How do you know that you are earning enough income to ensure that you can retire? I’m not even considering how to retire early. How do you know that you have enough income to just flat out retire? I’ll highlight one way that allows for you to capture both your retirement AND your income goals. Living off dividends is more realistic than you think.

Dividends are purely passive income. There is no debate about it in my opinion. You reap the benefits of dividend income after putting in some upfront time to make your investment decision. In addition, you are a minority owner in a business and maintain no controlling-interest decision making. Nor do you have to spend much time managing your investment. Just a few efficient reading every few months.

Thereafter, you can carve out a small amount of time to monitor your investments. With the rise of different mobile apps and speed of information, dividend investing is made for the modern investor for now and into the future.

Is living off dividends possible?

Historically, dividend investing has been viewed as a way for risk-averse, “belt and suspenders” investors to invest in the stock market. I couldn’t disagree with that mentality more. Dividend investing is one (if not my most) of my favorite ways to increase my income through passive income while also covering off my retirement goals.

Living off of dividends is a marathon. Not a sprint. However, do not take this marathon lightly. You should have the urgency to both increase your income and save for retirement by getting started immediately. The urgency for investing for passive income leads me to one of my favorite sayings:

“The best time to plant a tree was 20 years ago. The second-best time is today.”

Plant your dividend seed now by investing in dividend growth stocks. What will it take? Well, with an average dividend yield (I’ll explain later) of ~3.0% in your portfolio, you’d need approximately a $3.33 million portfolio to earn $100,000 per year in dividend income.

Is it feasible to live off of dividends right away? No. Can it happen over time? Of course. With a prudent plan and strategy, you can achieve the holy grail of passive income…. living off of dividends… sooner than you think. I’ll walk through some steps to help you invest for passive income.

The key to living off of dividends is to focus on dividend growth stocks. Dividend growth stocks increase their dividends annually, which increases our income without doing a single thing.

Remember that saying about planting a seed? Well, it fits perfectly. If you invest the right way your seed will grow into a large redwood tree.

How to build a dividend portfolio for regular income

How do I get started with building a dividend portfolio? I’ve built a great infographic that shows how you should think about building a dividend portfolio. When building a dividend portfolio start scaling in small positions that you will continue to build over time.

First, I suggest you use a brokerage that offers the lowest commissions fee trading available. I currently use Robinhood, which allows me to trade completely commission-free on ALL stocks and options. This is huge because options are usually VERY expensive to trade.

When used properly, options are a great way to mitigate risk in your portfolio, put on a hedge in the case of downside scenario and boost your monthly income from your dividend portfolio. These are the best stocks for covered call writing.

Alternatively, you can use options to increase your income by writing put options. If the stock crosses below the exercise price, you can just buy the stock. This is a great tool to be able to participate in a stock if you don’t know if it will increase in the short-term. Here is a guide to selling weekly puts for income.

If you sign up, we BOTH receive a free share of stock! You can check out our Robinhood dividends guide and review to understand how the app works.

Having your commissions be as low as possible is key to ensure that you are not eroding your returns unnecessarily by paying sunk costs to the brokerages. We want to maximize earning potential for every single penny.

Robinhood has opened the flood gates for investing for passive income. The app has all the necessary news for your stocks right there and it is simple enough to discourage you from trading.

I don’t know about you, but I’m sick of the brokerages pushing retail investors to become traders overnight. With algorithmic trading, the retail investor has no place day trading. The Robinhood app was built for the passive income investor. Here are several other top investing apps to consider.

Dividend portfolio allocation

I suggest the following allocation of exposure to different types of dividend stocks to ensure a successful dividend growth portfolio:

- 20% of your dividend portfolio should be allocated to Dividend Kings

- 35% of your dividend growth portfolio should be allocated to Dividend Aristocrats

- 30% of your dividend portfolio should be allocated to up and coming dividend stocks. We want stocks that have demonstrated a track record of increasing their dividend and rewarding shareholders. These stocks are not considered the ‘classic’ dividend growth stocks like the Dividend Kings or Dividend Aristocrats.

- The remaining 15% of your asset allocation in your dividend growth portfolio should be international dividend growth stocks. You can get a basket of international dividend growth stocks by investing in a global dividend growth fund. Or, you can select individual blue chip international dividend growth stocks.

Keep in mind Dividend Aristocrats have a strong track record of success. Dividend Kings are likely slower growers but have an even better track record of success.

At the end of the day, you should have a robust list of 25-30 dividend stocks to invest in over the long-term.

Once you have your invested dividend portfolio, you take any dividend income received and reinvest into your portfolio of dividend stocks. If you want to live off of dividends in the future, you need to invest the most you can today.

This is equivalent to the savings snowball, but with dividends. Dividend growth investing is a phenomenal way to capitalize on the power of compound interest due to the income potential and the ease of reinvestment into your portfolio.

I keep track of my dividend income and dividend stock prices via Personal Capital. I check this daily and it is completely free.

It’s so satisfying waking up after a weekend of relaxing and seeing $30+ of dividend income hit my dividend portfolio account. I love dividends. Time to go buy more stocks.

Important dividend investing calculations to consider

In general, dividend investing is not very complex. In fact, the simpler you keep it the better you’ll do. Good investing is boring. However, there are several dividend investing calculations that you should consider as you build and monitor your portfolio.

Here are three essential dividend investing calculations that you need to know:

- Annual dividend yield: Annual dividend yield is the calculation of the percentage of dividend per share received relative to the stock price. This is a great barometer of the annual income you receive from investing in a stock. For example, if you invest in a $50 stock and it pays $2 per share in dividends. This is equal to a 4% annual dividend yield. If you plan on living off dividends, you want the annual dividend yield based on the cost you invested in shares to be the highest as possible.

- Dividend growth rate: The dividend growth rate for a dividend stock is very important. I love investing in stocks that continually increase their dividend because I essentially get a ‘raise’ every year for doing absolutely nothing. You can calculate the dividend growth rate on any annual timeframe. To do so, take the current year’s dividend per share divided by last year and subtract 1. This will calculate the dividend growth rate compared to the prior year.

- Dividend payout ratio: The dividend payout ratio is a measure of how much a dividend stock pays in dividends relative to their earnings. You must consider the payout ratio of a stock because a high payout ratio means the company is retaining limited cash to be reinvested in the business. This can sometimes flash a red flag. If earnings decline, the dividend stock will have to decrease their dividend. That goes completely against our rules. We only want stocks that we know no matter what they will (at a minimum) maintain their dividend or increase it over time.

If you want to live on dividends, you must focus on the income component first. Make sure that the dividend will never decrease in value.

You need stability of the income and stock appreciation. Good stocks increase their dividend over time and the stock value appreciates as well. This is since the earnings are likely increasing as well.

Also, understand that you are lowest priority in the capital stack in the event of a liquidation since you are an equity investor.

You can track these statistics easily with sites like FINVIZ. GuruFocus or Investopedia. Sign up for GuruFocus and we will both get a free month of premium. I love their guru investor trackers to search for new investment ideas.

Once I find a new investment idea, I like to do a quick-and-dirty analysis with our free downloadable dividend discount model.

Use the three ratios to start building your dividend portfolio and choosing the right stocks for you, so… what dividend stocks should you look for?

Identifying the best long-term stocks for dividends

I’ve read tons of investing books including those from Benjamin Graham, Warren Buffett, David Einhorn and other legendary investors. One common parallel among them all is the notion that you should only invest in stocks that you understand.

I like to invest in businesses that I understand at undervalued prices.

I love running my stocks through a qualitative analysis that features a series of yes/no questions, including but not limited to:

- Shareholder Friendly: Has the company increased its dividend in the last 3+ years? (Yes or No)

- Financial Health: Does the Company have a modest dividend payout ratio? (Yes or No)

- Management Team: Was the current CEO hired internally? (Yes or No)

- Operational Excellence: Do they have a track record of revenue and earnings growth? (Yes or No) Has the company provided a long-term growth plan? (Yes or No)

- Business Model: Do you understand the business model? (Yes or No) Is there a significant moat around the company? (Yes or No)

Think of each ‘Yes’ answer as 1 point to your score. You certainly cannot have more than half of your questions answered as ‘No’ if a company is going to become a dividend growth stock for the long haul. Living off dividends means that you are positioning yourself for the best future success possible. That means you need to be invested in the best performing stocks of the future.

Even a better scenario would feature an outcome where you are a frequent customer of the company. Warren Buffett has been an investor in Coca-Cola since 1988 / 1989, which has generated over a +1,595.58% return since that time. Warren also drinks at least one Coca-Cola per day. This is a great example of dividends and dividend growth investing.

Talk about putting your money where your mouth is… If you want a visual depiction of how we look for stocks.

Check out my dividend stock screener infographic.

5 Steps to Invest for Passive Income with the Goal of Living Off Dividends

If you follow the rules for finding the best stocks for dividends, your dividend investing will be passive. As you build your portfolio over time, there is limited work needed to be done. All you need to do is ensure you have real-time notifications enabled for your dividend portfolio.

Can you earn passive income from investing? Absolutely, all you is follow these five steps to achieve the ultimate goal of living off dividends.

1. Contribute $200 per month to your dividend portfolio your first year

Set up an automatic contribution of $200 per month to your dividend growth portfolio. That should be an easy start. If you want to contribute more, even better! Make your contributions automated as much as possible. We want to save our time for other sources of passive income.

2. Increase your monthly contributions by 25% per year

This sounds like a lot but can be doable so long as you increase your income from other sources along the way. As long as you are a good saver, you should be able to do this for the first 10 years. After that the annual increases get much more difficult, but they are certainly attainable. I’ve been saving at least 30% of my after-tax income each year.

3. Any dividend income you receive should be reinvested into your dividend growth portfolio

Once you receive dividend income, use this to buy more stock in your portfolio. Rather than a dividend reinvestment plan, I like to invest at my own discretion. A dividend reinvestment plan will automatically buy shares in that specific stock. Without the dividend reinvestment plan, I can invest in a stock when it declines in value or I can invest in a different dividend stock in my portfolio.

4. Invest in quality stocks that enable you to achieve a 6% growth rate in your equity value

This point shouldn’t be hard to do. You will have some winners and some losers, but just make sure you have 6-8 winners out of every 10 stocks.

5. Repeat steps 1-4 as you go over time

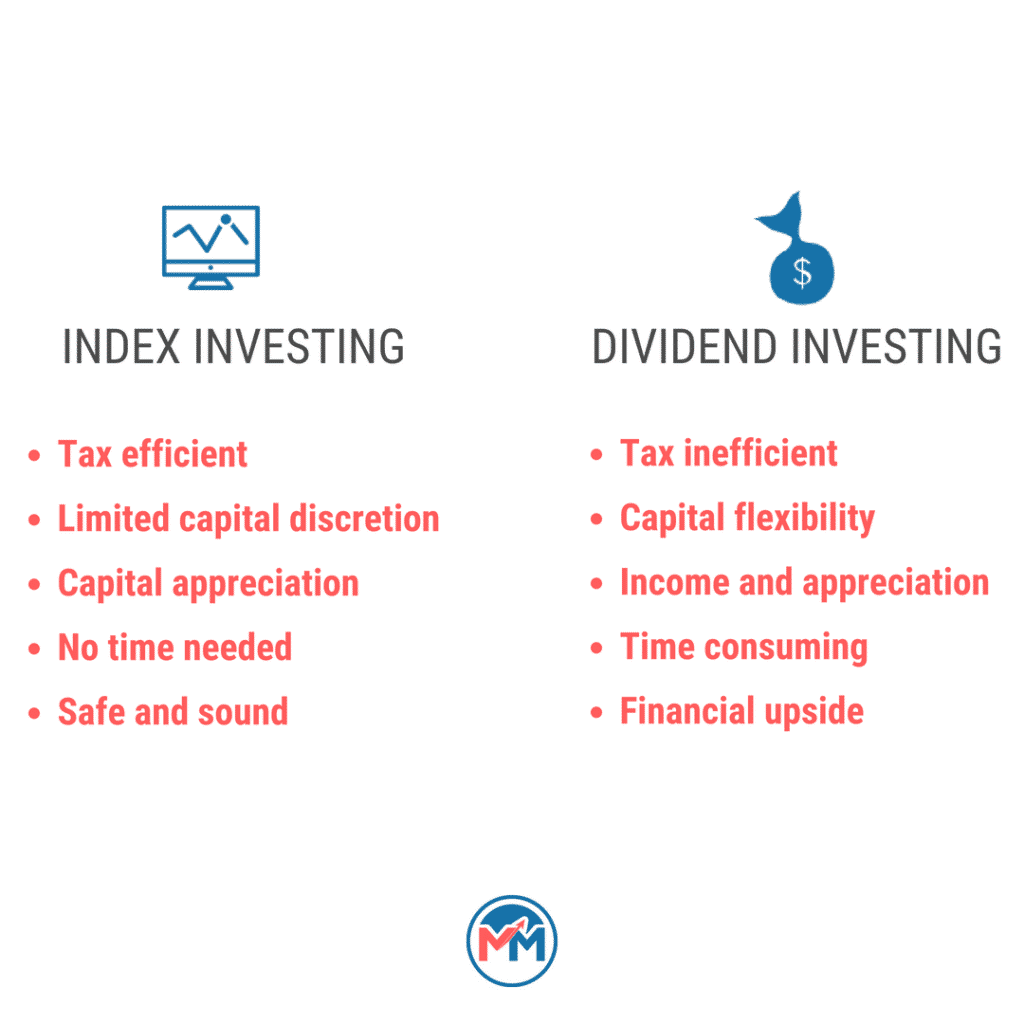

Continue with your plan and it will all work out. I like building a hand selected version of dividend stocks as opposed to index investing. This allows me to focus on specific yields and invest in companies at attractive valuations.

So, how do you truly get to the point of living off dividends?

Let’s look at a case study that validates the fives steps to living off dividends forever that I highlighted above.

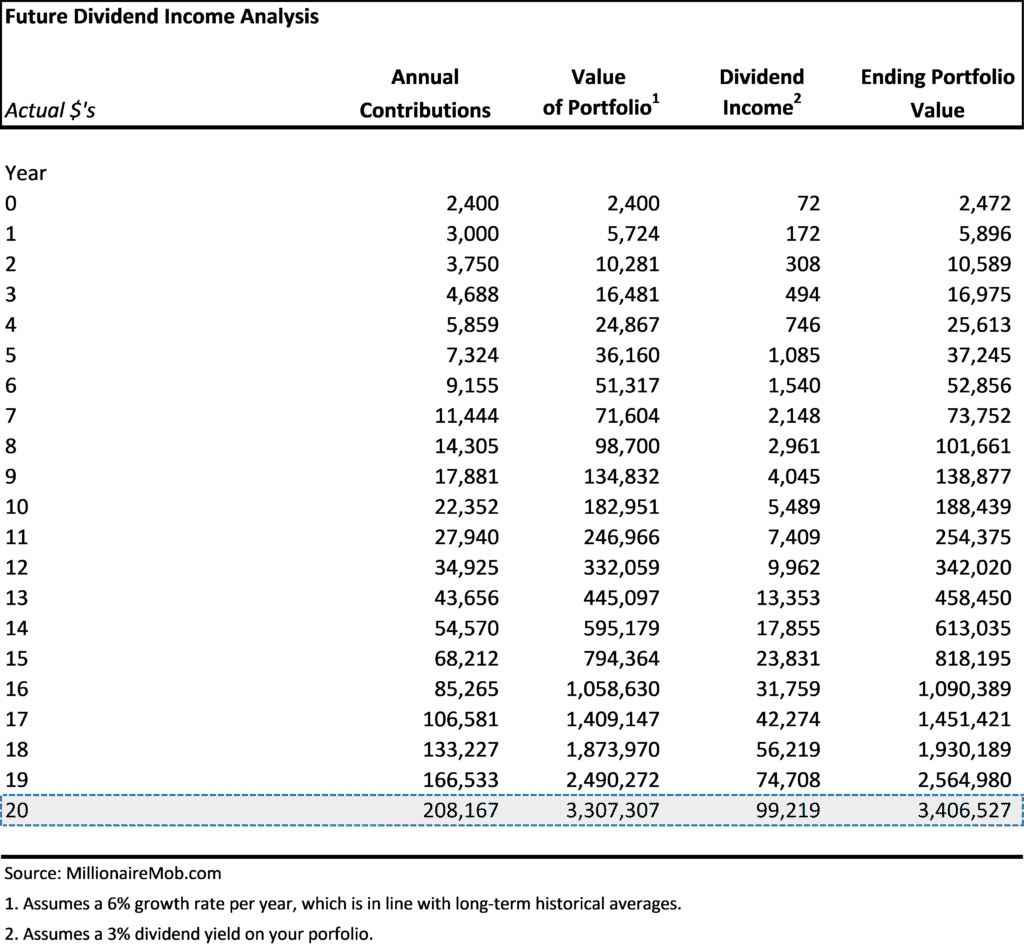

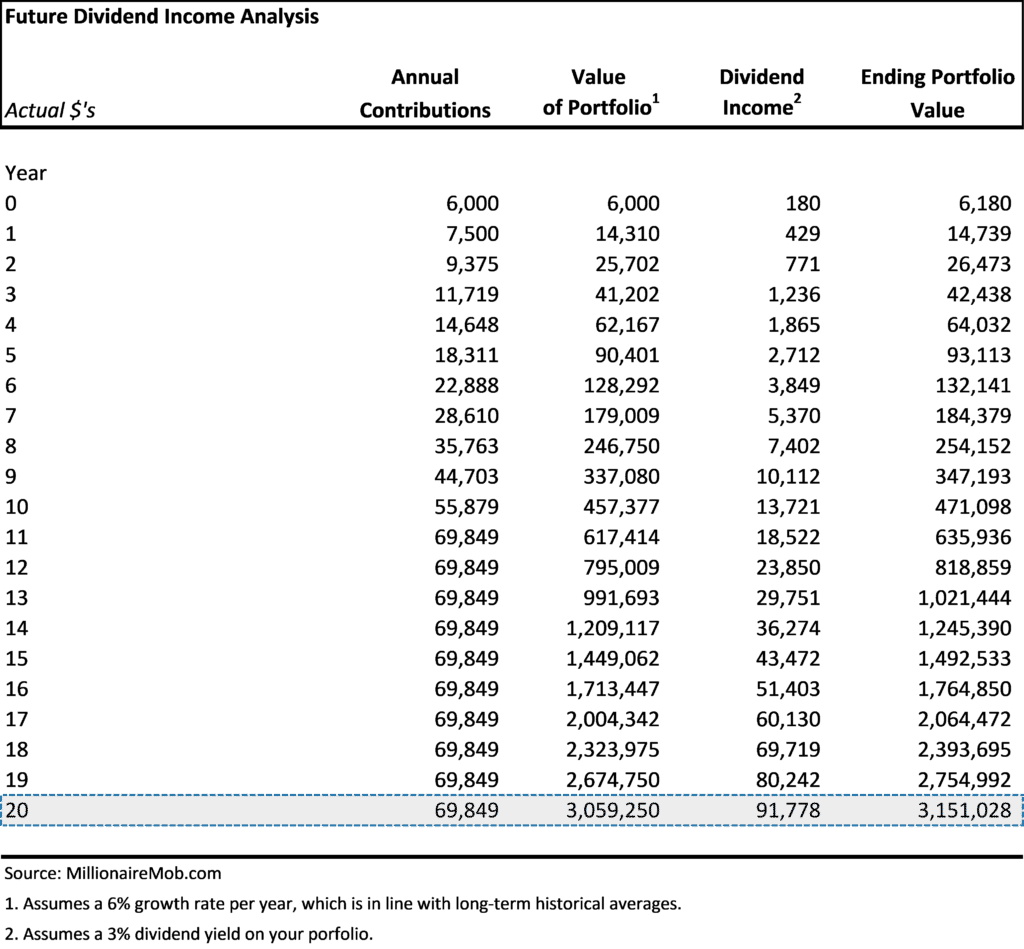

This is bound to convince you that living off of dividends is realistic. If you follow the five steps to investing for passive income, you will see the amazing effects of the following:

- The power of compound interest

- The ability to achieve two goals in one… Your portfolio value increases over time AND you increase your income significantly

- By year 20, you have achieved a ~$100,000 annual passive income and an aggregate portfolio value of over $3 million dollars

Let’s get into our case studies surrounding what it takes to live off dividends.

Scenario #1: Start off by Contributing $200 Per Month to Your Passive Income Dividend Portfolio

In the graph below, I show that you contribute $200 per month in your first year for a total annual contribution of $2,400. From there, you increase your annual contributions by 25% per year. Your portfolio appreciates in value as stocks increase in price at a rate of 6% per year.

Your dividend income received is 3% per year, which is very attainable. This is slightly above the average yield for the S&P 500.

Scenario #2: Start off by Contributing $500 Per Month to Your Passive Income Dividend Portfolio

In the graph below, I show that you contribute $500 per month in your first year for a total annual contribution of $6,000. From there, you increase your annual contributions by 25% per year, but you max out your contribution $69,849 in year 11 and maintain that annual contribution thereafter.

This assumes the same assumption that your portfolio appreciates in value as stocks increase in price at a rate of 6% per year.

Your dividend income received is 3% per year, which is very attainable. This is slightly above the average yield for the S&P 500. This results in you achieving the same mark but contributing less in total contributions of only $953,889 total contributed in 20 years.

Test you own case studies by using our dividend calculator to calculate the future value of your portfolio and income.

You can download the dividend calculator below:

Key Takeaways from the Living Off Dividends Scenarios

A key takeaway for how to live off of dividends is twofold.

- Increasing your income and savings over time is paramount. You cannot reach maximum goals if you do not continually increase your income. If you don’t increase your income you can rely on my next point for living off dividends. You can increase your income by investing in real estate income properties. Or, you can increase your income without working more.

- Start early. You need to contribute as much as possible to your dividend portfolio as early as possible. From there, you should maintain an annual increase in your contributions. Stay organized and keep a log of your contributions and when you are due for an annual increase.

Investing for passive income should not be taken lightly though. You simply do not just invest in dividend stocks blindly. Get involved and stay focused on improving over time.

You should do your own due diligence in stocks that you invest in. The better you are at your due diligence the more your investment returns should increase. Imagine if your portfolio value increased at an annual rate of 10% per year. The benefits can be significant.

Are you going to start investing for passive income?

My case study shows that investing for passive income is achievable for anyone. More importantly, it shows that dividend growth investing for passive income is MOST IMPORTANT for the younger generations.

If all you need is 20 years to become a multi-millionaire that receives a six-figure income for doing absolutely nothing, you can retire safely at age 41 so long as you start at age 21….

Simply amazing.

On a time-adjusted basis, dividend investing is one of the most attractive value propositions out there. No questions asked.

Dividend investing is a way to earn passive income without working at all. Take the time to pay yourself first by investing to live off of dividends. Use dividend income tracking software to know when your dividends will come in. This will help you continually deploy additional capital.

Dividend investing opens the door the following considerations that are not commonly found with other passive income ideas:

- Obtain unlimited upside potential by investing in high-quality dividend stocks

- Realize the benefits of monthly or quarterly income

- As Albert Einstein once said, “Compound interest is the eighth wonder of the world.” Dividend investing is the best way to capture compound interest over the long haul and maximize your total return.

What will you do next to live off dividends?

Keep in mind dividend investing is additive to your current retirement goals. You should be contributing the max amount to your 401(k) and maxing out your Roth IRA / IRA annually. Then, proceed with a dividend investing portfolio. Start investing and evaluate what it will take for you to retire early.

If you want to retire early, you’ll need to supplant your current income since your retirement accounts cannot be touched until your later years. By building a successful dividend portfolio, you’ll earn additional income that also features residual value once you hit your age threshold for your retirement accounts.

I use Blooom to do a free 401(k) and IRA analysis to determine my proper allocation. This has been very helpful for me as I continue to invest in index funds for my 401(k) and focus on increasing my income with a dividend growth portfolio. You can live off dividends in early retirement and retirement.

Disadvantages of dividend investing

There are some things to consider as disadvantages of dividend investing. I always like to consider the cons side of the equation with investing for passive income. You tend to learn a lot more from the cons to strengthen your story on the advantages.

- Taxes associated with dividends: Oftentimes, we are taxed at a much higher bracket. If you are a high-income earning (like myself), you effective tax rate is 40-50% on your dividend income. I am taking a small hit on my taxes for a huge benefit for the future.

- Taxes associated with dividends debunked by Millionaire Mob: We are investing for dividend growth people. I hope that you are buying stocks now that will increase their dividend significantly over time.

- I don’t invest to increase my current income today. I increase my current income for tomorrow (aka early retirement). In addition, with dividend investing for passive income, we are striving to achieve our goal of early retirement. When we retire early by living off dividends, our tax bracket decreases significantly.

- Total return is always better: Another disadvantage of dividend investing for passive income is the fact that companies are usually better off investing that cash back into their business. I’ve seen a few articles arguing that Warren Buffett’s Berkshire Hathaway doesn’t pay a dividend for a reason.

- Cash reinvested by companies’ debunked by Millionaire Mob: Berkshire Hathaway is an investment company. For people that believe it is a conglomerate is purely wrong, Berkshire Hathaway is an investment manager.

- They acquire and invest in high-quality businesses to generate a return for their shareholders. In order to maximize the return, they invest every dollar of capital into these businesses to take advantage of compound interest. Yes, there are instances where companies are better suited to reinvest all cash into the business. Warren Buffett is a great example. He has led by example on this effort and by my book, he deserves to invest every dollar into dividend-paying companies. Warren Buffett loves dividends.

- Further debunked myth, companies are generally not better off reinvesting cash back into the business. How about Twitter acquiring Vine just to shut it down? Prudent use of cash? Highly doubtful. Huge CEO bonuses are a prudent use of cash? I don’t think so.

The advantages of investing for passive income far outweigh the disadvantages. I love dividends. I also love increasing my nest egg for retirement. At some point, I will be able to live off my dividends completely. At the right time, you can then sell the dividend stocks in your portfolio to live off of that nest egg for the rest of your life.

I’ve highlighted why I believe you want dividends over growth investing. A growth stock is a share in a company whose earnings are expected to grow at an above-average rate relative to the market.

Growth stocks don’t typically pay dividends, because the companies would much prefer to reinvest the earnings in their own company. These stocks are a little riskier since they are reinvesting cash flow into a business that is unsure of proper capital allocation. Dividend stocks are proven companies that continue to deliver excellent financial performance.

Back to that killing two birds with one stone…

I love dividends

Fund managers and institutional investors love dividend paying stocks. Companies that pay dividends are a vote of confidence to the professional investing community that they are confident in their ability to increase earnings and confidence in their ability to increase their dividend. A win-win around the table.

Share repurchases also signal confidence but offer more flexibility because they don’t create a tacit commitment to additional purchases in future years. When you get both share repurchases and dividends, you unlock some outstanding benefits.

For now, continue to invest in a dividend portfolio to increase your income AND save for retirement. Your future self will thank you. You’ll want to track your dividend income using these software tools.

I love dividends so much that… I created a book called Dividend Investing Your Way to Financial Freedom

I think dividend investing is often misrepresented amongst the investing and financial freedom community. There is so much to learn from dividend investing and my approach.

Dividend investing is a fantastic way to build wealth through compound interest. Dividend investing is not the only strategy in the world. However, I believe that if you can combine value investing with dividend-paying stocks, you can achieve a compelling total return.

I created a dividend investing book to help you:

- Improve your portfolio returns

- Understand the pros and cons of a dividend investing approach

- Develop and craft your own dividend investing strategy

- Build wealth through a long-term compound interest plan

That is why I created Dividend Investing Your Way to Financial Freedom.

You can buy the book on Amazon

Check out on Amazon to buy the book if you wish! I think you will learn a lot. If not, here are 12+ other top dividend investing books to consider.

Follow Millionaire Mob’s dividend growth investing journey

Follow along on my dividend growth investing journey to get the latest and greatest updates on our dividend growth portfolio. I am building a dividend income portfolio from scratch that everyone can follow along.

Passive income dividend investing takes a lot of upfront work, but features massive benefits.

Are living off dividends? Do you have any questions that you’d like addressed? Let me know in the comments below. I’d love to hear from you. Our wealth management resources will help you plan and execute on your financial future. Good news is that they are all free.

Related Resources

Millionaire Mob is where people come together to find the best travel deals and financial advice. We specialize in dividend growth investing, passive income, and travel hacking. Our advice has helped thousands travel the world and achieve financial freedom. With both a million rewards points from travel hacking and a million dollar net worth, you can live a happier lifestyle.

Follow me on Twitter, Facebook or Instagram to get the latest updates on our investing for passive income journey. If you are an avid stock fan, follow us on Stocktwits to get my investments in real-time.

Subscribe to the Millionaire Mob early retirement blog newsletter to find out the best travel tips, dividend growth stocks, passive income ideas and more. Achieve a financially free lifestyle you’ve always wanted.

Join our community of mobsters seeking financial freedom. What are you waiting for?

Click here to see the full story