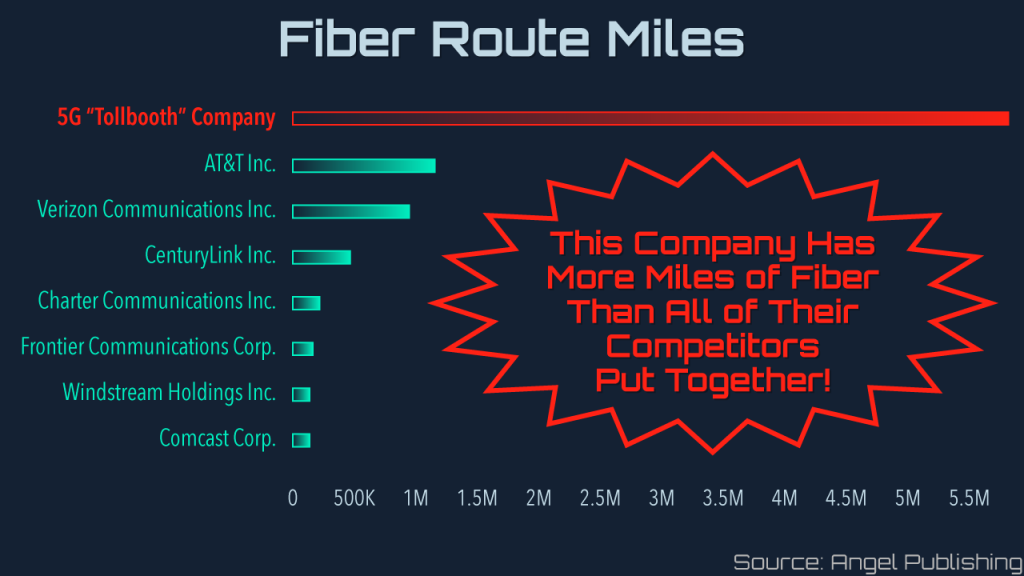

Quite simply: This company owns more fiber networks than anyone else in America.

It is the critical piece for winning the race to deploy 5G.

And best of all, this company’s stock is trading around $10 a share.

But according to my research, you could be sitting on more than 600% profits after all’s said and done.

This company is leading the charge to 5G and could make early investors filthy rich.

Click here to get the name and ticker symbol.

#1 The Maker of A $570 bn Chip Inside Apple’s 1st 5G-capable iPhone

5G has been promised for years.

In fact, it’s already here in some places…

But not many.

Barely one in 10 Americans have 5G access right now.

But Apple is going to change all that…

This September.

That’s when they are expected to launch their first 5G-capable iPhone.

And ignite a storm of 5G-related activity.

Sales could go from $0 to $150 billion…

In just three months.

And one stock in particular may soar as a result.

Click here to learn more.

BONUS: Our #1 Stock to Buy & Hold

Investing in today’s market is nerve-wracking. It seems that all it takes is a controversial tweet, an interest rate hike or trade war headline … and all the gains you’ve made get wiped out.

With stocks shooting up 500 points one day and down 500 points the next, you may be wondering if there is any good place to invest.

Wall Street legend Paul Mampilly says there is one such place … and when Paul speaks, people listen. His record speaks for itself.

He managed a hedge fund that was more than $5 billion and was ranked in the top 1% by Kiplinger. After joining that firm, the assets soared to $25 billion.

He won a prestigious competition, generating a 76% return on $50 million in one year – and that year was 2008, right in the middle of the economic crisis.

His advice has been sought after and featured on CNBC, Fox Business News, Bloomberg TV and more.

He’s even developed his own strategy for pinpointing exactly which stocks are poised for growth and the best time to get in (and out).

It’s how he made 279% on Facebook, back when most investors were still asking how they were supposed to be profitable.

And how he made an impressive 634% gain on Netflix, way back in May 2010 … before online streaming had taken off.

It can take hours of research and months of patience to pinpoint the right company at the right time. And even then, nothing is 100%.

However, Paul is honing in on a little-known tech stock he’s been watching for months. A small California-based chipmaker that has developed a new technology that could unlock an entirely new industry.

He calls it “the stock of the century” and made it his No. 1 pick for 2020.

To get all the details on Paul’s top stock, watch his latest video presentation by clicking here.