How to retire is one of the most pressing issues of the day. Countless readers have turned to Seeking Alpha to handle the challenges that face retirees today. Retirees need to know how to plan their cash flows, how to build a steady portfolio, and what levels of expectations are sensible. It is painful to hear from retirees who state they “NEED” a 14% return per year. Even with high volatility and risky investments, sustaining 14% annually is an insanely aggressive plan, and it certainly wouldn’t be likely to come in a steady sequence.

Today, I will be using hypothetical situations many readers may face. They aren’t professional investors and don’t have a huge portfolio. It would be easy to plan retirement with $10 million. So instead, let’s make it less: $500,000.

Market environment

The current interest rates available on bonds are low. Bonds are a difficult way to generate income unless it’s with a huge portfolio. The market is seeing all-time record highs day after day. Investing today should be done with caution. The investments I would choose are companies that are large and have a strong track record. A retiree today could invest in an income portfolio and expect solid dividend yields. Large companies with a great track record are unlikely to cut their dividend – even in harsh times. Short-term volatility of the market may be significant, but the income source should remain almost entirely intact.

Nursing homes

Nursing homes, for a prolonged period of time, would almost certainly drive most retirees into bankruptcy or an early grave. Skilled care costs are high enough to decimate a retirement portfolio. If you are considering this option, or know someone who is, please speak with a financial planner about designing a legal structure to protect your capital in the event of a forced bankruptcy.

Social Security

On a sheer numbers standpoint, there is definitely something to be said about waiting as long as possible to take SS. However, there’s also something to be said about taking it early. A lot of this depends on the individual retiree and what’s important to them. How long do you believe you will live? How will your quality of life be for the years you are not collecting SS? Are you carrying any high interest rate debt? I urge investors/retirees to be honest with themselves.

For this scenario, I will be having the retiree taking out SS as soon as possible. If an investor is unsure of whether they will live to be 65 or 105, taking it early may be wise. Let’s say if an investor at 63 pulled SS today, it would come out to $1,500 monthly. This comes out to $18,000 a year.

Challenges

Every retiree or future retiree faces their own unique challenges. Being committed to a plan and being frugal is extremely important when planning for retirement. I urge you to be diligent in your planning. Plan for every expense you can think of. After that’s done, see what expenses can be cut/reduced. Every retiree doesn’t get to retirement with $10 million, but we all have the capacity to do our due diligence.

Work

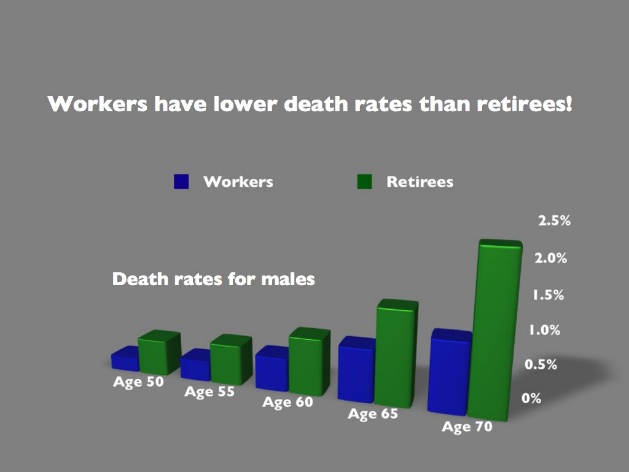

I want to point out that retirees who don’t work tend to have shorter lifespans:

The correlation here is a lack of physical activity and brain use. Combined, the two lead to an overall shorter lifespan. Clearly, physical activity and brain use do not only come from working. However, working greatly increases the likelihood of both.

Some of us love our work. Some of us will eventually find work that we love doing. The word “work” can be used loosely here, because what is work for one may be a hobby for another. I’m sure there are some readers who would much rather work than travel. Often, I fall into that category.

Portfolio investing

Let’s start looking at building a portfolio that is filled with strong dividend investments. An investing strategy should help you sleep at night. Investing should not keep you up at all hours of the night wondering if your 16% dividend yielding company is going to go bankrupt tomorrow. I will be focusing on dividends to supplement income. The plan is to buy and hold 20 of the best dividend stocks on the market.

Let’s begin!

MO and PM

My first and second picks are probably obvious: Altria Group (MO) and Philip Morris (PM). I consider MO’s dividend history applied to PM. Altria Group has raised their dividend for 47 years. Both of these companies have massive market share and sell an addictive market. They are also showing the ability to transition into new products. Philip Morris is testing their new technology in international markets: IQOS. The FDA announced a plan to reduce nicotine in combustible cigarettes. Since then, MO’s price has been down. I believe this is good news for Altria Group. Once MO is cleared to sell IQOS domestically, sales should go up substantially.

PG, MMM, and JNJ

Third, fourth, and fifth picks:

Procter & Gamble (NYSE:PG) has 60 years of dividend increases. 3M (MMM) has 58 years of dividend increases. Johnson & Johnson (JNJ) has 54 years of increases. All of these companies have something else in common: product diversity. Within their sector, these companies are giants. All three have products that are probably in your residence. When it comes to dividend portfolios, these three companies should be at the top.

KO and PEP

Sixth and seventh:

Coke (KO) and Pepsi (PEP) combined come to 98 years of dividend raises. While the growth of either company looking forward is debatable, their ability to give out dividends is not. I’m not thrilled with the direction Pepsi’s management is driving the company in. I did not pick either of these up for excellent growth potential. KO and PEP have a great dividend and they sell junk food. Junk food sales are going down, but KO and PEP are transitioning into healthier products.

LOW and HD

Eighth and ninth:

Lowe’s (LOW) and Home Depot (HD) are the kings of their niche. I find it difficult to believe a new player will be able to come in anytime soon. When I’m deciding which one to shop at, it’s almost always which one is closer.

O and NNN

Tenth and eleventh:

Realty Income (O) and National Retail Properties (NNN) are two of the strongest REITs on the market. Both are exceptional at choosing tenants. In a market that is seeing harsh criticism, both are putting up extraordinary numbers. When it comes to yields near 5%, these are two of the best. Exceptional management and a strong dividend history separate these two from most REITs.

T and VZ

Twelfth and Thirteenth:

AT&T (T) and Verizon (VZ) are the two gatekeepers of mobile internet access. If telecommunications can be too big to fail, these would be the first players to receive the designation. These are leaders in their sector with strong dividend yields and cheap P/E ratios.

AAPL

Fourteenth:

It’s hard not to put Apple (AAPL) into a retirement portfolio. The dividend yield isn’t all that high, but best of luck finding a safer one. Easily covered dividend, massive company, and a tech allocation is good for diversification. Apple saw a significant rally in price recently, but long-term, this is one of the safest tech options.

XOM

Fifteenth:

Exxon Mobile (XOM) is a huge oil company with low beta. XOM is a good fit for almost any dividend growth portfolio. XOM’s enormous size gives them political influence. It would be hard for oil to become obsolete when oil donates heavily to congress.

V and MA

Sixteenth and Seventeenth:

Visa (V) and MasterCard (MA) are another two companies that dominate a sector. Visa is the leader in electronic payments. The company is “everywhere” and we are moving towards a cashless society. The service Visa provides is difficult to replicate. MasterCard is a strong competitor of Visa.

WMT

Eighteenth:

Wal-Mart (WMT) is arguably the king of retail. They’ve shown great progress in the e-commerce market. I believe WMT is protected if retail continues to fall off. Wal-Mart’s rapid growth in e-commerce makes them second only to Amazon (AMZN).

MCD

Nineteenth:

McDonald’s (MCD) is the king of fast food. The company also has 40 years of dividend raises. The dividend isn’t as impressive as some on the list, but the consecutive raises are impressive. MCD may have questionable future growth with competition from mobile ordering making other food more accessible. However, I don’t see the dividend going anywhere.

SPG

Twentieth:

Simon Property Group (SPG) is still going to be around decades from now. Investors are generally terrified of the mall REIT space. Anything associated with retail gets hammered. However, the malls in SPG’s portfolio are exceptionally strong and maintained well. Even as e-commerce grows, the malls are not going to die. Stores will be replaced, but the landlord should be fine.

Portfolio

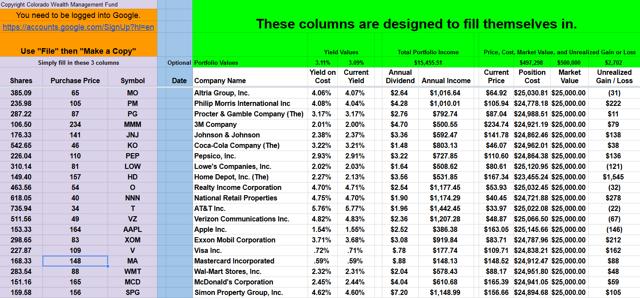

Here are all the stocks put into a portfolio tracker:

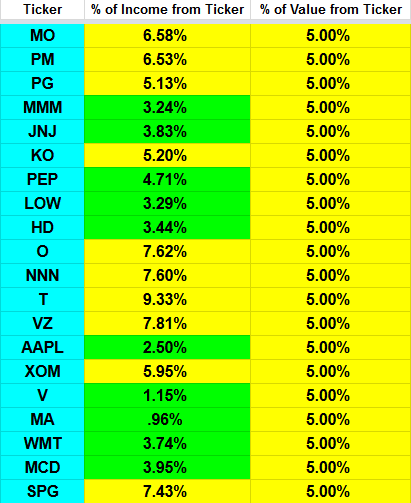

To ensure that neither portfolio value nor dividend income is too heavily concentrated in any one name, I use the following chart to check the diversification. As you’ll notice, none of the positions contributes 10% or more of the portfolio’s total income. However, AT&T does get pretty close:

The total portfolio income would be $15,455.51. SS brings in $18,000 a year. This comes out to $33,488.51 per year for one person. If a retiree has a spouse also bringing in Social Security, that could be a significant increase in yearly income. This is enough to live off of for one person, but comfort levels may differ. If a retiree were able to find a job for $15/hour with benefits (health insurance), we’d be looking at around $60,000 a year. This retiree would also no longer be a retiree, they would just be a person with a job. Working part time, a retiree could still make nearly $50,000 a year.

Bond option

If the investor wants to have a moderate bond allocation to stabilize portfolio values, I would suggest the Schwab U.S. Aggregate Bond ETF (SCHZ). It carries a 2.36% dividend yield and the portfolio is constructed with mostly high quality bonds and relatively short duration.

Conclusion

There are numerous strong companies that got left out. The companies I did choose are strong enough for any retiree looking for income. Most of retirement is planning expenses. Without planning, everything else can easily fall apart. Due diligence on choosing stocks in the market is important. Investors who are not comfortable investing in individual companies could just invest in the S&P 500 (SPY). However, this would bring in fewer dividends. My intent was to go with large companies and get a higher/relatively safe dividend yield.

Click The REIT Forum to sign up for:

- Actionable buy and sell target prices

- Best research on preferred shares and REITs

- Best reviews on the site – 294/295 stars

- Stable dividend yields over 7%

- You get instant actionable SMS alerts

- Sign up before November 1, 2017, to lock in at $370/year

Disclosure: I am/we are long MO, PM, WMT, SPG. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: No financial advice. Investors are expected to do their own due diligence and consult with a professional who knows their objectives and constraints. CWMF actively trades in preferred shares and may buy or sell anything in the sector without prior notice. Tipranks: No ratings in this article.

Click here to see the full story